There's Reason For Concern Over Anshan Hifichem Co., Ltd.'s (SZSE:300758) Massive 30% Price Jump

Despite an already strong run, Anshan Hifichem Co., Ltd. (SZSE:300758) shares have been powering on, with a gain of 30% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

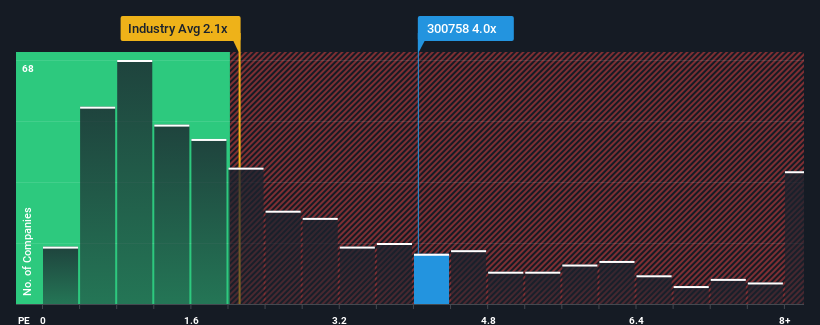

After such a large jump in price, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Anshan Hifichem as a stock to potentially avoid with its 4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Anshan Hifichem

How Has Anshan Hifichem Performed Recently?

Anshan Hifichem certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Anshan Hifichem.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Anshan Hifichem would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen a 12% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 11% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 22%, which is noticeably more attractive.

With this information, we find it concerning that Anshan Hifichem is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Anshan Hifichem's P/S?

The large bounce in Anshan Hifichem's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Anshan Hifichem currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Anshan Hifichem, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Anshan Hifichem, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300758

Anshan Hifichem

Engages in the research, development, manufacture, and sale of high-performance organic pigments, solvent dyes, and intermediates in China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives