Zhejiang Runyang New Material Technology Co., Ltd. (SZSE:300920) Surges 29% Yet Its Low P/E Is No Reason For Excitement

The Zhejiang Runyang New Material Technology Co., Ltd. (SZSE:300920) share price has done very well over the last month, posting an excellent gain of 29%. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

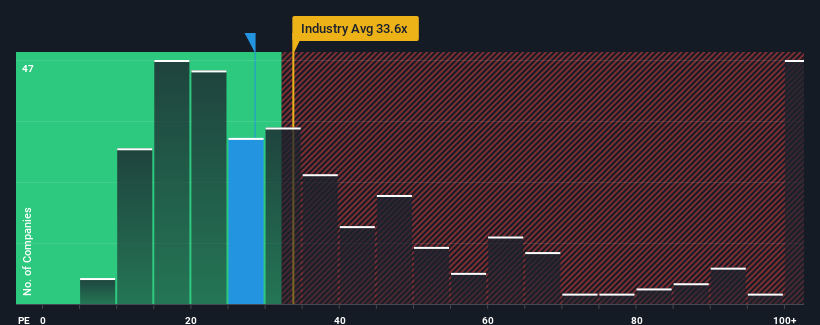

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Zhejiang Runyang New Material Technology as an attractive investment with its 28.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for Zhejiang Runyang New Material Technology as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Zhejiang Runyang New Material Technology

Is There Any Growth For Zhejiang Runyang New Material Technology?

In order to justify its P/E ratio, Zhejiang Runyang New Material Technology would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 353% gain to the company's bottom line. Still, incredibly EPS has fallen 62% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Zhejiang Runyang New Material Technology's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Zhejiang Runyang New Material Technology's P/E?

The latest share price surge wasn't enough to lift Zhejiang Runyang New Material Technology's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhejiang Runyang New Material Technology maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Zhejiang Runyang New Material Technology is showing 3 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Runyang New Material Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300920

Zhejiang Runyang New Material Technology

Zhejiang Runyang New Material Technology Co., Ltd.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives