The 18% return this week takes Xinjiang Bai Hua Cun Pharma TechLtd's (SHSE:600721) shareholders three-year gains to 54%

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, the Xinjiang Bai Hua Cun Pharma Tech Co.,Ltd (SHSE:600721) share price is up 54% in the last three years, clearly besting the market decline of around 30% (not including dividends).

The past week has proven to be lucrative for Xinjiang Bai Hua Cun Pharma TechLtd investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Xinjiang Bai Hua Cun Pharma TechLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

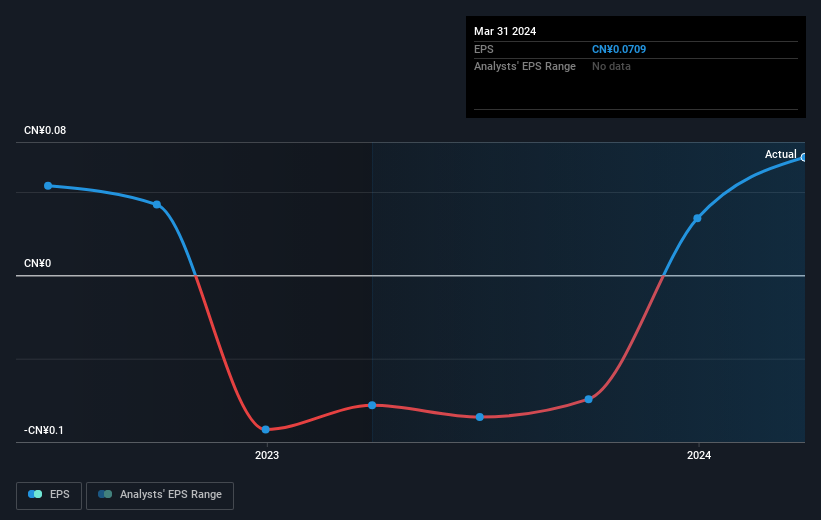

During three years of share price growth, Xinjiang Bai Hua Cun Pharma TechLtd moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Xinjiang Bai Hua Cun Pharma TechLtd's key metrics by checking this interactive graph of Xinjiang Bai Hua Cun Pharma TechLtd's earnings, revenue and cash flow.

A Different Perspective

While it's certainly disappointing to see that Xinjiang Bai Hua Cun Pharma TechLtd shares lost 6.1% throughout the year, that wasn't as bad as the market loss of 18%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 3% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Xinjiang Bai Hua Cun Pharma TechLtd .

But note: Xinjiang Bai Hua Cun Pharma TechLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600721

Xinjiang Bai Hua Cun Pharma TechLtd

Engages in the pharmaceutical research and development, clinical trials, biomedicine, commercial properties, and other businesses.

Flawless balance sheet with acceptable track record.