Unveiling Three Undiscovered Gems in Asia with Strong Fundamentals

Reviewed by Simply Wall St

The Asian market landscape has been influenced by mixed performances in major indices, with small-cap stocks facing challenges amid broader economic uncertainties and geopolitical tensions. Despite these conditions, opportunities can still be found in companies with strong fundamentals that are well-positioned to navigate the current environment. Identifying such stocks often involves looking for robust financial health, sustainable growth prospects, and resilience to external pressures—key attributes that can help them thrive even when market sentiment is volatile.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NS United Kaiun Kaisha | 44.97% | 10.62% | 10.49% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 7.85% | 12.88% | ★★★★★★ |

| GakkyushaLtd | 18.85% | 4.12% | 13.58% | ★★★★★★ |

| Ohashi Technica | NA | 6.56% | -6.88% | ★★★★★★ |

| Maezawa Kasei Industries | 0.77% | 3.52% | 20.55% | ★★★★★★ |

| Cota | NA | 4.47% | 2.79% | ★★★★★★ |

| Kondotec | 12.90% | 6.97% | 11.26% | ★★★★★☆ |

| CHANGE HoldingsInc | 63.47% | 29.29% | 14.76% | ★★★★★☆ |

| KinjiroLtd | 20.72% | 11.66% | 24.80% | ★★★★★☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. focuses on the research, development, production, and sales of pharmaceuticals and health products in mainland China, with a market cap of CN¥11.97 billion.

Operations: Zhejiang CONBA Pharmaceutical generates revenue primarily from the sale of pharmaceuticals and health products in mainland China. The company has a market capitalization of CN¥11.97 billion.

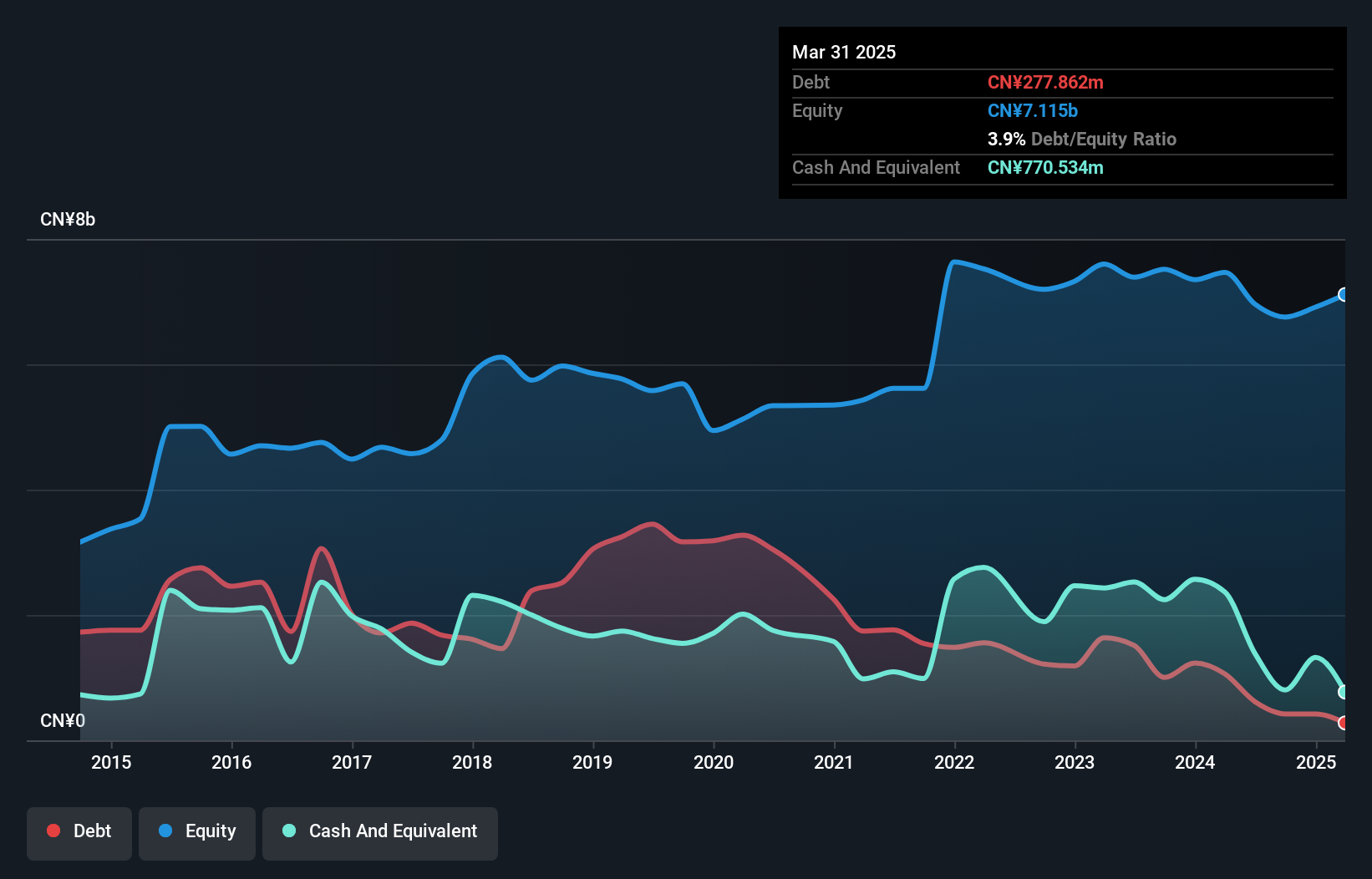

Zhejiang CONBA Pharmaceutical has shown impressive financial resilience, with its debt to equity ratio dropping from 49.5% to 5.6% over five years, indicating strong balance sheet management. Earnings surged by 41.3% in the past year, outpacing the pharmaceutical industry average of 4%. Despite a large one-off gain of CN¥238 million impacting recent results, the company appears undervalued at nearly 20% below estimated fair value and maintains positive free cash flow. Recent earnings showed net income rising to CN¥584 million for nine months ending September 2025, up from CN¥518 million last year.

Shanghai Shuixing Home Textile (SHSE:603365)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Shuixing Home Textile Co., Ltd. engages in the research, development, design, production, and sale of home textile products in China with a market capitalization of approximately CN¥5.94 billion.

Operations: The company's primary revenue stream is derived from textile manufacturing, generating approximately CN¥4.31 billion.

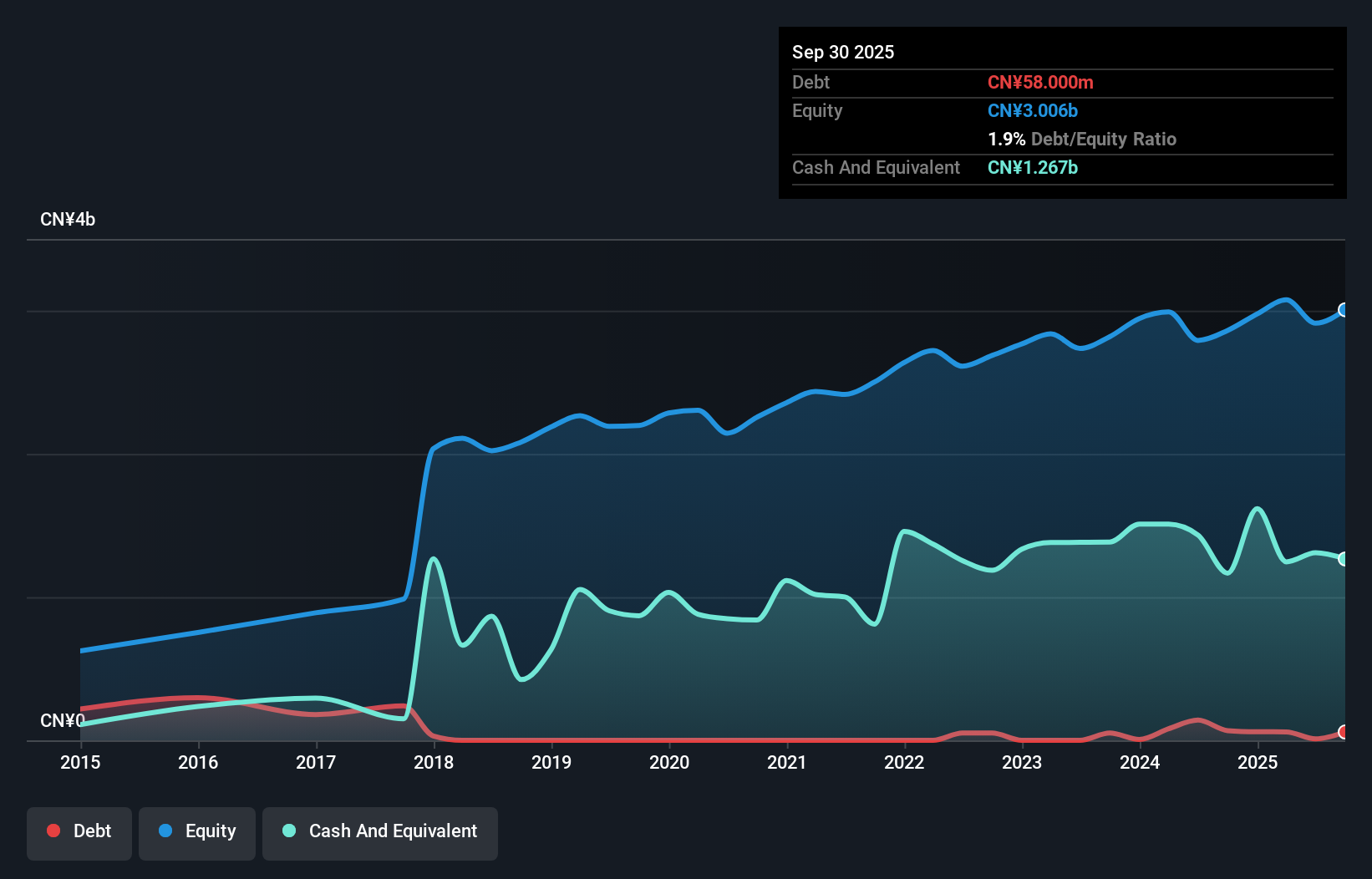

Shanghai Shuixing Home Textile, a small player in the home textile industry, showcases promising financial health with earnings growth of 1.7% over the past year, outpacing the luxury sector's -1.2%. The company is trading at a favorable price-to-earnings ratio of 16.4x compared to the broader CN market's 44.7x, suggesting it offers good value relative to its peers. Despite net income slipping slightly from CNY 146 million to CNY 141 million in H1 2025, it remains profitable with high-quality earnings and more cash than total debt, ensuring robust coverage for interest payments and future growth prospects forecasted at 12.19% annually.

HOB Biotech GroupLtd (SHSE:688656)

Simply Wall St Value Rating: ★★★★★★

Overview: HOB Biotech Group Corp., Ltd. is an in vitro diagnostic company operating in China and internationally, with a market cap of CN¥10.37 billion.

Operations: HOB Biotech Group Ltd. generates revenue primarily from its in vitro diagnostic products. The company focuses on managing production costs to optimize profitability, reflected in its net profit margin trends over recent periods.

