- China

- /

- Construction

- /

- SHSE:603153

Exploring Three Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical uncertainties, small-cap stocks have experienced mixed performance, with indices like the Russell 2000 showing modest declines amidst broader market volatility. In this environment, identifying promising small-cap companies requires an astute focus on those with robust fundamentals and potential resilience amid economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai Research Institute of Building Sciences Group (SHSE:603153)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Research Institute of Building Sciences Group Co., Ltd. operates in the field of building sciences and has a market cap of CN¥7.52 billion.

Operations: The company generates revenue through its operations in building sciences. It has a market capitalization of CN¥7.52 billion, indicating its significant presence in the industry. The financial data lacks detailed breakdowns of revenue streams and cost structures, limiting further analysis.

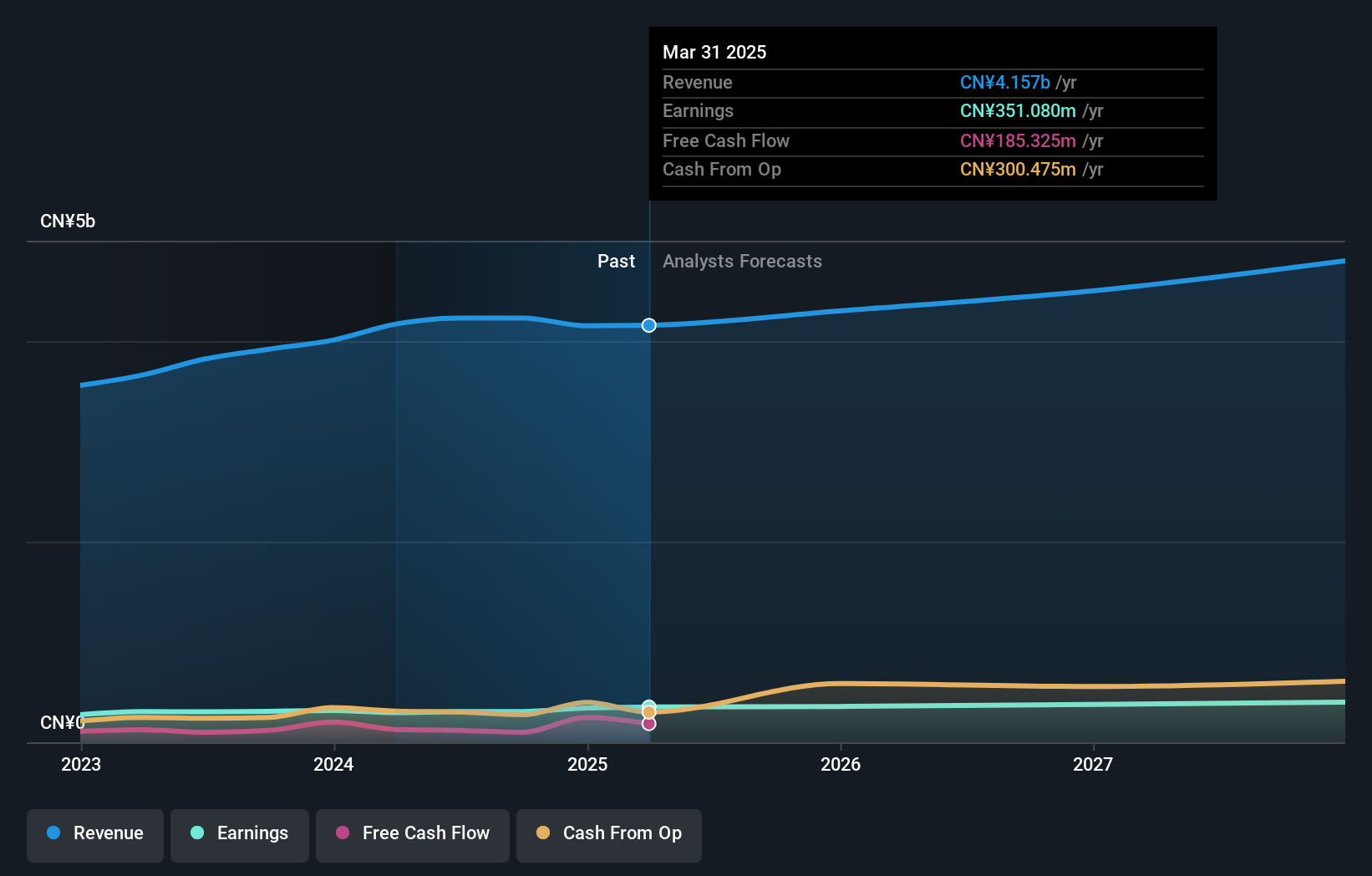

Shanghai Research Institute of Building Sciences Group, a small-cap player in the construction sector, has been making waves with its solid financial standing. Over the past year, earnings grew by 6.1%, outpacing the industry average of -3.9%. The company is debt-free now, a significant improvement from five years ago when it had a debt-to-equity ratio of 0.2%. Additionally, it's trading at 32% below its estimated fair value, suggesting potential undervaluation. A notable CN¥90 million one-off gain impacted recent results positively. The company completed a share buyback worth CN¥94.97 million for 5,802,710 shares in late 2024.

