There's Reason For Concern Over Poly Plastic Masterbatch (SuZhou) Co.,Ltd's (SZSE:300905) Massive 49% Price Jump

The Poly Plastic Masterbatch (SuZhou) Co.,Ltd (SZSE:300905) share price has done very well over the last month, posting an excellent gain of 49%. The last 30 days bring the annual gain to a very sharp 35%.

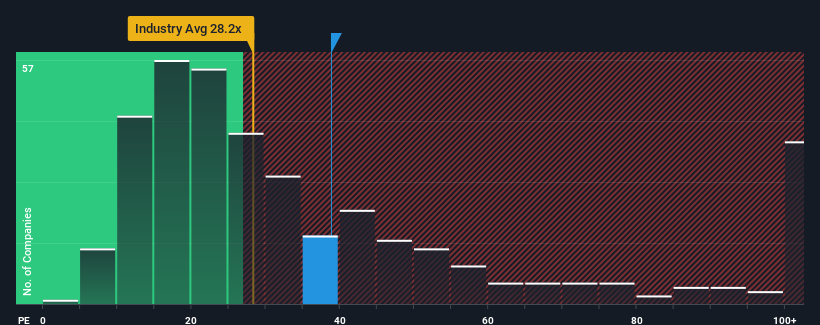

After such a large jump in price, Poly Plastic Masterbatch (SuZhou)Ltd may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 38.8x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Poly Plastic Masterbatch (SuZhou)Ltd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Poly Plastic Masterbatch (SuZhou)Ltd

Does Growth Match The High P/E?

Poly Plastic Masterbatch (SuZhou)Ltd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 87%. However, this wasn't enough as the latest three year period has seen a very unpleasant 39% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 35% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Poly Plastic Masterbatch (SuZhou)Ltd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Poly Plastic Masterbatch (SuZhou)Ltd's P/E

The large bounce in Poly Plastic Masterbatch (SuZhou)Ltd's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Poly Plastic Masterbatch (SuZhou)Ltd currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for Poly Plastic Masterbatch (SuZhou)Ltd (2 are concerning!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300905

Poly Plastic Masterbatch (SuZhou)Ltd

Engages in the research and development, production, and sale of chemical fiber solution colorings and advanced functional modified materials in China and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives