Subdued Growth No Barrier To PhiChem Corporation (SZSE:300398) With Shares Advancing 26%

Despite an already strong run, PhiChem Corporation (SZSE:300398) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 5.8% isn't as attractive.

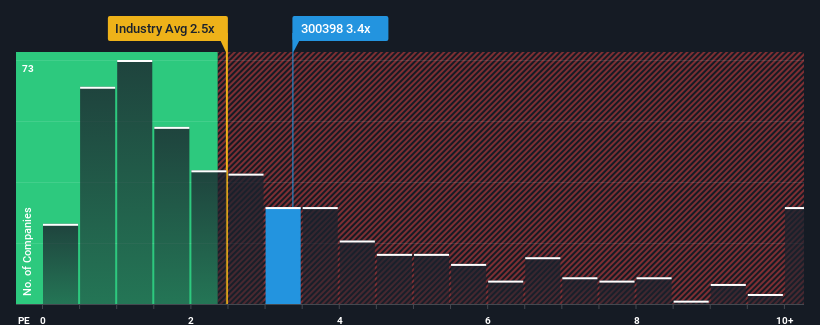

Since its price has surged higher, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider PhiChem as a stock to potentially avoid with its 3.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for PhiChem

How PhiChem Has Been Performing

PhiChem certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think PhiChem's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like PhiChem's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.8%. The solid recent performance means it was also able to grow revenue by 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 13% as estimated by the only analyst watching the company. With the industry predicted to deliver 25% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that PhiChem is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

PhiChem's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that PhiChem currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for PhiChem that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300398

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success