Optimistic Investors Push Anhui Hyea Aromas Co., Ltd. (SZSE:300886) Shares Up 30% But Growth Is Lacking

Anhui Hyea Aromas Co., Ltd. (SZSE:300886) shareholders have had their patience rewarded with a 30% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

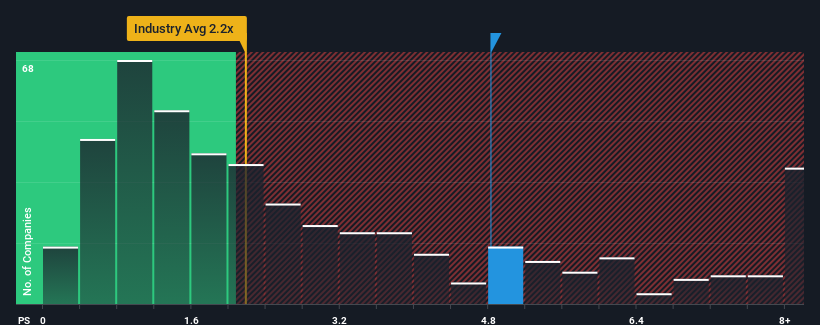

After such a large jump in price, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Anhui Hyea Aromas as a stock not worth researching with its 4.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Anhui Hyea Aromas

How Has Anhui Hyea Aromas Performed Recently?

Anhui Hyea Aromas has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Anhui Hyea Aromas, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Anhui Hyea Aromas' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Anhui Hyea Aromas' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.7% last year. This was backed up an excellent period prior to see revenue up by 32% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 23% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Anhui Hyea Aromas is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Anhui Hyea Aromas' P/S

Anhui Hyea Aromas' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Anhui Hyea Aromas currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 4 warning signs for Anhui Hyea Aromas (1 is significant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300886

Anhui Hyea Aromas

Engages in the research and development, production, and sale of fine chemicals.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives