- China

- /

- Entertainment

- /

- SHSE:600633

Market Cool On Zhejiang Daily Digital Culture Group Co.,Ltd's (SHSE:600633) Earnings Pushing Shares 26% Lower

The Zhejiang Daily Digital Culture Group Co.,Ltd (SHSE:600633) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

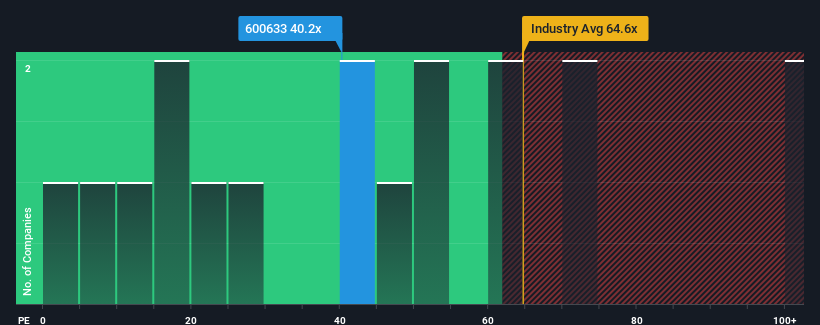

Even after such a large drop in price, there still wouldn't be many who think Zhejiang Daily Digital Culture GroupLtd's price-to-earnings (or "P/E") ratio of 40.2x is worth a mention when the median P/E in China is similar at about 39x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Zhejiang Daily Digital Culture GroupLtd as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Zhejiang Daily Digital Culture GroupLtd

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Zhejiang Daily Digital Culture GroupLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. As a result, earnings from three years ago have also fallen 18% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 40% as estimated by the dual analysts watching the company. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Zhejiang Daily Digital Culture GroupLtd's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

With its share price falling into a hole, the P/E for Zhejiang Daily Digital Culture GroupLtd looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Zhejiang Daily Digital Culture GroupLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Zhejiang Daily Digital Culture GroupLtd (1 is significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Zhejiang Daily Digital Culture GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Daily Digital Culture GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600633

Zhejiang Daily Digital Culture GroupLtd

Operates as an internet digital cultural company in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success