In a week marked by a flurry of earnings reports and economic data, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 hit record highs before retreating, while small-cap stocks demonstrated resilience relative to their larger counterparts. Amidst this backdrop of cautious optimism and mixed signals in labor and manufacturing data, identifying promising high-growth tech stocks involves assessing factors such as innovation potential, market demand, and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Jinyu Bio-technology (SHSE:600201)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jinyu Bio-technology Co., Ltd. focuses on the research, development, production, and sale of veterinary products in China with a market capitalization of CN¥7.73 billion.

Operations: The company generates revenue primarily through the sale of veterinary products. It invests significantly in research and development to support its product offerings. The financial performance is influenced by production costs and market demand within China.

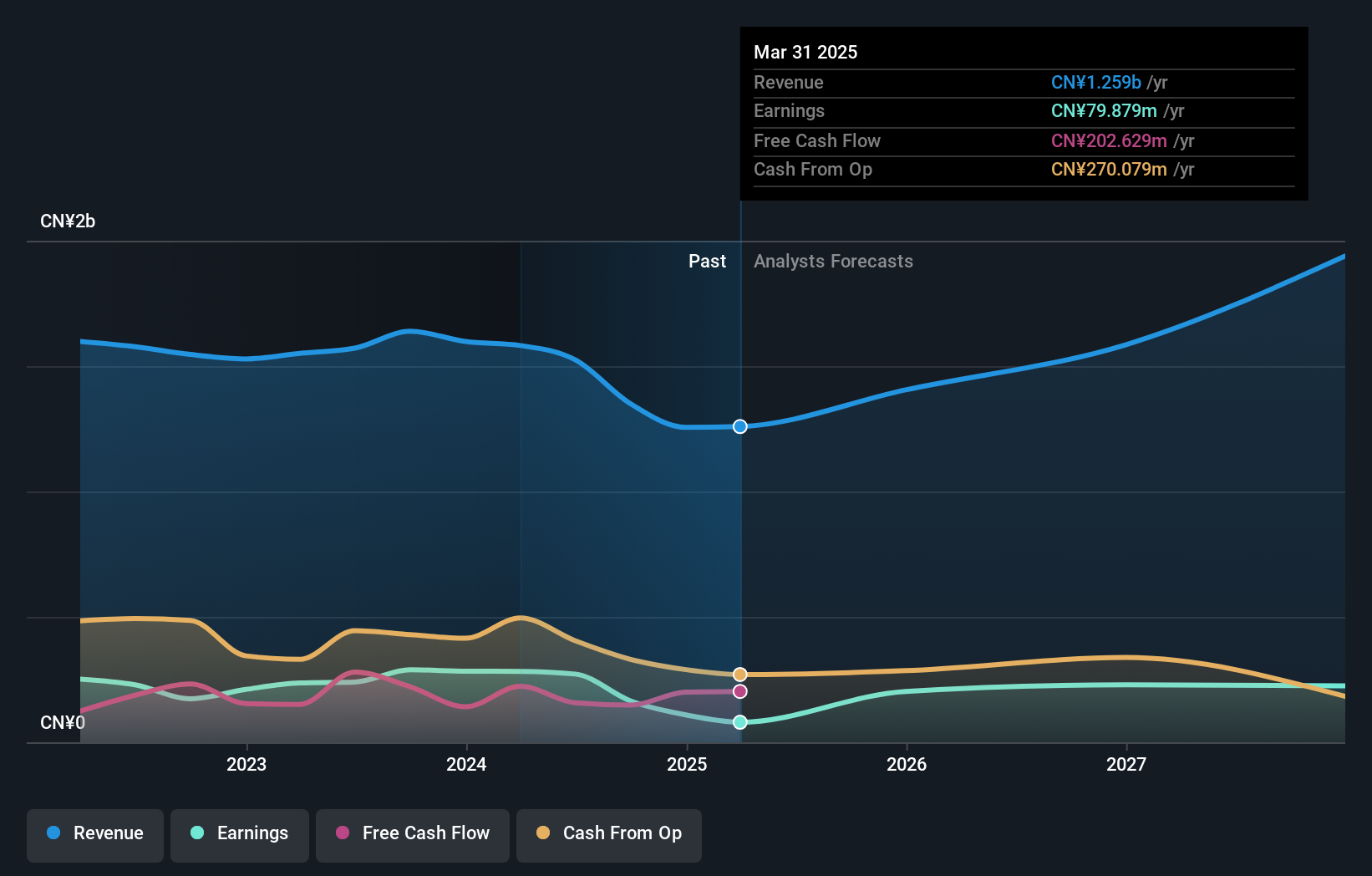

Jinyu Bio-technology, amidst a challenging fiscal year with a 42.9% dip in earnings, still projects robust growth with expected annual profit surges of 48% and revenue increases at 27.9%. This growth trajectory starkly outpaces the broader Chinese market's projections of 26.1% for earnings and 14% for revenue growth. Recently, the company initiated a share repurchase plan to buy back up to CNY 160 million worth of shares at no more than CNY 10.01 each—a move aimed at bolstering shareholder value and supporting long-term incentive strategies. Despite current profitability pressures, evidenced by a drop in net profit margins from last year's 17.6% to this year's 12.2%, Jinyu’s aggressive R&D investment positions it well for future technological advancements and market competitiveness.

- Take a closer look at Jinyu Bio-technology's potential here in our health report.

Assess Jinyu Bio-technology's past performance with our detailed historical performance reports.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥15.11 billion.

Operations: The company generates revenue primarily through the production and distribution of film and television dramas, targeting both domestic and international markets. The business model focuses on leveraging content creation to capture diverse audience segments, contributing significantly to its financial performance.

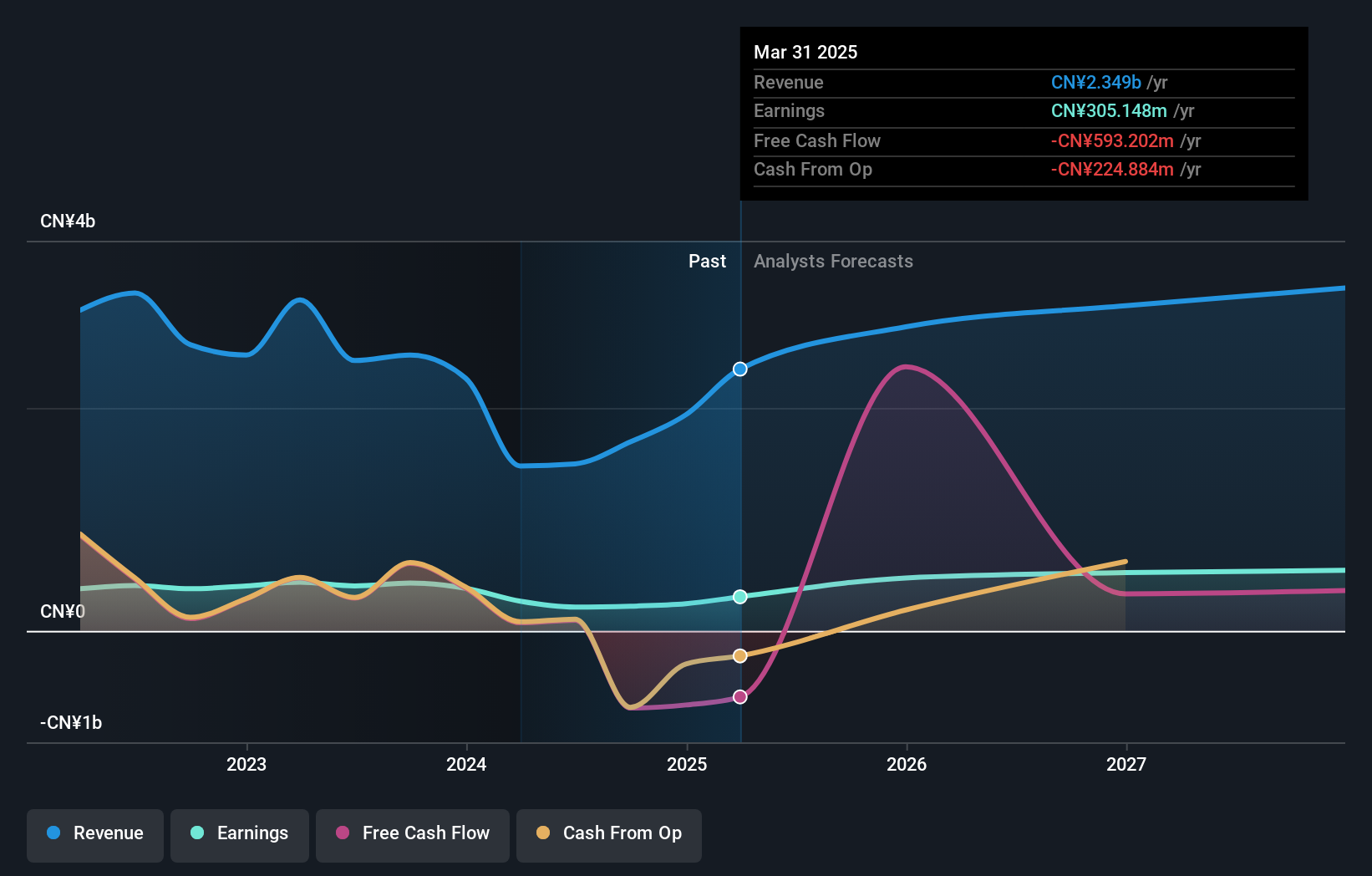

Zhejiang Huace Film & TV has faced a challenging period with a significant revenue drop to CNY 892.54 million from last year's CNY 1,464.47 million, alongside a decrease in net income from CNY 327.28 million to CNY 166.23 million. Despite these setbacks, the company's future looks promising with an expected annual revenue growth of 21.2% and earnings growth forecast at an impressive rate of 35.5% per year, outpacing the broader Chinese market projections significantly. This optimistic outlook is supported by their strategic focus on enhancing content production capabilities and expanding digital distribution channels, positioning them well within the rapidly evolving entertainment industry landscape.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥7.79 billion.

Operations: The company generates revenue primarily from software services, amounting to CN¥2.28 billion.

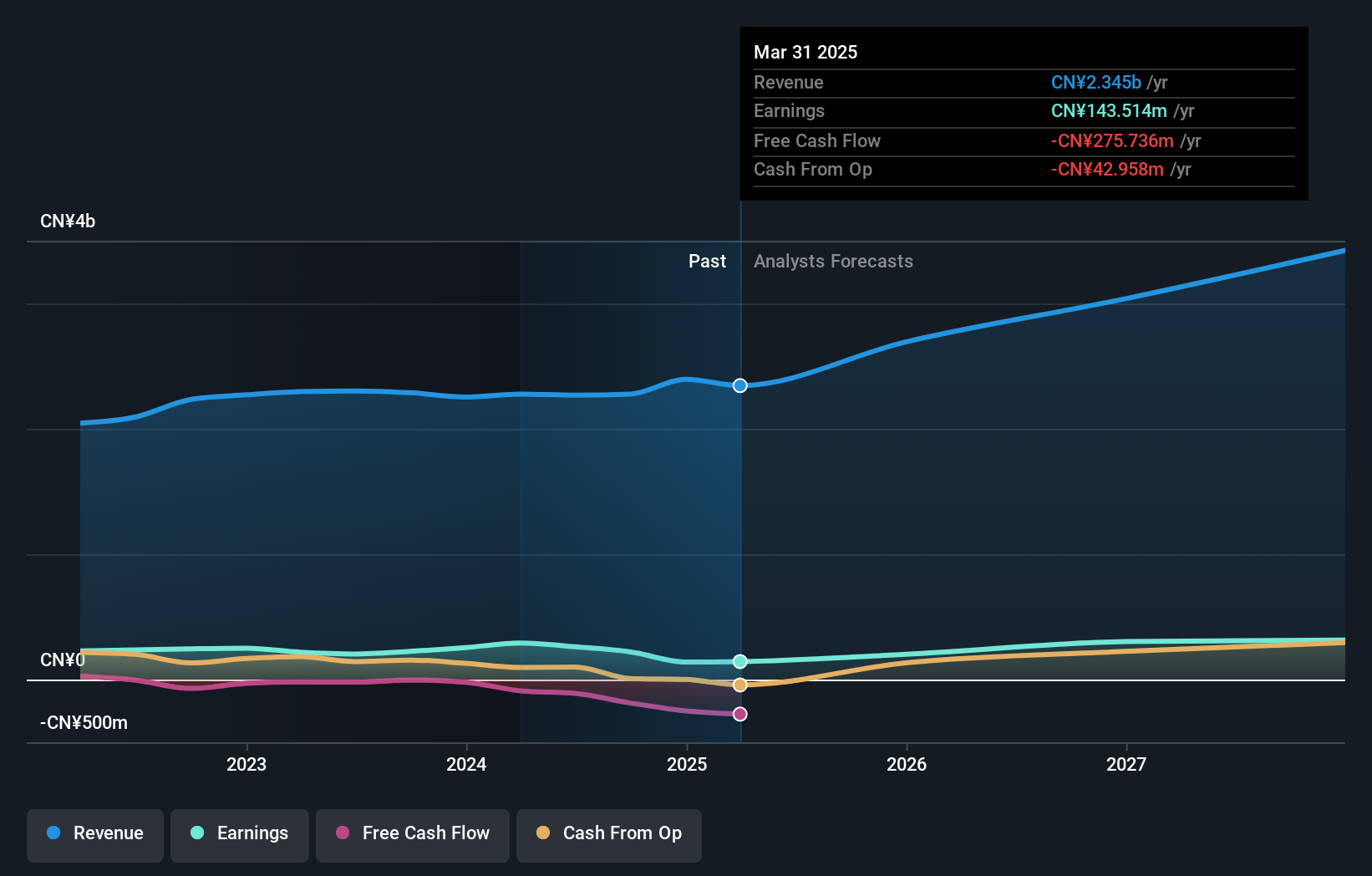

Guangzhou Sie Consulting, amidst a challenging tech landscape, managed a modest revenue increase to CNY 1.71 billion from CNY 1.68 billion year-over-year, reflecting resilience in its core operations. Despite this growth, net income dipped to CNY 94.66 million from CNY 128.45 million due to increased operational costs and investments in innovation. Notably, the firm's commitment to shareholder value is evident from its recent repurchase of shares worth CNY 19.84 million, aligning with strategic initiatives like the implementation of a new restricted stock incentive plan aimed at retaining top talent and fostering long-term loyalty within the company structure. This approach underscores Guangzhou Sie’s proactive stance in navigating market fluctuations while preparing for future scalability through robust R&D expenditures and strategic equity plans.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1288 High Growth Tech and AI Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300687

Guangzhou Sie Consulting

Operates as solution provider in the fields of industrial Internet and intelligent manufacturing, core ERP, and business operation center in China.

Reasonable growth potential with adequate balance sheet.