- China

- /

- Entertainment

- /

- SHSE:600633

Why Investors Shouldn't Be Surprised By Zhejiang Daily Digital Culture Group Co.,Ltd's (SHSE:600633) 37% Share Price Surge

The Zhejiang Daily Digital Culture Group Co.,Ltd (SHSE:600633) share price has done very well over the last month, posting an excellent gain of 37%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

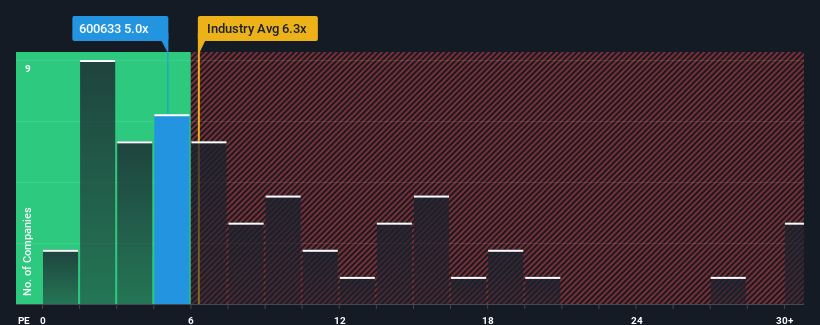

Although its price has surged higher, you could still be forgiven for feeling indifferent about Zhejiang Daily Digital Culture GroupLtd's P/S ratio of 5x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in China is also close to 6.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Zhejiang Daily Digital Culture GroupLtd

What Does Zhejiang Daily Digital Culture GroupLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Zhejiang Daily Digital Culture GroupLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Daily Digital Culture GroupLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Zhejiang Daily Digital Culture GroupLtd?

Zhejiang Daily Digital Culture GroupLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 37%. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 25% as estimated by the three analysts watching the company. With the industry predicted to deliver 28% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Zhejiang Daily Digital Culture GroupLtd's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Zhejiang Daily Digital Culture GroupLtd's P/S?

Its shares have lifted substantially and now Zhejiang Daily Digital Culture GroupLtd's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Zhejiang Daily Digital Culture GroupLtd's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Zhejiang Daily Digital Culture GroupLtd (1 doesn't sit too well with us!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Daily Digital Culture GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600633

Zhejiang Daily Digital Culture GroupLtd

Operates as an internet digital cultural company in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success