- China

- /

- Communications

- /

- SZSE:002396

Exploring 3 High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets experience a surge in optimism, driven by hopes for softer tariffs and enthusiasm around artificial intelligence, major indices like the S&P 500 have reached new heights. In this climate of growth, identifying high-growth tech stocks can be crucial for potential portfolio enhancement, especially those that align with current market trends and economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Bona Film Group (SZSE:001330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bona Film Group Co., Ltd. is a Chinese company focused on film production and distribution, with a market capitalization of CN¥8.52 billion.

Operations: The company generates revenue primarily through film production and distribution in China. The business focuses on creating and distributing films, leveraging its extensive industry experience to capture a significant share of the Chinese entertainment market.

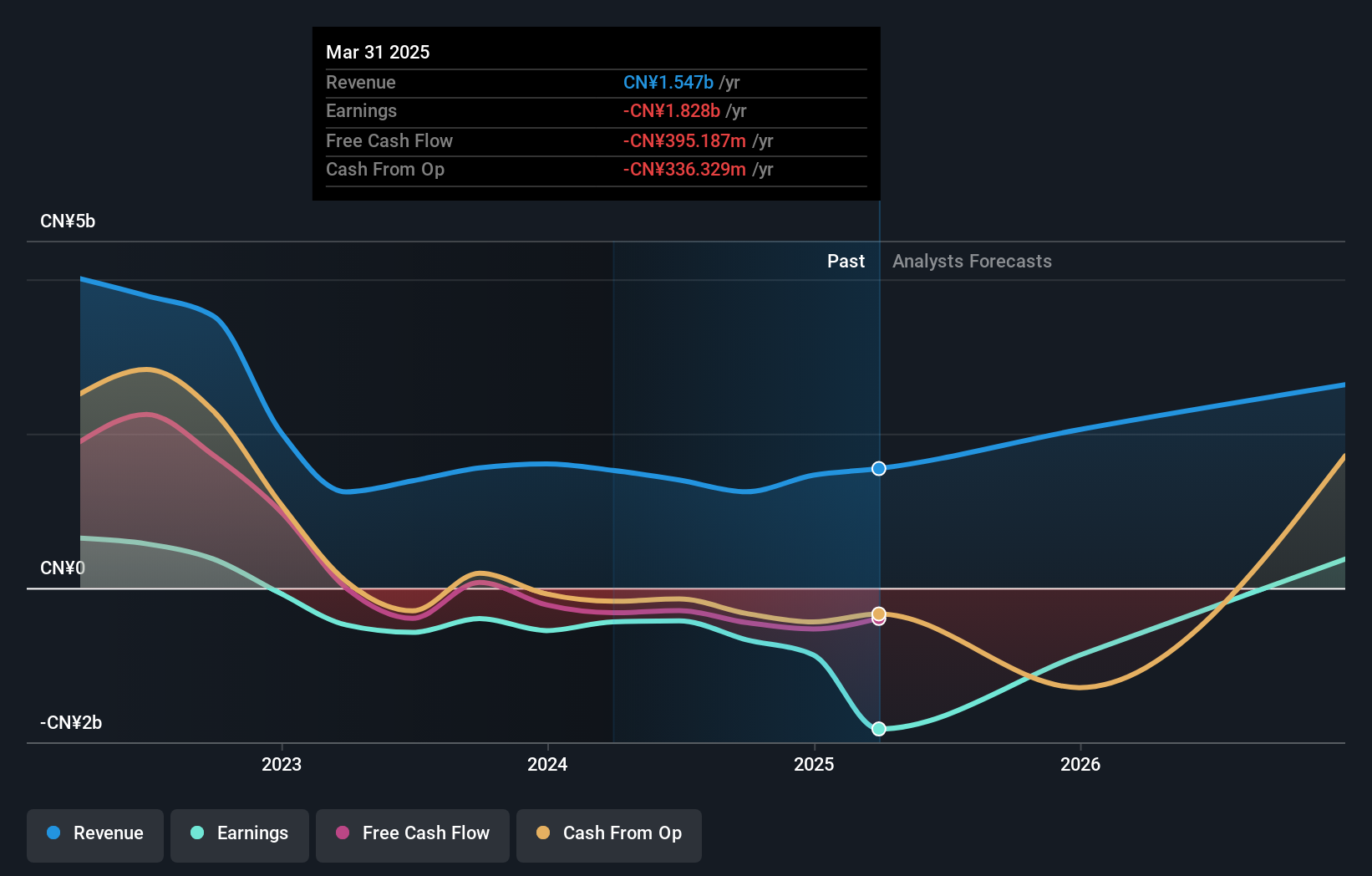

Despite recent challenges, Bona Film Group's future appears promising with expected revenue growth of 50.7% annually, outpacing the Chinese market's 13.4%. This robust projection is coupled with an anticipated earnings surge of 108.6% per year, positioning the company for a profitable turnaround within three years. However, it's important to note that Bona has been navigating through a tough phase marked by a significant revenue drop to CNY 960 million from CNY 1.32 billion year-over-year and escalating losses, now standing at CNY 354.36 million. The firm completed its share buyback program last November, acquiring shares worth CNY 47 million which reflects confidence in its strategic direction despite current financial volatilities.

- Take a closer look at Bona Film Group's potential here in our health report.

Assess Bona Film Group's past performance with our detailed historical performance reports.

Fujian Star-net Communication (SZSE:002396)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Star-net Communication Co., LTD. offers ICT infrastructure and AI application solutions in China, with a market cap of approximately CN¥12.07 billion.

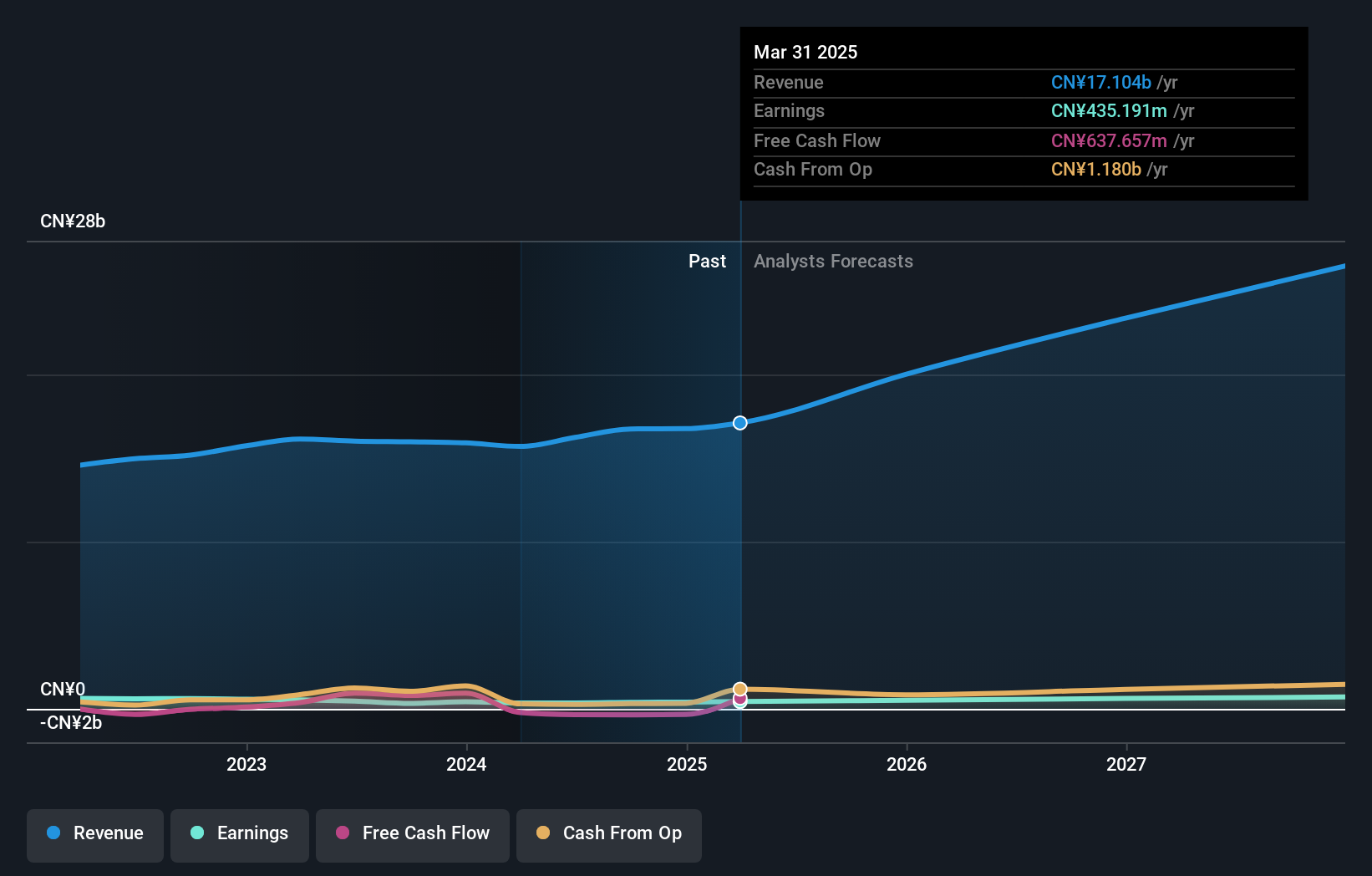

Operations: Star-net generates revenue primarily from its communication equipment manufacturing segment, which accounts for CN¥16.74 billion.

Fujian Star-net Communication, despite its recent removal from several Shenzhen Stock Exchange indexes, shows a promising financial trajectory with an expected annual revenue growth of 18.9% and earnings growth forecast at 35.5%. These figures notably surpass the broader Chinese market's averages of 13.4% and 25.1%, respectively. The company's focus on innovation is evident from its R&D spending trends, which have consistently aligned with or exceeded industry norms, positioning it well within the competitive tech landscape. Moreover, a special shareholders meeting scheduled for late December suggests proactive governance, potentially steering the firm towards sustained growth amidst market shifts.

- Navigate through the intricacies of Fujian Star-net Communication with our comprehensive health report here.

Gain insights into Fujian Star-net Communication's past trends and performance with our Past report.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co.Ltd, along with its subsidiaries, engages in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally, with a market cap of CN¥16.88 billion.

Operations: The company generates revenue primarily from the sale of intelligent controller products, catering to both domestic and international markets. Its operations encompass research, development, manufacturing, sales, and marketing activities.

Shenzhen H&T Intelligent Control Co.Ltd has demonstrated robust financial performance, with revenue surging by 28.3% to CNY 7.04 billion and net income increasing to CNY 355.37 million, up from last year's figures. This growth trajectory is complemented by an aggressive R&D focus, where the company has not only maintained but increased its investment in innovation, crucial for staying competitive in the fast-evolving tech landscape. Recent corporate actions including a special shareholders meeting to discuss strategic changes such as stock repurchases and amendments to the company's articles of association indicate proactive governance aimed at refining operational efficiencies and shareholder value. These moves are aligned with the company’s broader strategy to enhance technological capabilities and market adaptability.

- Dive into the specifics of Shenzhen H&T Intelligent ControlLtd here with our thorough health report.

Seize The Opportunity

- Reveal the 1226 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002396

Fujian Star-net Communication

Provides ICT infrastructure and AI application solutions in China.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives