3 Stocks That May Be Priced Below Intrinsic Value By Up To 49.8%

Reviewed by Simply Wall St

In the midst of a bustling week marked by macroeconomic data and cautious corporate earnings, global markets have experienced some turbulence, with major indices like the S&P 500 and Nasdaq Composite seeing fluctuations. Despite these challenges, value stocks have shown resilience compared to their growth counterparts, highlighting potential opportunities for investors seeking undervalued assets. In this environment, identifying stocks that are priced below their intrinsic value can be particularly appealing as they may offer significant upside potential when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.67 | CN¥76.89 | 49.7% |

| PharmaResearch (KOSDAQ:A214450) | ₩226500.00 | ₩451715.38 | 49.9% |

| JYP Entertainment (KOSDAQ:A035900) | ₩53900.00 | ₩107294.90 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.73 | A$9.45 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| EVERTEC (NYSE:EVTC) | US$33.02 | US$65.79 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.90 | €5.77 | 49.7% |

| Open Lending (NasdaqGM:LPRO) | US$6.14 | US$12.21 | 49.7% |

| Hunan TV & Broadcast Intermediary (SZSE:000917) | CN¥10.01 | CN¥20.01 | 50% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

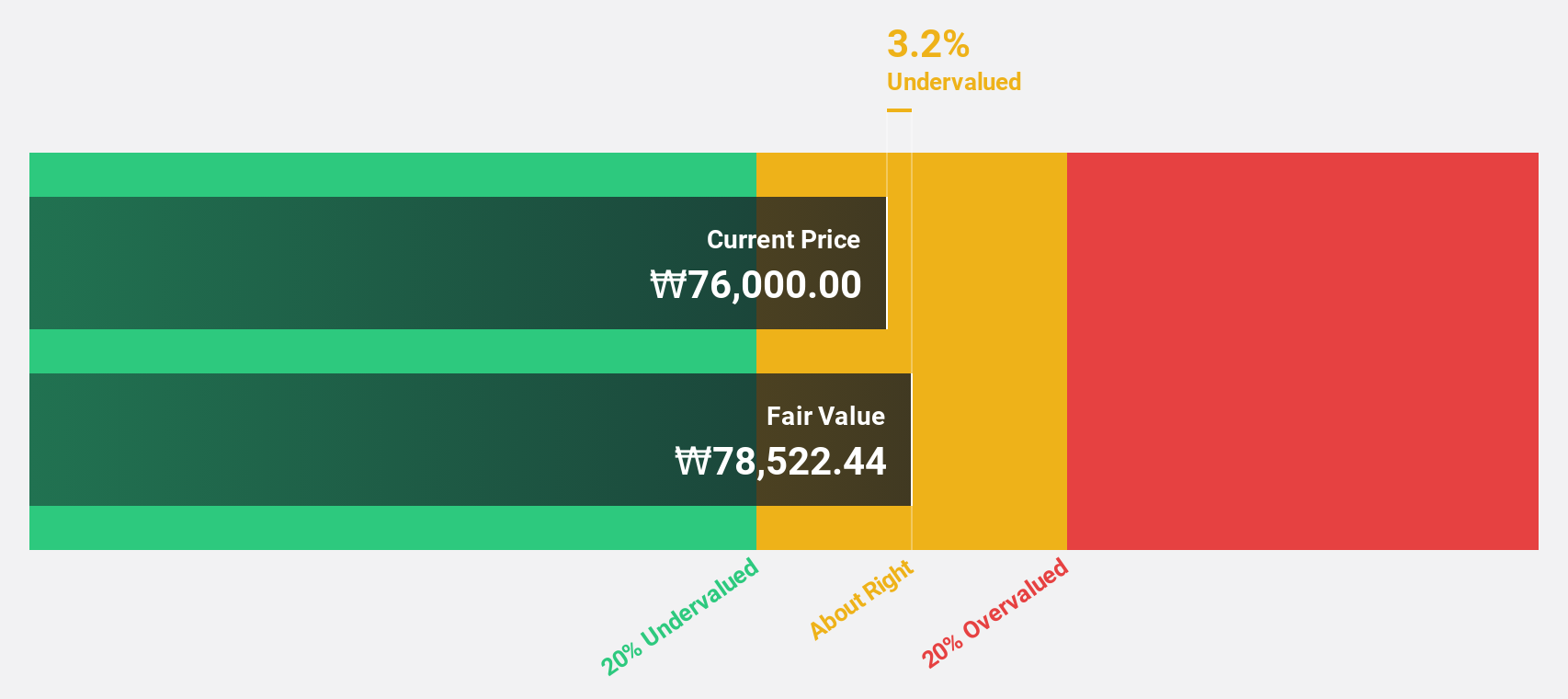

JYP Entertainment (KOSDAQ:A035900)

Overview: JYP Entertainment Corporation operates as an entertainment company both in South Korea and internationally, with a market cap of ₩1.79 trillion.

Operations: The company's revenue is derived from Entertainment (₩456.35 billion), Music Publishing (₩12.07 billion), and Distribution and Sales (₩60.51 billion).

Estimated Discount To Fair Value: 49.8%

JYP Entertainment is trading at ₩53,900, significantly undervalued compared to its estimated fair value of ₩107,294.9. Despite a decrease in profit margins from 21.4% to 13.5% over the past year, analysts agree on a potential price rise of 28.8%. While earnings are forecasted to grow at 21.35% annually—slower than the market's expectation—the company's revenue growth rate surpasses the KR market average at 11.5%.

- The growth report we've compiled suggests that JYP Entertainment's future prospects could be on the up.

- Dive into the specifics of JYP Entertainment here with our thorough financial health report.

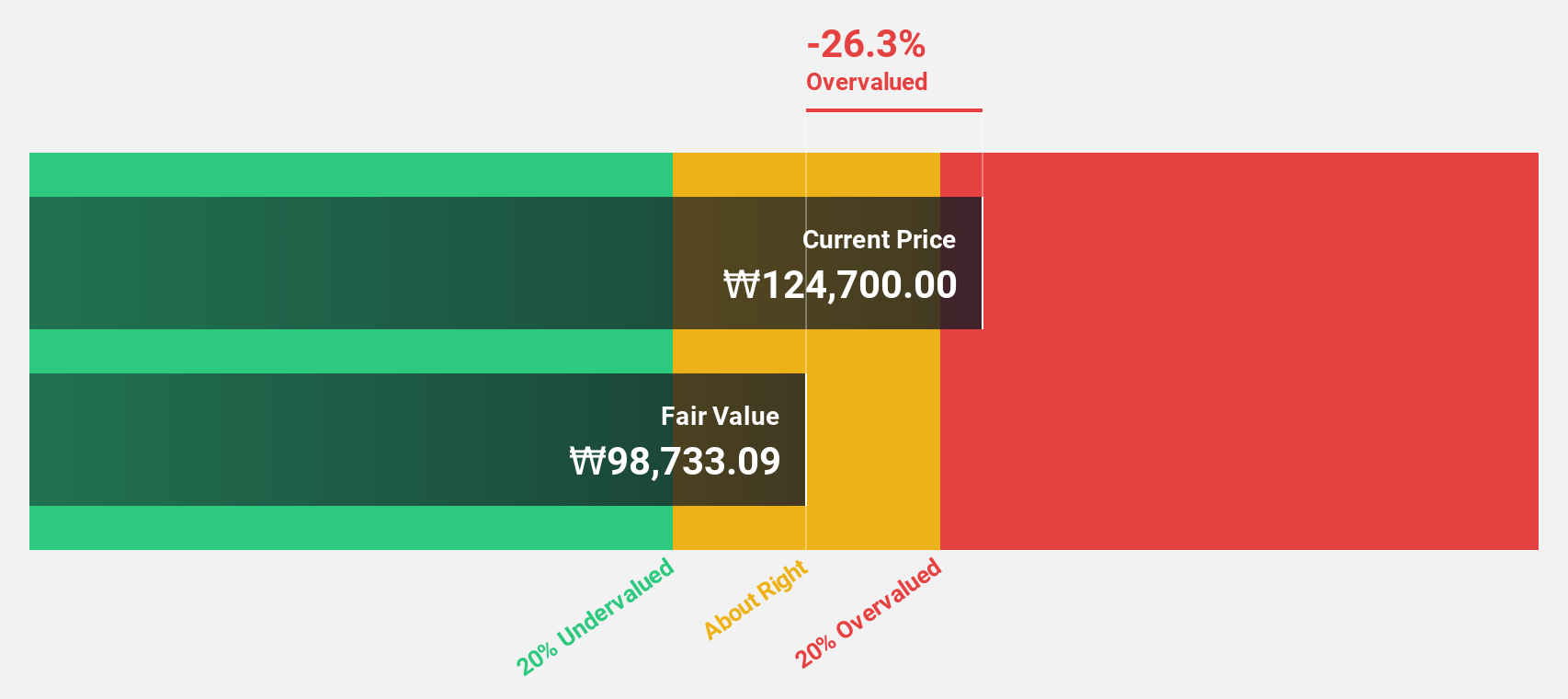

SM Entertainment (KOSDAQ:A041510)

Overview: SM Entertainment Co., Ltd. operates in music and sound production, talent management, and music/audio content publication both in South Korea and internationally, with a market cap of ₩1.70 trillion.

Operations: The company's revenue is primarily derived from its entertainment segment, excluding advertising agency activities, which accounts for ₩892.47 billion, followed by its advertising agency segment at ₩82.61 billion.

Estimated Discount To Fair Value: 33.5%

SM Entertainment is trading at ₩74,900, significantly undervalued compared to its fair value estimate of ₩112,650.03. Analysts forecast earnings growth of 32.1% annually over the next three years, outpacing the KR market's 29.3%. Despite a low forecasted return on equity of 14.2%, revenue is expected to grow faster than the market average at 10% per year. Recent buybacks totaling KRW 63.47 billion indicate strong cash flow management and shareholder return focus.

- Upon reviewing our latest growth report, SM Entertainment's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of SM Entertainment stock in this financial health report.

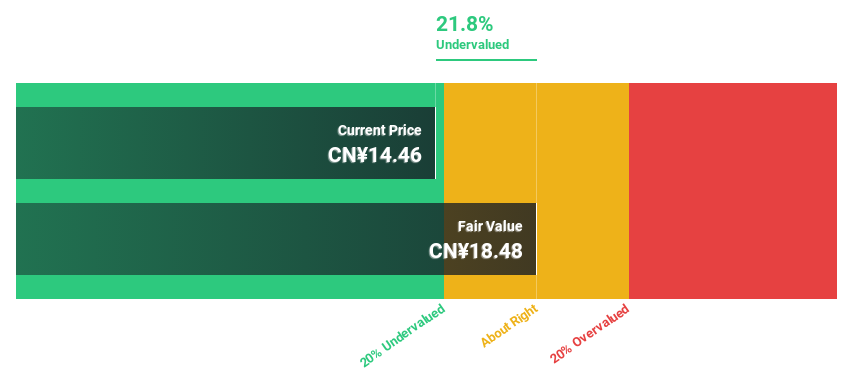

Xiamen Jihong Technology (SZSE:002803)

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector in Southeast Asia and has a market capitalization of CN¥5.38 billion.

Operations: The company's revenue is primarily derived from its E-Commerce Business, which generated CN¥3.62 billion, and its Packaging Business, contributing CN¥2.13 billion.

Estimated Discount To Fair Value: 23.1%

Xiamen Jihong Technology, trading at CN¥14.19, is significantly undervalued compared to its fair value estimate of CN¥18.46. Analysts project earnings growth of 30.9% annually over the next three years, surpassing the Chinese market's average growth rate of 25.8%. Despite a low forecasted return on equity of 17.6%, the company is valued favorably against peers and industry standards, with recent buybacks totaling CN¥86.02 million reflecting prudent cash flow management amidst declining sales and net income figures for 2024.

- Our expertly prepared growth report on Xiamen Jihong Technology implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Xiamen Jihong Technology.

Make It Happen

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 960 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002803

Xiamen Jihong Technology

Engages in the cross-border social e-commerce business in the Southeast Asia.

Flawless balance sheet, undervalued and pays a dividend.