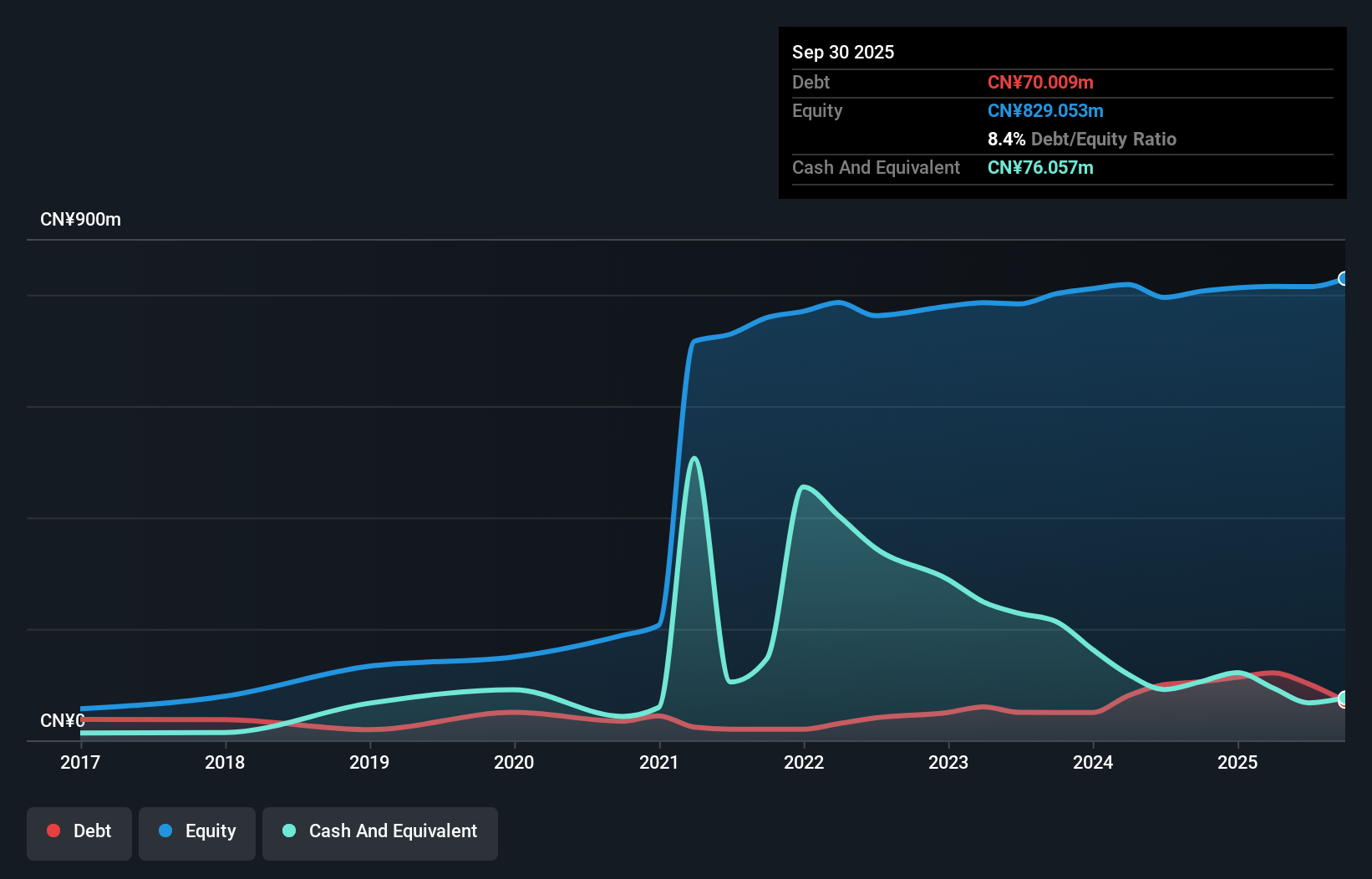

HOB Biotech Group, a nimble player in the biotech sector, has shown resilience with its earnings growing by 3.3% over the past year, outpacing the broader industry's -9.6%. Despite this growth, net income for the nine months ending September 30, 2025 was CN¥26.19 million, slightly down from CN¥26.56 million a year prior. The company’s debt to equity ratio improved significantly from 18.2% to 8.6% over five years and its interest payments are well covered by EBIT at 26 times coverage. However, sales dipped to CN¥292.18 million compared to last year's CN¥307.03 million for the same period.

Make It Happen

- Dive into all 2407 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603365

Shanghai Shuixing Home Textile

Researches, develops, designs, produces, and sells home textile products in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives