- China

- /

- Metals and Mining

- /

- SZSE:300618

Investors Appear Satisfied With Nanjing Hanrui Cobalt Co.,Ltd.'s (SZSE:300618) Prospects As Shares Rocket 41%

Nanjing Hanrui Cobalt Co.,Ltd. (SZSE:300618) shares have had a really impressive month, gaining 41% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

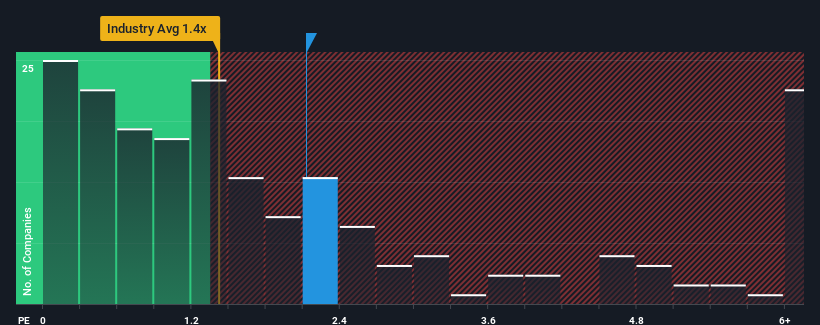

Since its price has surged higher, you could be forgiven for thinking Nanjing Hanrui CobaltLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in China's Metals and Mining industry have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Nanjing Hanrui CobaltLtd

What Does Nanjing Hanrui CobaltLtd's P/S Mean For Shareholders?

For instance, Nanjing Hanrui CobaltLtd's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nanjing Hanrui CobaltLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Nanjing Hanrui CobaltLtd's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 121% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Nanjing Hanrui CobaltLtd's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Nanjing Hanrui CobaltLtd's P/S

Nanjing Hanrui CobaltLtd's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Nanjing Hanrui CobaltLtd revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Nanjing Hanrui CobaltLtd (1 is significant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Hanrui CobaltLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300618

Nanjing Hanrui CobaltLtd

Engages in the extraction of cobalt and copper ores.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives