Capital Allocation Trends At Sunlour PigmentLtd (SZSE:301036) Aren't Ideal

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Although, when we looked at Sunlour PigmentLtd (SZSE:301036), it didn't seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

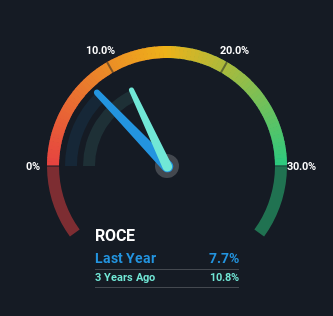

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Sunlour PigmentLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.077 = CN¥129m ÷ (CN¥1.8b - CN¥164m) (Based on the trailing twelve months to September 2024).

So, Sunlour PigmentLtd has an ROCE of 7.7%. On its own that's a low return, but compared to the average of 5.6% generated by the Chemicals industry, it's much better.

Check out our latest analysis for Sunlour PigmentLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Sunlour PigmentLtd.

So How Is Sunlour PigmentLtd's ROCE Trending?

When we looked at the ROCE trend at Sunlour PigmentLtd, we didn't gain much confidence. To be more specific, ROCE has fallen from 13% over the last five years. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

On a related note, Sunlour PigmentLtd has decreased its current liabilities to 9.0% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Bottom Line

While returns have fallen for Sunlour PigmentLtd in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. And the stock has followed suit returning a meaningful 77% to shareholders over the last three years. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the positive view.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 2 warning signs for Sunlour PigmentLtd (of which 1 is a bit unpleasant!) that you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301036

Sunlour PigmentLtd

Engages in the research, development, production, and sale of phthalocyanine, chrome yellow, and molybdate orange pigments in China and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives