Is Guangxi Radio and Television Information Network (SHSE:600936) Using Debt In A Risky Way?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Guangxi Radio and Television Information Network Corporation Limited (SHSE:600936) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Guangxi Radio and Television Information Network

How Much Debt Does Guangxi Radio and Television Information Network Carry?

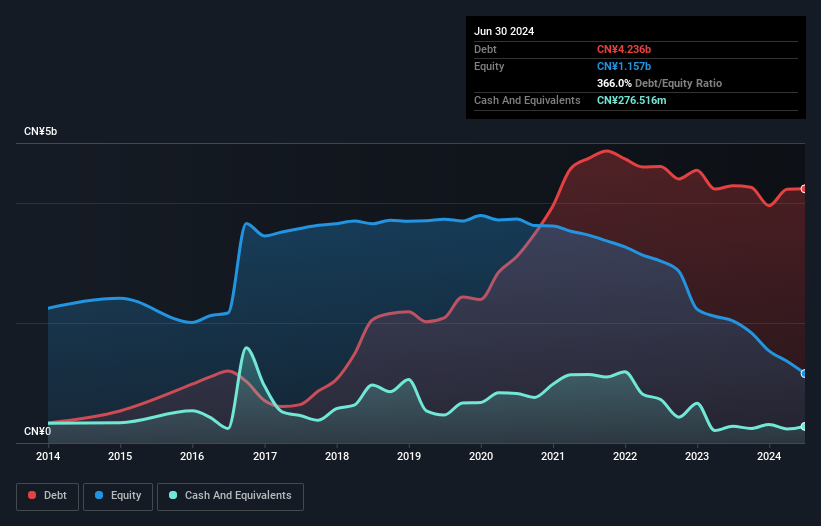

The chart below, which you can click on for greater detail, shows that Guangxi Radio and Television Information Network had CN¥4.24b in debt in June 2024; about the same as the year before. However, it also had CN¥276.5m in cash, and so its net debt is CN¥3.96b.

How Healthy Is Guangxi Radio and Television Information Network's Balance Sheet?

We can see from the most recent balance sheet that Guangxi Radio and Television Information Network had liabilities of CN¥3.04b falling due within a year, and liabilities of CN¥3.68b due beyond that. On the other hand, it had cash of CN¥276.5m and CN¥879.8m worth of receivables due within a year. So it has liabilities totalling CN¥5.56b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's CN¥4.18b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. When analysing debt levels, the balance sheet is the obvious place to start. But it is Guangxi Radio and Television Information Network's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Guangxi Radio and Television Information Network had a loss before interest and tax, and actually shrunk its revenue by 27%, to CN¥1.2b. That makes us nervous, to say the least.

Caveat Emptor

While Guangxi Radio and Television Information Network's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping CN¥675m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through CN¥75m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Guangxi Radio and Television Information Network you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600936

Guangxi Radio and Television Information Network

Provides radio and television network services in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives