Global markets have shown resilience, with U.S. stocks recording solid gains and growth stocks outperforming their value counterparts. This positive momentum is buoyed by encouraging economic data and investor optimism for a "soft landing" in the economy. In this environment, companies that exhibit high insider ownership often signal strong confidence from those closest to the business, making them attractive candidates for investors seeking growth opportunities. Here are three high-growth insider stocks demonstrating impressive revenue growth of up to 25%.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

Let's dive into some prime choices out of the screener.

Vista Energy. de (BMV:VISTA A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vista Energy, S.A.B. de C.V., with a market cap of MX$90.87 billion, engages in the exploration and production of oil and gas in Latin America through its subsidiaries.

Operations: Revenue from the exploration and production of crude oil, natural gas, and LPG amounts to $1.33 billion.

Insider Ownership: 12.4%

Revenue Growth Forecast: 21.9% p.a.

Vista Energy, S.A.B. de C.V. has demonstrated strong growth potential with earnings forecasted to grow 20.61% annually and revenue expected to increase by 21.9% per year, outpacing the MX market's growth rate. Recent earnings reports show substantial year-over-year increases in sales (US$396.72 million) and net income (US$139.64 million). Despite high debt levels and a volatile share price, Vista Energy trades at a significant discount to its estimated fair value, indicating potential for future appreciation given its robust financial performance and high insider ownership.

- Click here to discover the nuances of Vista Energy. de with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Vista Energy. de's share price might be too pessimistic.

Guangdong Yussen Energy Technology (SZSE:002986)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Yussen Energy Technology Co., Ltd. (SZSE:002986) operates in the energy technology sector and has a market cap of approximately CN¥3.95 billion.

Operations: Guangdong Yussen Energy Technology's revenue segments are not provided in the text.

Insider Ownership: 32.5%

Revenue Growth Forecast: 25.6% p.a.

Guangdong Yussen Energy Technology's earnings are forecast to grow 25.76% annually, outpacing the CN market. The company trades at a favorable P/E ratio of 10.4x compared to the market's 26.7x, suggesting good value relative to peers. However, shareholders have faced dilution over the past year and its dividend yield of 0.88% is not well covered by free cash flows. Recent events include a special meeting on Aug 12, 2024, addressing stock repurchase and cancellation plans.

- Dive into the specifics of Guangdong Yussen Energy Technology here with our thorough growth forecast report.

- According our valuation report, there's an indication that Guangdong Yussen Energy Technology's share price might be on the cheaper side.

Shandong Longhua New Material (SZSE:301149)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shandong Longhua New Material Co., Ltd. engages in the research, development, production, and sale of polyether polyols and polymer polyols products in China with a market cap of CN¥3.32 billion.

Operations: The company's revenue segments include CN¥1.23 billion from polyether polyols and CN¥2.45 billion from polymer polyols products.

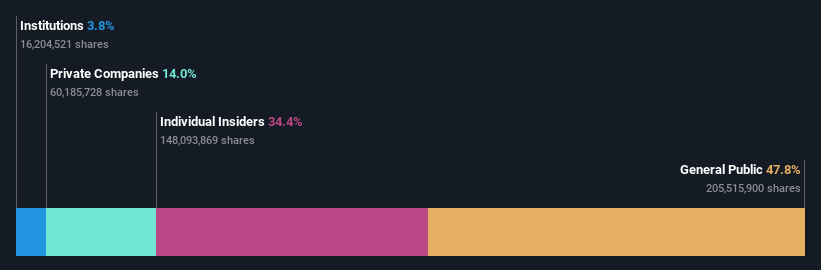

Insider Ownership: 34.4%

Revenue Growth Forecast: 24% p.a.

Shandong Longhua New Material's recent earnings report shows significant growth, with sales rising to CNY 2.78 billion and net income increasing to CNY 90.53 million for the half year ended June 30, 2024. The company is forecasted to grow revenue by 24% annually and earnings by over 42%, both outpacing the CN market. Trading at a P/E ratio of 15.4x, it offers good value compared to peers, with substantial insider ownership supporting investor confidence.

- Navigate through the intricacies of Shandong Longhua New Material with our comprehensive analyst estimates report here.

- Our valuation report here indicates Shandong Longhua New Material may be undervalued.

Where To Now?

- Click this link to deep-dive into the 1486 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301149

Shandong Longhua New Material

Engages in the research and development, production, and sale of polyether polyols and polymer polyols products in China.

Exceptional growth potential with excellent balance sheet.