- China

- /

- Electronic Equipment and Components

- /

- SZSE:002658

High Growth Tech Stocks To Consider This November 2024

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant movements, with small-cap indices like the Russell 2000 showing notable gains despite remaining below record highs. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that can leverage favorable regulatory changes and tax incentives to drive innovation and expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing SDL Technology Co., Ltd. focuses on the development and sale of environmental monitoring products in China, with a market capitalization of CN¥4.07 billion.

Operations: The company generates revenue primarily through the sale of environmental monitoring products in China. With a market capitalization of CN¥4.07 billion, its business model is centered around developing technologies for environmental assessment and compliance.

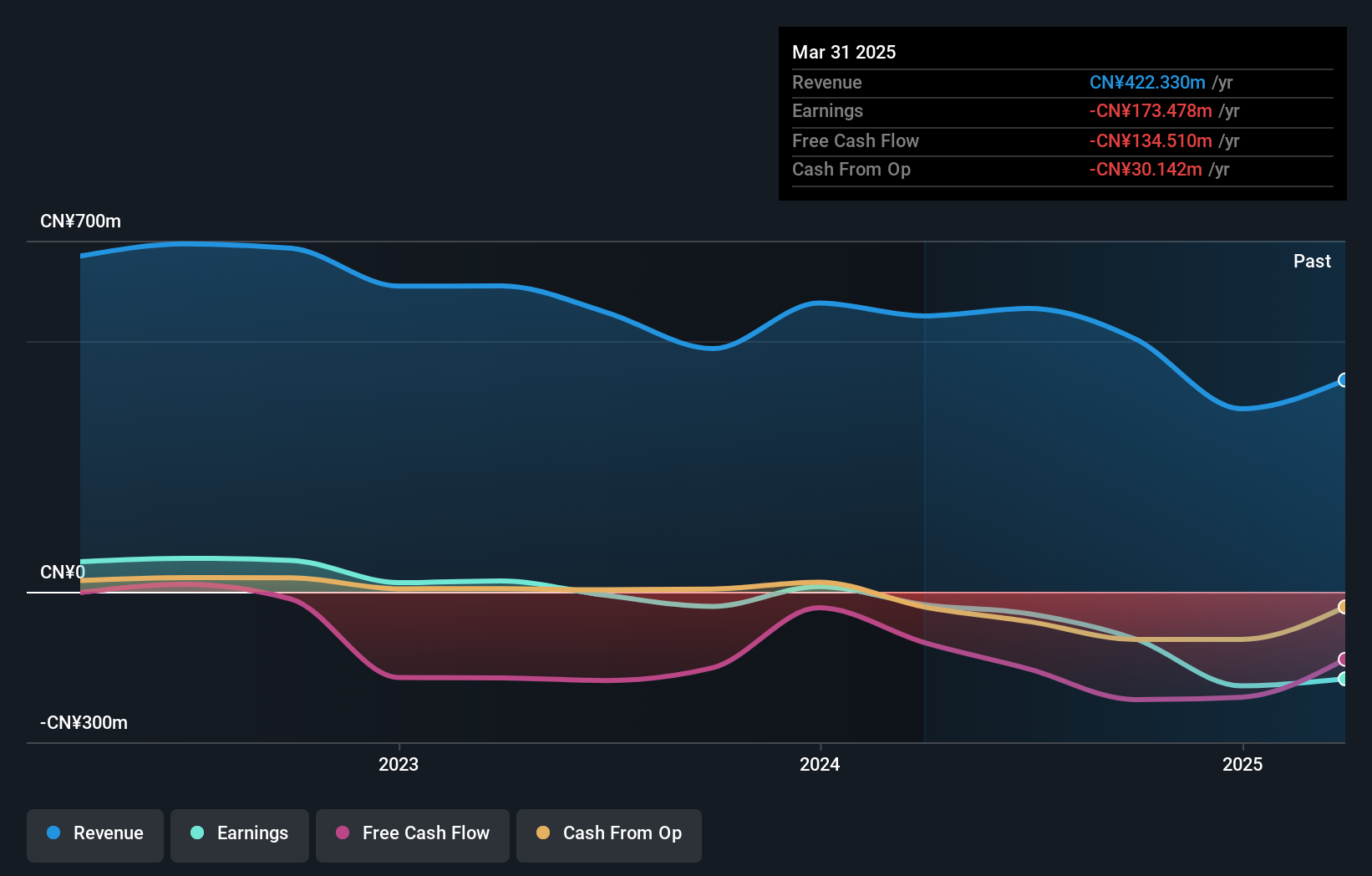

Beijing SDL TechnologyLtd, amidst a challenging fiscal year with a revenue drop to CNY 835.35 million from CNY 947.21 million, still showcases resilience with strategic R&D investments aimed at future-proofing its operations. The company's commitment to innovation is evident as it channels significant resources into research and development, crucial for maintaining competitive edge in the rapidly evolving tech landscape. Despite recent earnings contraction by 11% compared to the industry's modest growth of 1.7%, Beijing SDL is poised for a robust recovery with projected earnings growth of 27.1% annually, outpacing the Chinese market forecast of 26.2%. This focus on R&D not only reflects in their financial priorities but also aligns with industry trends towards enhanced technological offerings, positioning Beijing SDL well for potential market share gains in upcoming years.

Guangzhou Frontop Digital Creative Technology (SZSE:301313)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Frontop Digital Creative Technology Corporation focuses on the exploration and research of digital multimedia display services and technology, with a market capitalization of CN¥2.30 billion.

Operations: Frontop Digital Creative Technology specializes in digital multimedia display services and technology, serving markets both within China and internationally. The company operates with a market capitalization of approximately CN¥2.30 billion.

Despite a challenging financial backdrop with a net loss widening to CNY 127.15 million from CNY 22.88 million year-over-year, Guangzhou Frontop Digital Creative Technology remains committed to its strategic growth through significant R&D investments, which is evident in their recent earnings reports. With revenue anticipated to grow at an impressive rate of 23.9% per year, the company is aggressively pursuing innovation, positioning itself well within the competitive tech landscape. This focus on research and development not only aims to reverse the current financial downturn but also capitalizes on emerging tech trends, potentially leading to substantial market share expansion as profitability forecasts improve over the next three years with earnings expected to surge by approximately 74% annually.

SIIX (TSE:7613)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SIIX Corporation primarily engages in the sale and distribution of electronic components in Japan and internationally, with a market cap of ¥55 billion.

Operations: SIIX Corporation operates in the electronics sector, focusing on the sale and distribution of electronic components across Japan and global markets. The company generates revenue through these sales, contributing to its market capitalization of approximately ¥55 billion.

SIIX Corporation, amidst a competitive tech landscape, is demonstrating robust growth prospects with its revenue expected to increase by 6.5% annually, outpacing the Japanese market's average of 4.2%. This growth trajectory is bolstered by an aggressive R&D strategy, with expenses significantly contributing to fostering innovation—evident from the recent earnings forecast predicting an impressive 24.9% annual increase in profits. Moreover, the company’s commitment to reinvesting in itself was highlighted by substantial share repurchases within the last year, underscoring a confident outlook towards future profitability and market position enhancement.

Where To Now?

- Unlock our comprehensive list of 1283 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SDL TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002658

Beijing SDL TechnologyLtd

Develops and sells environmental monitoring products in China.

Flawless balance sheet, undervalued and pays a dividend.