- China

- /

- Metals and Mining

- /

- SZSE:300963

Earnings Tell The Story For Shanghai Zhongzhou Special Alloy Materials Co., Ltd. (SZSE:300963) As Its Stock Soars 40%

The Shanghai Zhongzhou Special Alloy Materials Co., Ltd. (SZSE:300963) share price has done very well over the last month, posting an excellent gain of 40%. Notwithstanding the latest gain, the annual share price return of 9.8% isn't as impressive.

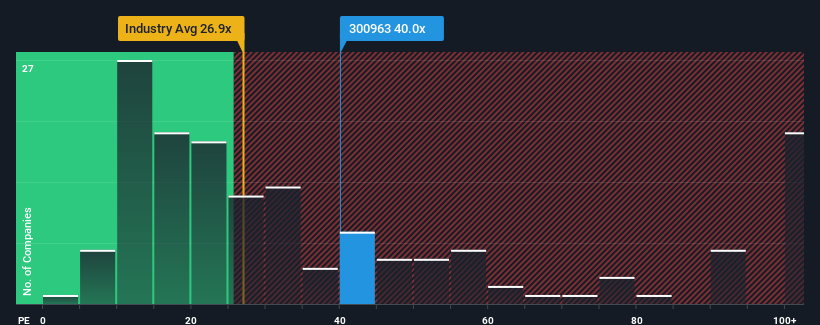

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 33x, you may consider Shanghai Zhongzhou Special Alloy Materials as a stock to potentially avoid with its 40x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Shanghai Zhongzhou Special Alloy Materials has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Shanghai Zhongzhou Special Alloy Materials

How Is Shanghai Zhongzhou Special Alloy Materials' Growth Trending?

Shanghai Zhongzhou Special Alloy Materials' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. Regardless, EPS has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 34% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% each year, which is noticeably less attractive.

With this information, we can see why Shanghai Zhongzhou Special Alloy Materials is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shanghai Zhongzhou Special Alloy Materials' P/E?

Shanghai Zhongzhou Special Alloy Materials' P/E is getting right up there since its shares have risen strongly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Shanghai Zhongzhou Special Alloy Materials' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Shanghai Zhongzhou Special Alloy Materials (1 is a bit concerning!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300963

Shanghai Zhongzhou Special Alloy Materials

Shanghai Zhongzhou Special Alloy Materials Co., Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success