Anhui Anke Biotechnology (Group) (SZSE:300009)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Anke Biotechnology (Group) Co., Ltd. is a company engaged in the research, development, production, and sale of biopharmaceutical products with a market cap of CN¥13.91 billion.

Operations: Anke Biotechnology generates revenue primarily from the sale of biopharmaceutical products. The company's financial performance includes a notable net profit margin trend, reflecting its operational efficiency in managing costs relative to revenue.

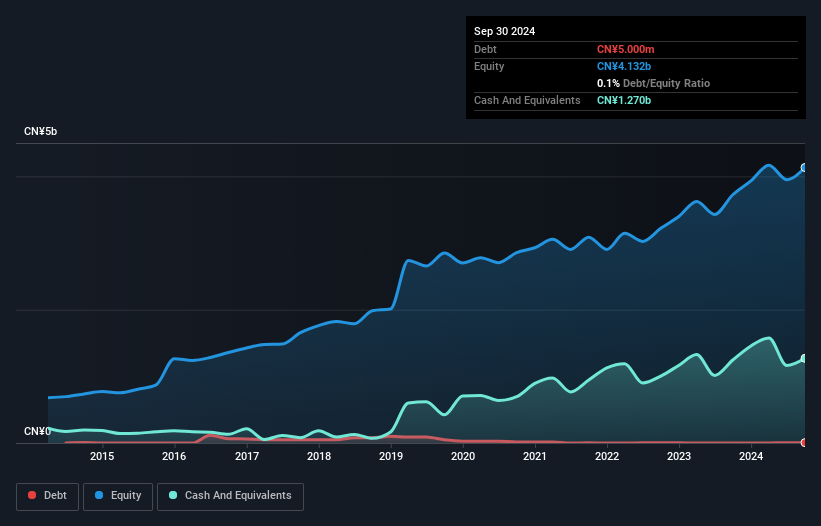

Anhui Anke Biotechnology, a smaller player in the biotech field, has been catching attention with its solid financial footing and strategic moves. Over the past year, earnings grew by 2.5%, outpacing the industry's 1.3% growth rate, highlighting its competitive edge. The company boasts high-quality past earnings and maintains a price-to-earnings ratio of 17.8x, which is favorable compared to the broader CN market's 34.9x. Recent decisions include approving a cash dividend of CNY 1 per ten shares and reducing registered capital to streamline operations further, suggesting proactive management in enhancing shareholder value while keeping debt levels low at a debt-to-equity ratio of just 0.1%.

- Take a closer look at Anhui Anke Biotechnology (Group)'s potential here in our health report.

Learn about Anhui Anke Biotechnology (Group)'s historical performance.

Shenzhen Cotran New MaterialLtd (SZSE:300731)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Cotran New Material Co., Ltd. specializes in manufacturing and supplying waterproof and sealing insulation products and solutions in China, with a market capitalization of CN¥3 billion.

Operations: Shenzhen Cotran New Material Co., Ltd. generates revenue primarily from the production and sales of high-performance special rubber sealing materials, totaling CN¥794.50 million. The company's market capitalization stands at approximately CN¥3 billion.

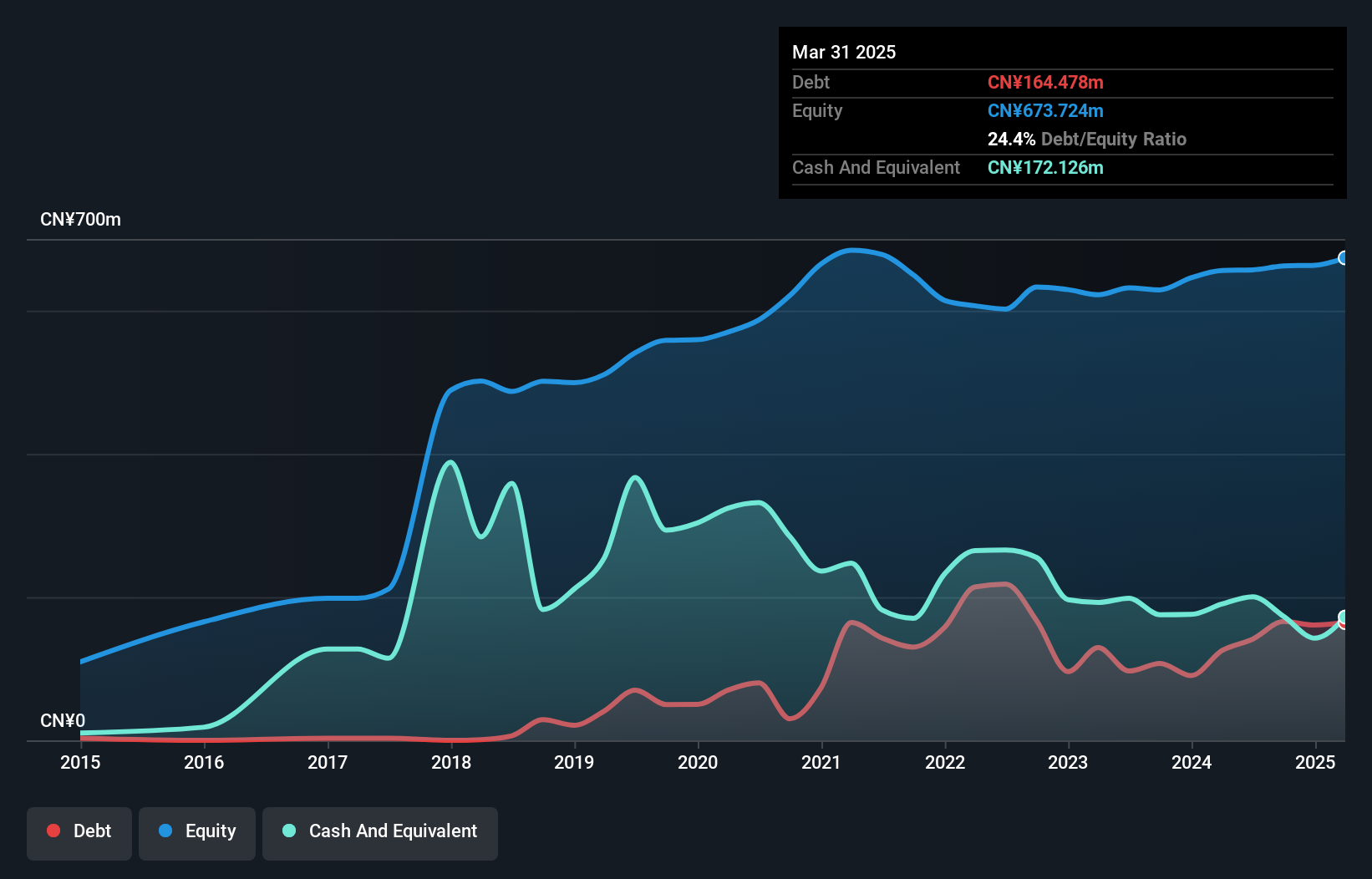

Shenzhen Cotran New Material Ltd., a relatively small player in the industry, has shown impressive earnings growth of 60.3% over the past year, outpacing the broader Chemicals sector's -5.4%. Despite its volatile share price recently, Cotran's high-quality earnings suggest strong operational efficiency. The company's debt to equity ratio has risen from 9% to 25% over five years, yet it remains financially sound with more cash than total debt and robust interest coverage. With forecasts indicating a potential annual earnings growth of 53.94%, Cotran seems poised for continued expansion within its market niche.

- Click here to discover the nuances of Shenzhen Cotran New MaterialLtd with our detailed analytical health report.

Understand Shenzhen Cotran New MaterialLtd's track record by examining our Past report.

Taking Advantage

- Get an in-depth perspective on all 4721 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603153

Shanghai Research Institute of Building Sciences Group

Shanghai Research Institute of Building Sciences Group Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives