- China

- /

- Semiconductors

- /

- SHSE:603061

Chinese Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As Chinese equities show resilience despite weaker-than-expected economic activity, investors are increasingly looking towards growth companies with high insider ownership as potential opportunities. In this article, we will explore three such companies in China that stand out due to their strong growth prospects and significant insider holdings.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 26.9% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 40.1% |

| UTour Group (SZSE:002707) | 23% | 36.1% |

Let's take a closer look at a couple of our picks from the screened companies.

JHT DesignLtd (SHSE:603061)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JHT Design Co., Ltd. engages in the research, development, production, and sale of semiconductor chip testing equipment in China and has a market cap of CN¥3.87 billion.

Operations: The company generates revenue from the research, development, production, and sale of semiconductor chip testing equipment in China.

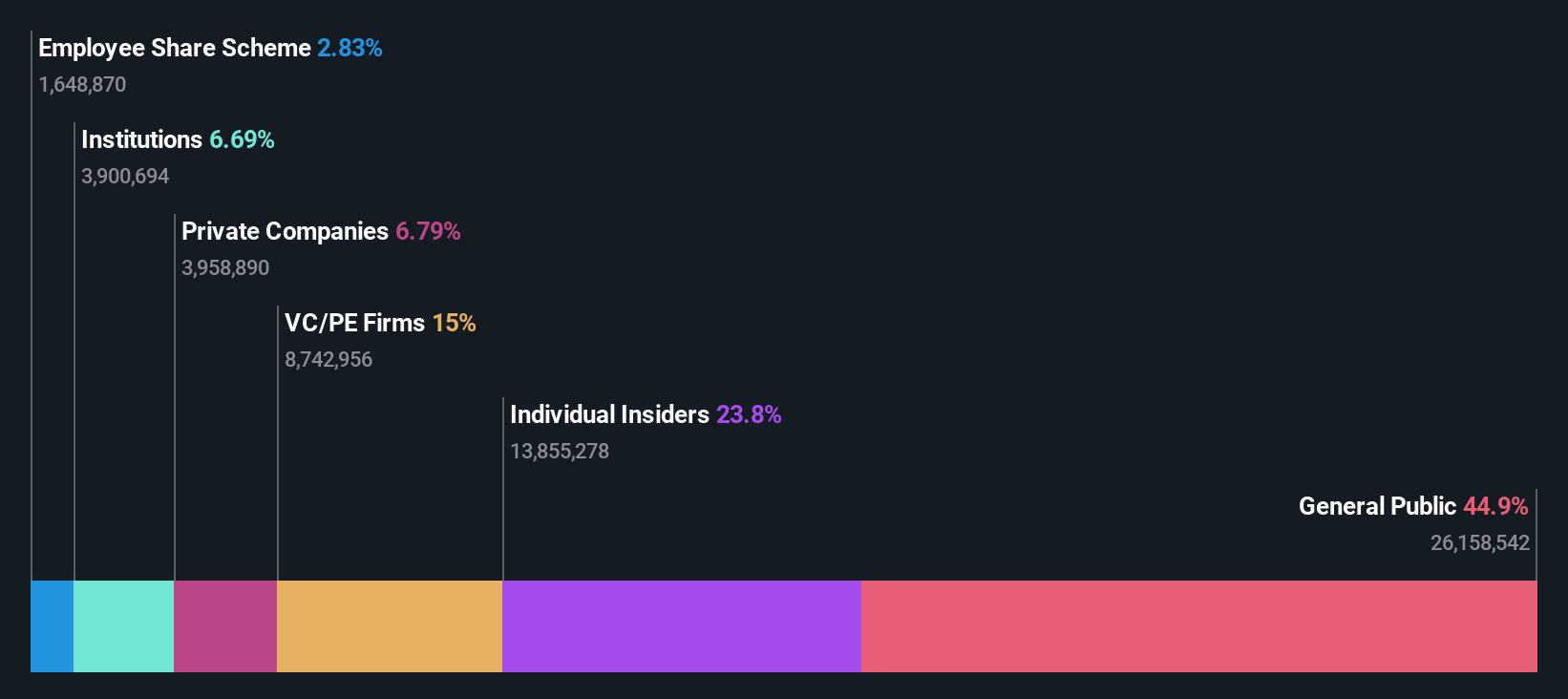

Insider Ownership: 23.1%

Earnings Growth Forecast: 32% p.a.

JHT Design Ltd. is a growth company in China with high insider ownership, forecasted to grow earnings by 31.96% annually and revenue by 26.9% per year, outpacing the Chinese market's growth rates. Despite recent earnings showing a slight decline—sales of ¥183.14 million and net income of ¥39.68 million—the company's long-term outlook remains strong due to its significant expected annual profit growth above market averages and substantial revenue expansion projections.

- Get an in-depth perspective on JHT DesignLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our JHT DesignLtd valuation report hints at an inflated share price compared to its estimated value.

APT Medical (SHSE:688617)

Simply Wall St Growth Rating: ★★★★★★

Overview: APT Medical Inc. focuses on the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China, with a market cap of CN¥34.79 billion.

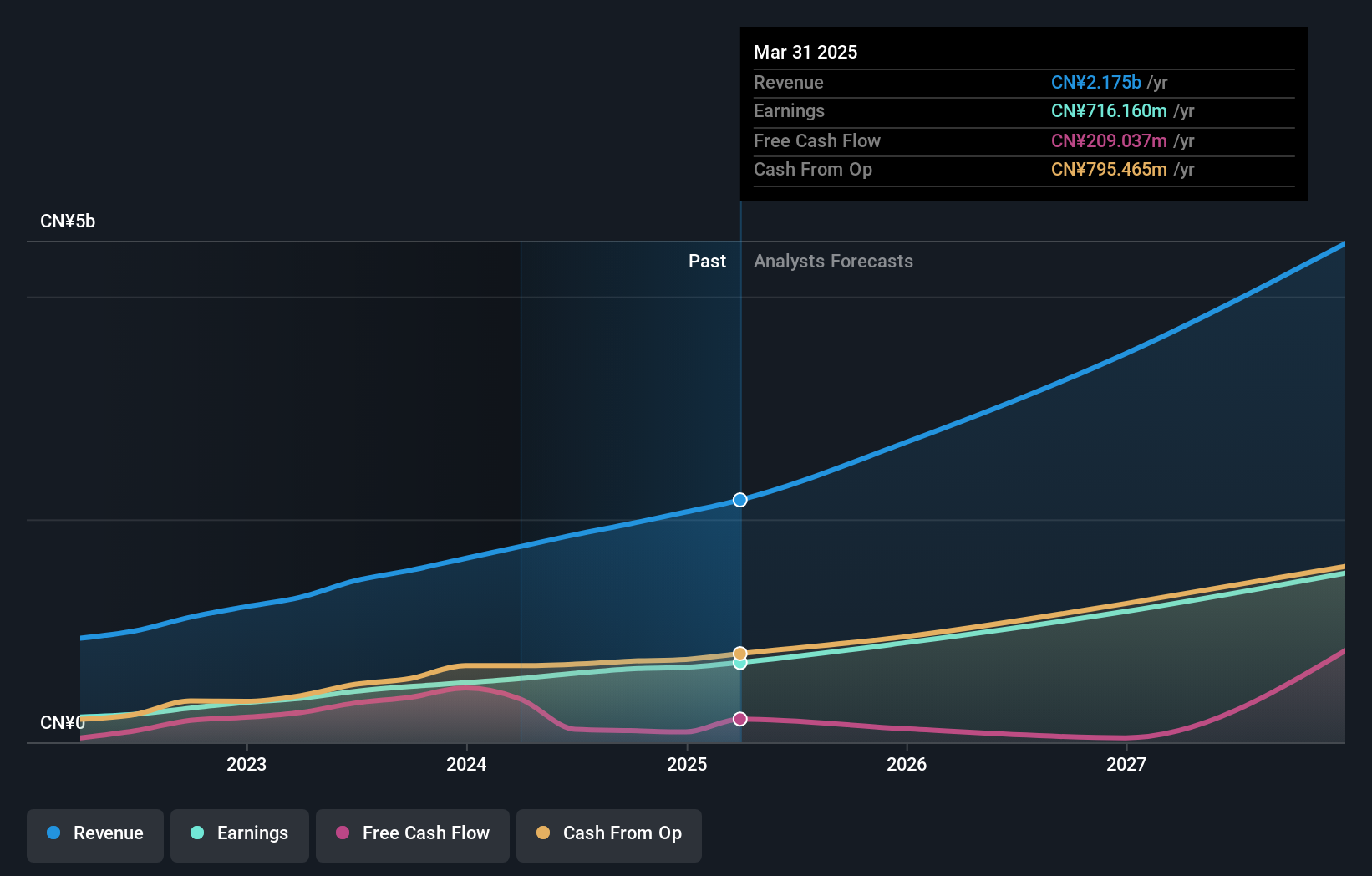

Operations: The company's revenue from medical products stands at CN¥1.76 billion.

Insider Ownership: 31.9%

Earnings Growth Forecast: 27.7% p.a.

APT Medical is forecasted to achieve significant earnings growth of 27.72% annually over the next three years, outpacing the Chinese market's average. Revenue is also expected to grow robustly at 27.3% per year, surpassing market rates. The company has demonstrated strong recent performance with a 45.1% earnings increase last year and maintains high-quality earnings with substantial non-cash components. No notable insider trading activity was reported in the past three months.

- Dive into the specifics of APT Medical here with our thorough growth forecast report.

- Our valuation report here indicates APT Medical may be overvalued.

Beijing Forever Technology (SZSE:300365)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Forever Technology Co., Ltd. provides smart grid solutions and services in the People’s Republic of China and internationally, with a market cap of CN¥2.85 billion.

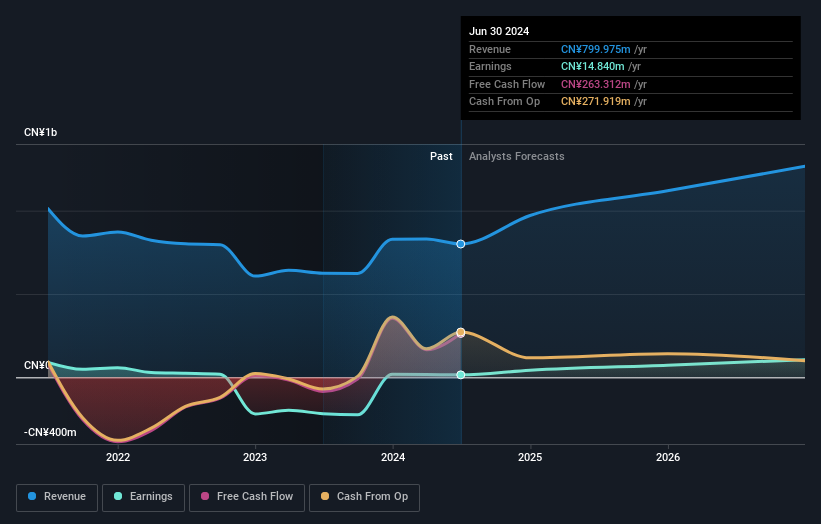

Operations: The company's revenue segments include smart grid solutions and services in China and internationally.

Insider Ownership: 31.5%

Earnings Growth Forecast: 53.7% p.a.

Beijing Forever Technology is expected to achieve significant annual earnings growth of 53.7% over the next three years, well above the Chinese market average of 21.8%. Despite dropping from the S&P Global BMI Index in June 2024, its revenue is forecasted to grow at 15% per year, faster than the market's 13.4%. The company became profitable this year and has high insider ownership but lacks recent notable insider trading activity.

- Click to explore a detailed breakdown of our findings in Beijing Forever Technology's earnings growth report.

- According our valuation report, there's an indication that Beijing Forever Technology's share price might be on the expensive side.

Taking Advantage

- Take a closer look at our Fast Growing Chinese Companies With High Insider Ownership list of 372 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603061

JHT DesignLtd

Engages in research, development, production, and sale of semiconductor chip testing equipment in China.

Flawless balance sheet with high growth potential.