- China

- /

- Interactive Media and Services

- /

- SHSE:600228

Discovering Fanli Digital TechnologyLtd And 2 Other Noteworthy Global Penny Stocks

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, U.S. stocks have shown resilience with major indices climbing for the second consecutive week, driven by strong performances in small-cap and technology sectors. Amid these developments, investors might consider exploring opportunities beyond well-known giants, where penny stocks—often representing smaller or newer companies—can present intriguing possibilities. Although the term "penny stocks" may seem outdated, they remain a relevant area of investment that can offer surprising value when backed by solid financial health and potential for growth.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.15 | HK$731.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.035 | £453.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 3 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.63 | A$434.95M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.95 | A$704.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.31 | SGD9.09B | ✅ 5 ⚠️ 0 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.58 | HK$52.24B | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,578 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Fanli Digital TechnologyLtd (SHSE:600228)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fanli Digital Technology Co., Ltd operates Fanli.com, an e-commerce shopping guide platform in China, with a market cap of CN¥1.91 billion.

Operations: The company's revenue is primarily derived from its Internet and related services segment, which generated CN¥233.11 million.

Market Cap: CN¥1.91B

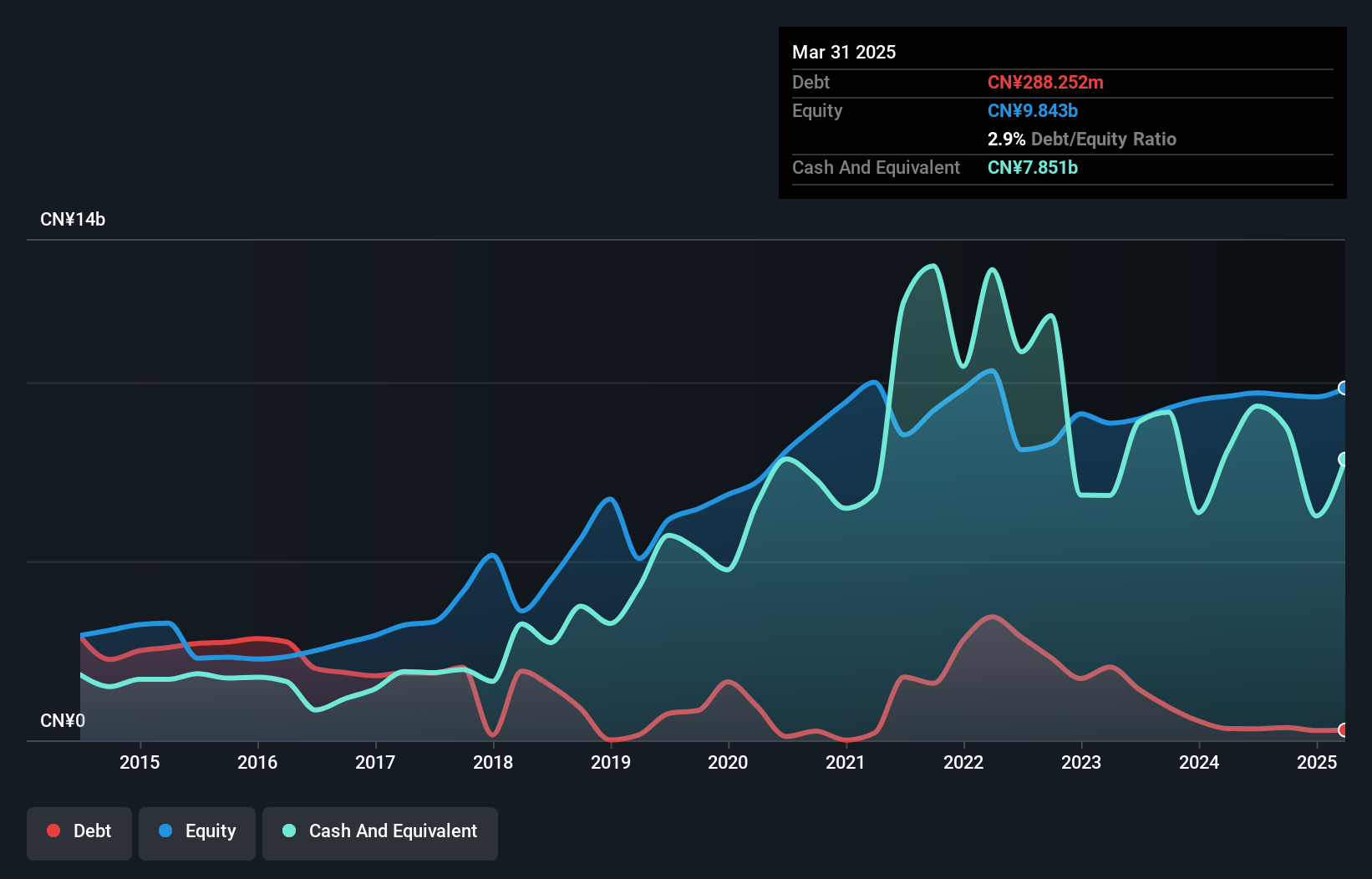

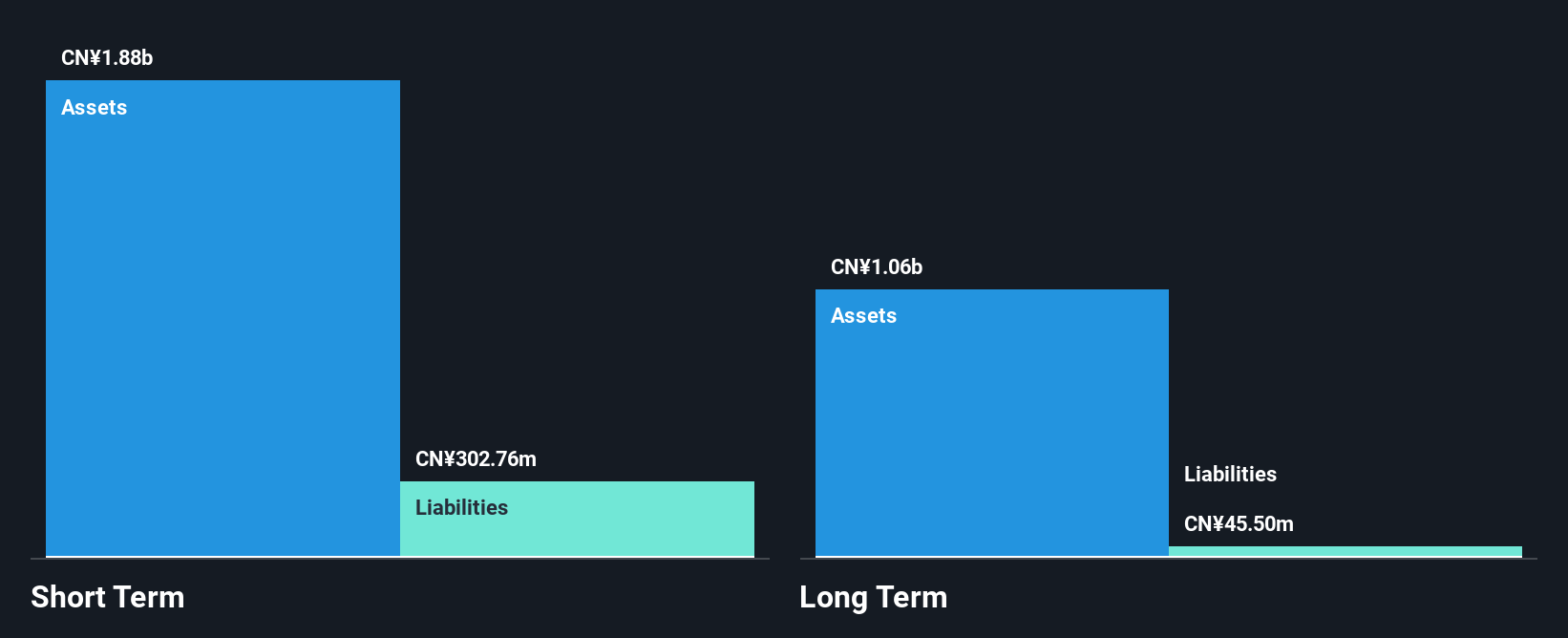

Fanli Digital Technology Co., Ltd, with a market cap of CN¥1.91 billion, recently reported a decline in revenue to CN¥53.6 million for Q1 2025 from CN¥64.32 million the previous year, alongside an increased net loss of CN¥13.98 million. Despite its unprofitability and high share price volatility, the company remains debt-free and has not diluted shareholders over the past year. Its short-term assets significantly exceed both short-term and long-term liabilities, providing some financial stability amidst ongoing challenges in achieving profitability within the highly competitive e-commerce sector in China.

- Click to explore a detailed breakdown of our findings in Fanli Digital TechnologyLtd's financial health report.

- Examine Fanli Digital TechnologyLtd's past performance report to understand how it has performed in prior years.

Fangda Special Steel Technology (SHSE:600507)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fangda Special Steel Technology Co., Ltd. operates in the steel industry, focusing on the production and sale of special steel products, with a market cap of CN¥9.55 billion.

Operations: Fangda Special Steel Technology Co., Ltd. operates without reported revenue segments, focusing on the production and sale of special steel products.

Market Cap: CN¥9.55B

Fangda Special Steel Technology, with a market cap of CN¥9.55 billion, reported Q1 2025 earnings showing decreased revenue of CN¥4.35 billion from CN¥5.87 billion a year earlier, yet net income rose to CN¥250.34 million from CN¥93.41 million. The company's short-term assets exceed both its short-term and long-term liabilities, indicating financial stability despite negative operating cash flow and low return on equity at 4.1%. While the management team is relatively new with an average tenure of 0.6 years, the board is experienced with an average tenure of 6.1 years, suggesting strategic continuity amidst leadership changes.

- Click here to discover the nuances of Fangda Special Steel Technology with our detailed analytical financial health report.

- Explore Fangda Special Steel Technology's analyst forecasts in our growth report.

Sanchuan Wisdom Technology (SZSE:300066)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sanchuan Wisdom Technology Co., Ltd. manufactures and sells water meters under the San Chuan brand, with a market cap of CN¥4.40 billion.

Operations: Sanchuan Wisdom Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.4B

Sanchuan Wisdom Technology, with a market cap of CN¥4.40 billion, has faced challenges as evidenced by decreased revenue and earnings over the past year. Despite reporting sales of CN¥213.34 million for Q1 2025, down from CN¥348.53 million a year ago, net income improved to CN¥16.31 million from a marginal profit previously. The company benefits from having more cash than total debt and its short-term assets significantly exceed both short-term and long-term liabilities, indicating strong liquidity management. However, declining profit margins and negative earnings growth remain concerns amidst an unstable dividend track record.

- Click here and access our complete financial health analysis report to understand the dynamics of Sanchuan Wisdom Technology.

- Assess Sanchuan Wisdom Technology's previous results with our detailed historical performance reports.

Key Takeaways

- Get an in-depth perspective on all 5,578 Global Penny Stocks by using our screener here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600228

Fanli Digital TechnologyLtd

Operates Fanli.com, an e-commerce shopping guide platform in China.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives