- China

- /

- Life Sciences

- /

- SHSE:603127

Joinn Laboratories(China)Co.Ltd (SHSE:603127 investor three-year losses grow to 77% as the stock sheds CN¥403m this past week

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Joinn Laboratories(China)Co.,Ltd. (SHSE:603127) investors who have held the stock for three years as it declined a whopping 77%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 52%, so we doubt many shareholders are delighted. Even worse, it's down 17% in about a month, which isn't fun at all.

With the stock having lost 3.5% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Joinn Laboratories(China)Co.Ltd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

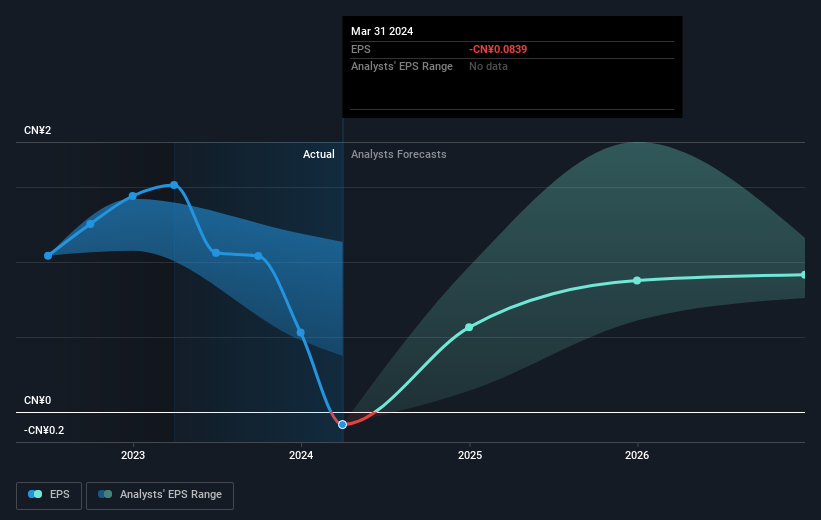

Over the three years that the share price declined, Joinn Laboratories(China)Co.Ltd's earnings per share (EPS) dropped significantly, falling to a loss. Extraordinary items contributed to this situation. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Joinn Laboratories(China)Co.Ltd's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Joinn Laboratories(China)Co.Ltd shareholders are down 51% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 9.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Joinn Laboratories(China)Co.Ltd you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603127

Joinn Laboratories(China)Co.Ltd

Provides preclinical and non-clinical services in the United States, the People’s Republic of China, and internationally.

Flawless balance sheet with moderate growth potential.