- China

- /

- Electronic Equipment and Components

- /

- SHSE:688401

Undiscovered Gems in Asia to Watch This November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances across major indices and cautious monetary policy signals, small-cap stocks in Asia present intriguing opportunities amid broader economic uncertainties. With interest rate movements and shifting market sentiments playing pivotal roles, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential for growth despite the current challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Te Chang Construction | 10.33% | 13.82% | 17.08% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Wowow | NA | -1.33% | -27.86% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| Kanro | 5.65% | 7.36% | 35.28% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| KNJ | 65.48% | 8.93% | 40.98% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 11.75% | 17.91% | -3.17% | ★★★★★☆ |

| Guangdong Tloong Technology GroupLtd | 38.37% | -9.77% | -17.24% | ★★★★★☆ |

| JB Foods | 113.93% | 31.03% | 41.46% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company involved in the design, development, and production of mask products in China with a market cap of CN¥9.40 billion.

Operations: Shenzhen Newway derives its revenue primarily from electronic components and parts, amounting to CN¥1.10 billion.

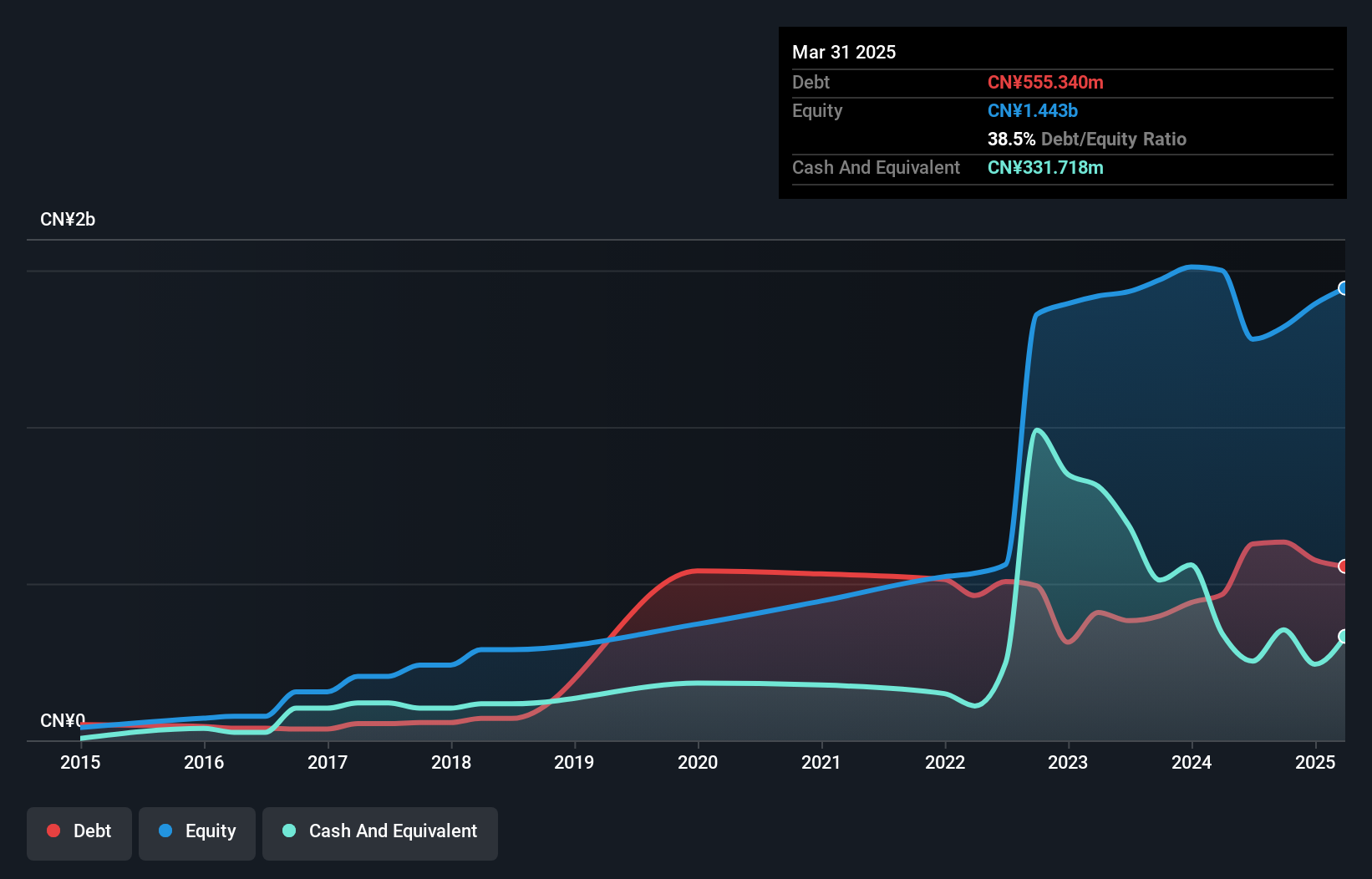

Shenzhen Newway Photomask Making, a small player in the electronics sector, is showing promising growth. Over the past year, earnings surged by 49.6%, outpacing the industry's 9% growth rate. The company's net income for the nine months ending September 2025 was CNY 171.76 million, up from CNY 121.06 million a year prior, with basic earnings per share rising to CNY 0.89 from CNY 0.63. Trading at about 38% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in Asia's technology space despite its highly volatile share price recently observed over three months.

Shenzhen Cotran New MaterialLtd (SZSE:300731)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Cotran New Material Co., Ltd. specializes in manufacturing waterproof and sealing insulation products and solutions in China, with a market capitalization of CN¥6.08 billion.

Operations: Cotran generates revenue primarily from the production and sales of high-performance special rubber sealing materials, amounting to CN¥1.20 billion.

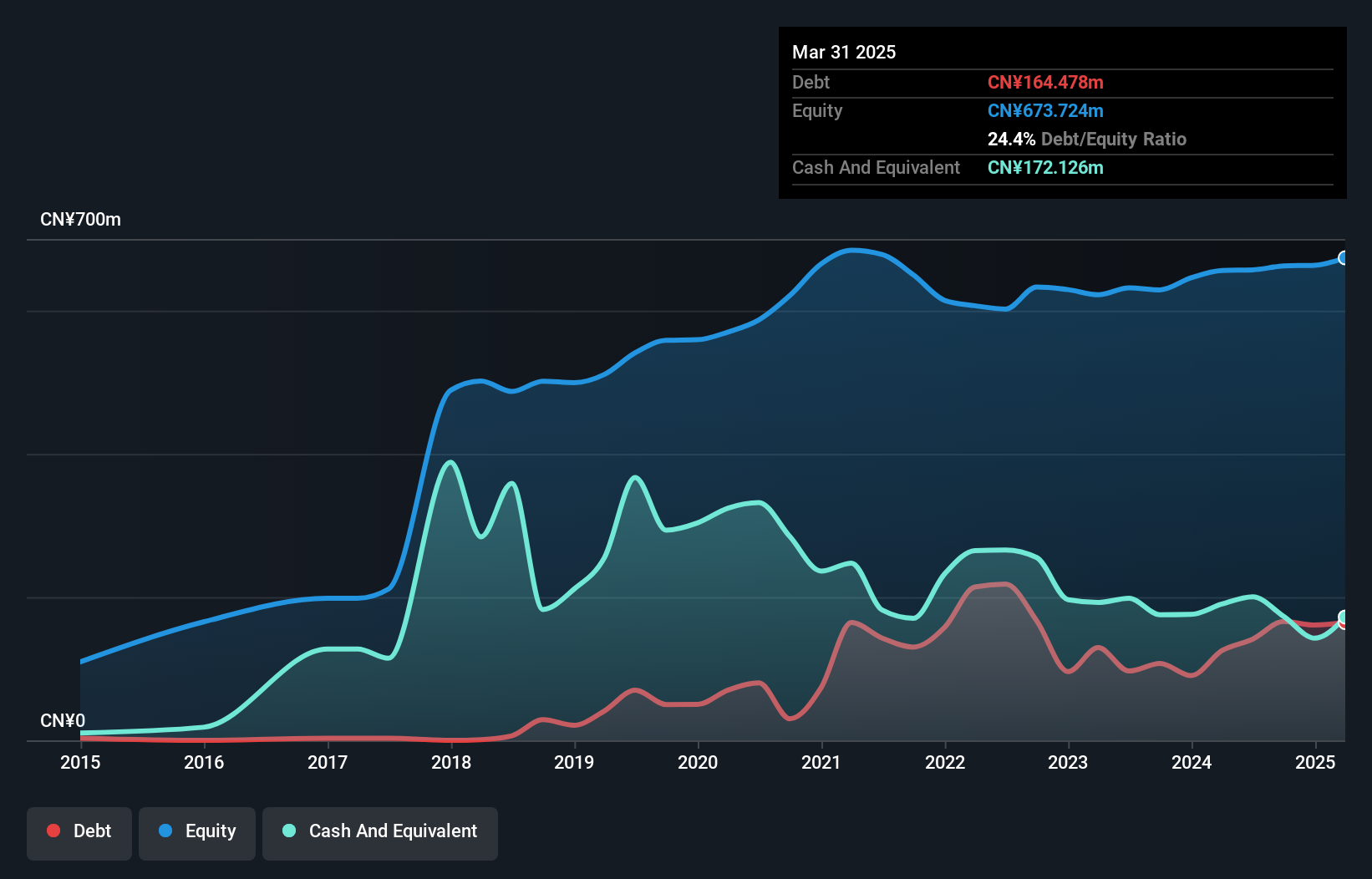

Shenzhen Cotran New Material, a smaller player in the materials sector, has been making waves with its impressive financial performance. Over the past year, earnings surged by 33.5%, outpacing the broader chemicals industry growth of 6.8%. The company reported net income of CNY 27 million for the nine months ending September 2025, up from CNY 10.67 million a year prior. Despite an increase in debt to equity ratio from 4.8% to 29.6% over five years, Shenzhen Cotran's interest payments are well covered by EBIT at a multiple of 9x, indicating robust financial health amidst rapid revenue growth to CNY 838 million this year from CNY 593 million last year.

EMTEK (Shenzhen) (SZSE:300938)

Simply Wall St Value Rating: ★★★★★★

Overview: EMTEK (Shenzhen) Co., Ltd. operates as a third-party testing company in China with a market capitalization of CN¥7.68 billion.

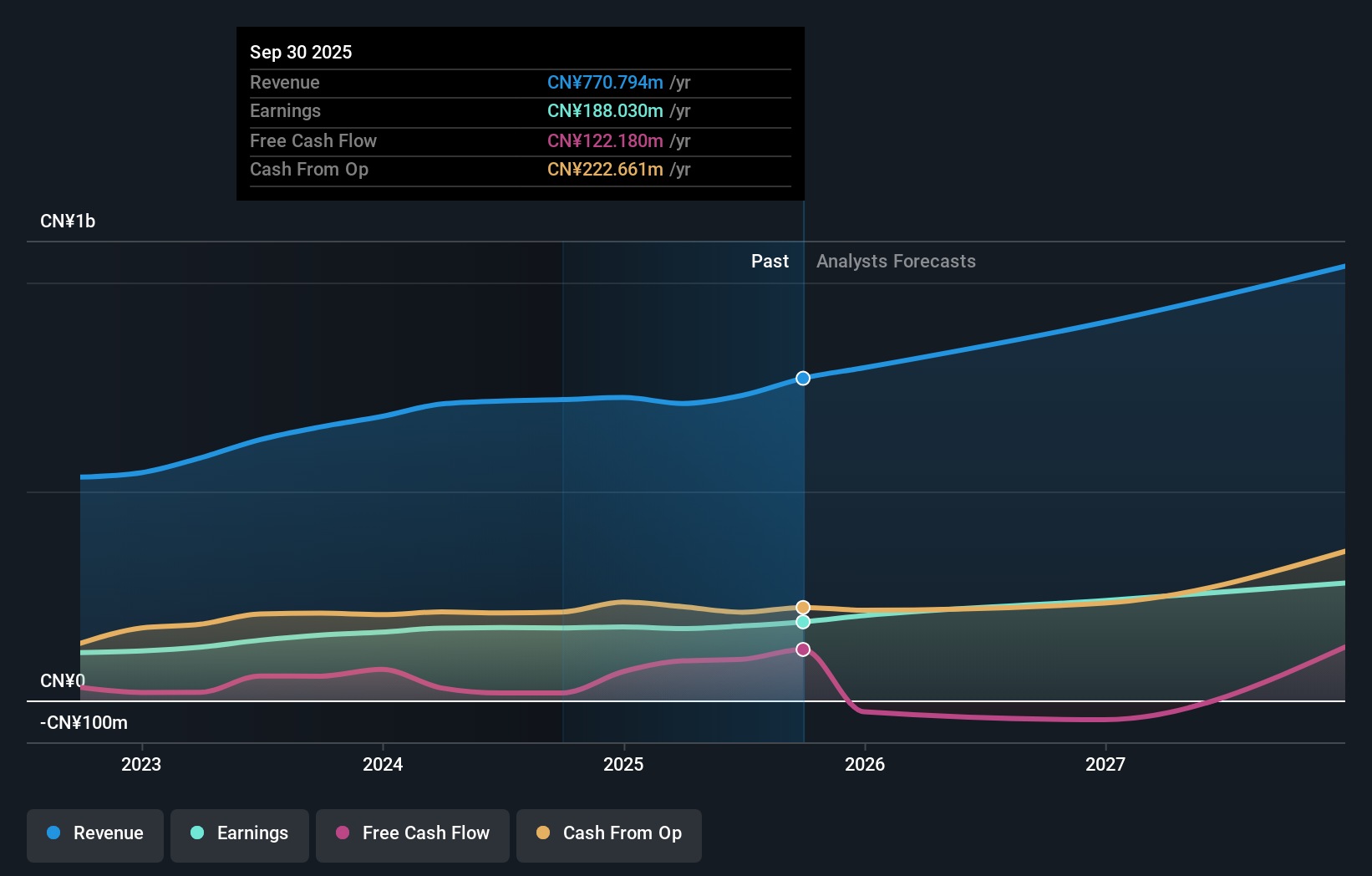

Operations: EMTEK (Shenzhen) generates revenue primarily from research services, amounting to CN¥770.79 million.

EMTEK (Shenzhen) showcases a promising profile with its debt-to-equity ratio dropping significantly from 4.8% to 0.2% over five years, indicating prudent financial management. The company reported sales of CNY 597.05 million for the first nine months of 2025, up from CNY 551.25 million the previous year, while net income rose to CNY 154.99 million from CNY 143.07 million, reflecting solid profitability and an earnings growth rate surpassing industry norms at 8.4%. With a P/E ratio of 40.9x below the CN market average and positive free cash flow trends, EMTEK appears well-positioned for future growth in its sector.

Where To Now?

- Dive into all 2481 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688401

Shenzhen Newway Photomask Making

A lithography company, engages in the design, development, and production of mask products in China.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives