- Thailand

- /

- Oil and Gas

- /

- SET:PRM

Undiscovered Gems On None Exchange To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by tariff tensions and mixed economic indicators, small-cap stocks continue to draw attention amidst the broader market's fluctuations. With U.S. job growth falling short of expectations and manufacturing showing signs of recovery, investors are keenly observing potential opportunities in lesser-known companies that may offer unique growth prospects. In this environment, identifying stocks with strong fundamentals and resilience to external pressures can be crucial for uncovering hidden gems poised for future success.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Central Finance | 1.21% | 11.98% | 16.10% | ★★★★★☆ |

| Vinacomin - Power Holding | 42.01% | -0.84% | 34.75% | ★★★★★☆ |

| Li Ming Development Construction | 236.64% | 31.54% | 34.00% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Prima Marine (SET:PRM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Prima Marine Public Company Limited specializes in marine transportation of petroleum and chemical products across Thailand, Singapore, and internationally, with a market cap of THB18.04 billion.

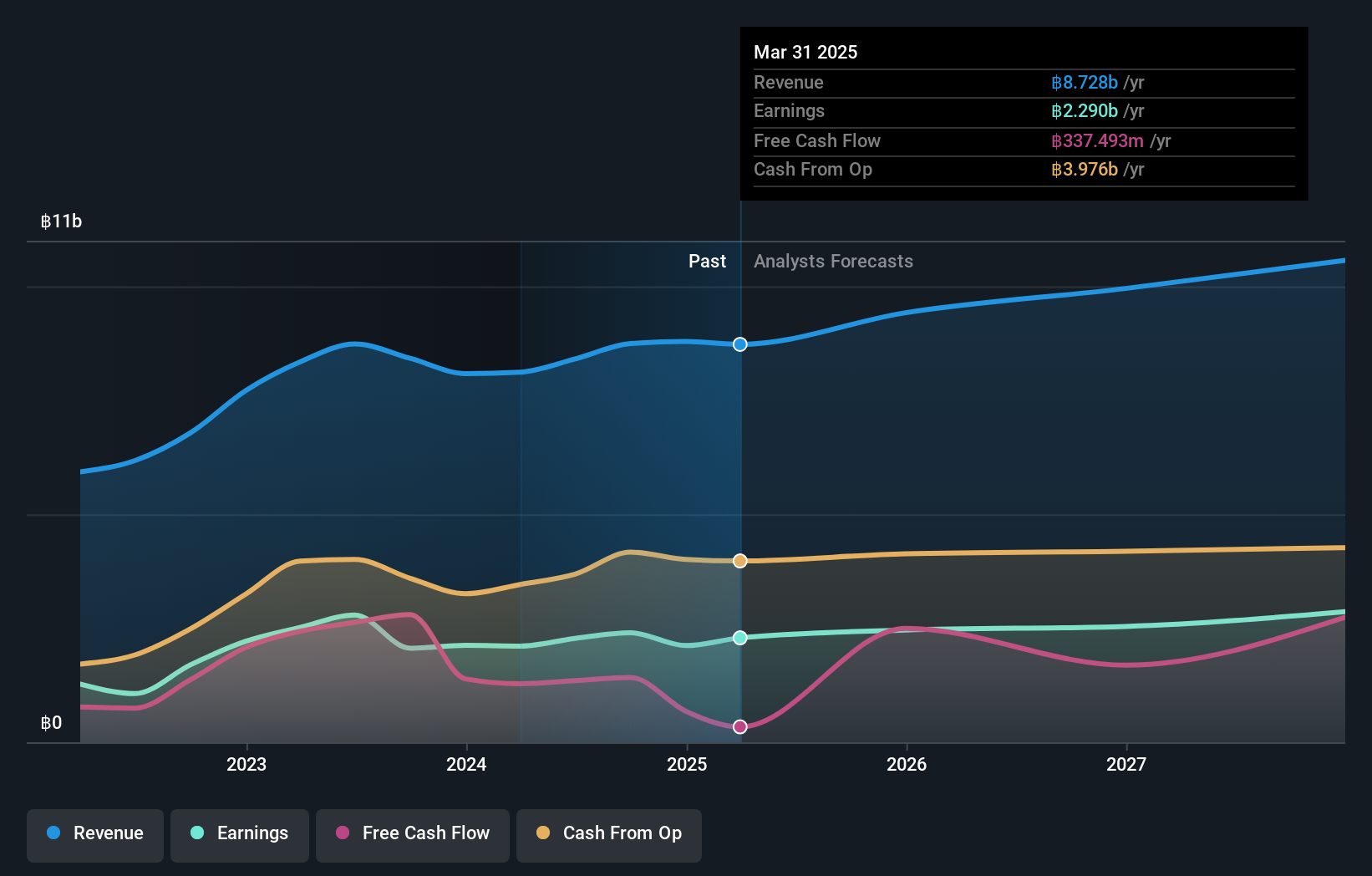

Operations: Prima Marine generates revenue primarily from marine transportation of petroleum and chemical products (THB6.16 billion) and storage of petroleum products (THB3.65 billion), with additional contributions from ship management and related services (THB1.21 billion). The company also earns from supporting offshore petroleum exploration activities, amounting to THB895.93 million.

Prima Marine, a small-cap player in the oil and gas sector, showcases promising financial health with high-quality earnings and a satisfactory net debt to equity ratio of 3.7%. Over the past year, its earnings grew by 16.4%, outpacing the industry's -2.4% growth rate. The company also trades at about 29% below its estimated fair value, suggesting potential upside for investors. Recent results reflect strong performance with third-quarter net income rising to THB 449 million from THB 328 million last year, while nine-month figures reached THB 1.65 billion compared to THB 1.38 billion previously—highlighting robust operational momentum.

- Get an in-depth perspective on Prima Marine's performance by reading our health report here.

Examine Prima Marine's past performance report to understand how it has performed in the past.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Value Rating: ★★★★★★

Overview: Wee Hur Holdings Ltd. is an investment holding company involved in general building and civil engineering construction in Singapore and Australia, with a market capitalization of SGD 510.18 million.

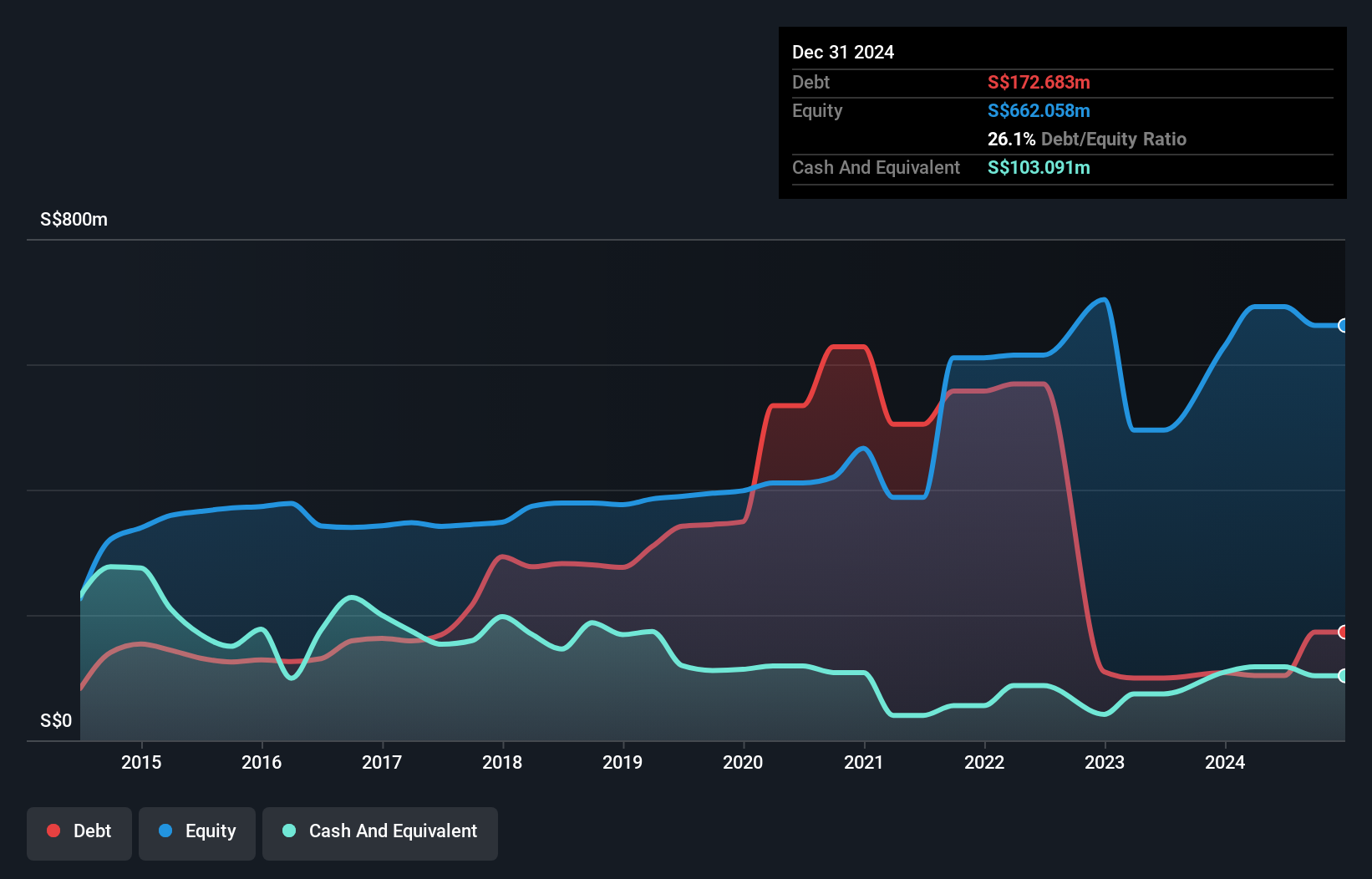

Operations: Wee Hur Holdings derives its revenue primarily from building construction, contributing SGD 121.19 million, and workers' dormitory operations, which add SGD 76.45 million. The company also generates income from property development in Singapore at SGD 50.76 million and smaller segments like fund management and PBSA operations.

Wee Hur Holdings, a small player in the construction sector, has recently turned profitable, showcasing a notable shift in its financial trajectory. Its debt-to-equity ratio has impressively decreased from 87.7% to 14.9% over five years, indicating prudent financial management. The company's interest payments are well covered by EBIT at 11.2 times coverage, reflecting strong operational efficiency. Despite these positives, earnings are forecasted to decline by an average of 12.5% annually over the next three years; however, revenue is expected to grow at a steady pace of 6.32% per year, suggesting potential for future growth and stability in its niche market segment.

Shanghai New World (SHSE:600628)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai New World Co., Ltd. operates department stores in Shanghai, China, with a market capitalization of CN¥5.30 billion.

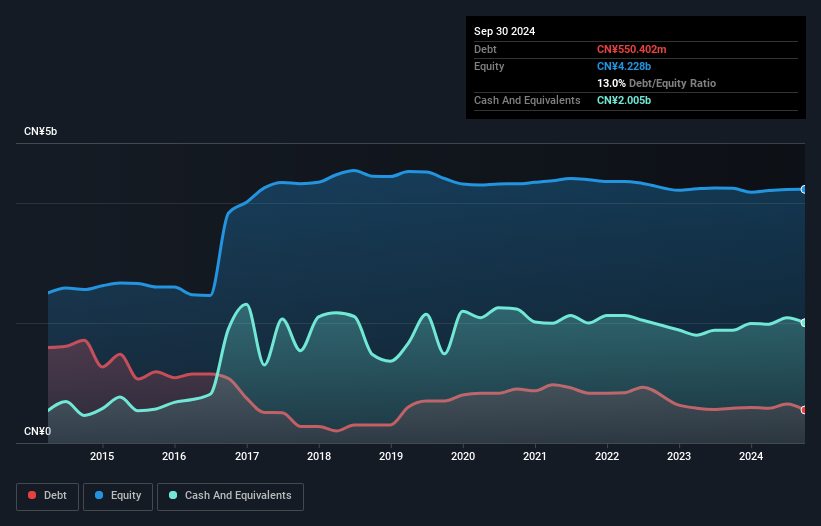

Operations: Shanghai New World Co., Ltd. generates revenue primarily through its department store operations in Shanghai. The company's financial performance is influenced by various cost components, with a focus on optimizing expenses to enhance profitability.

Shanghai New World stands out with its robust financial positioning, boasting more cash than total debt, which is an encouraging sign for stability. Over the past year, earnings surged by 44%, a notable achievement compared to the pharmaceutical industry's -2.5% performance. Despite a one-off loss of CN¥35M impacting recent results, the company remains undervalued at nearly 65% below fair value estimates. The debt-to-equity ratio has improved from 16% to 13% over five years, reflecting prudent financial management. However, investors should note the stock's high volatility in recent months and consider attending the upcoming shareholder meeting on December 9th for further insights.

- Click to explore a detailed breakdown of our findings in Shanghai New World's health report.

Evaluate Shanghai New World's historical performance by accessing our past performance report.

Next Steps

- Delve into our full catalog of 4695 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PRM

Prima Marine

Provides marine transportation of petroleum and chemical products in Thailand, Singapore, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion