Guizhou BC&TV Information Network CO.,LTD (SHSE:600996) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Guizhou BC&TV Information Network CO.,LTD (SHSE:600996) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 42% in the last twelve months.

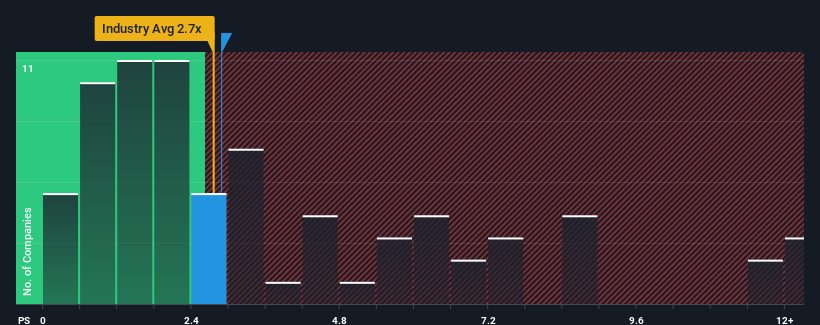

In spite of the firm bounce in price, there still wouldn't be many who think Guizhou BC&TV Information NetworkLTD's price-to-sales (or "P/S") ratio of 2.9x is worth a mention when the median P/S in China's Media industry is similar at about 2.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Guizhou BC&TV Information NetworkLTD

How Guizhou BC&TV Information NetworkLTD Has Been Performing

Revenue has risen firmly for Guizhou BC&TV Information NetworkLTD recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Guizhou BC&TV Information NetworkLTD will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guizhou BC&TV Information NetworkLTD's earnings, revenue and cash flow.How Is Guizhou BC&TV Information NetworkLTD's Revenue Growth Trending?

Guizhou BC&TV Information NetworkLTD's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 20% shows it's noticeably less attractive.

In light of this, it's curious that Guizhou BC&TV Information NetworkLTD's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Guizhou BC&TV Information NetworkLTD's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Guizhou BC&TV Information NetworkLTD's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you settle on your opinion, we've discovered 2 warning signs for Guizhou BC&TV Information NetworkLTD that you should be aware of.

If you're unsure about the strength of Guizhou BC&TV Information NetworkLTD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600996

Guizhou BC&TV Information NetworkLTD

Operates and constructs radio and television network in China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives