As global markets continue to navigate geopolitical tensions and economic uncertainties, U.S. indexes have shown resilience with broad-based gains, while the labor market remains robust. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities as insiders often have a deep understanding of their company's prospects and are more likely to align their interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Tianyang New Materials (Shanghai) Technology (SHSE:603330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tianyang New Materials (Shanghai) Technology Co., Ltd. operates in the materials technology sector and has a market cap of CN¥3.04 billion.

Operations: Tianyang New Materials (Shanghai) Technology Co., Ltd. does not have any specified revenue segments listed in the provided text.

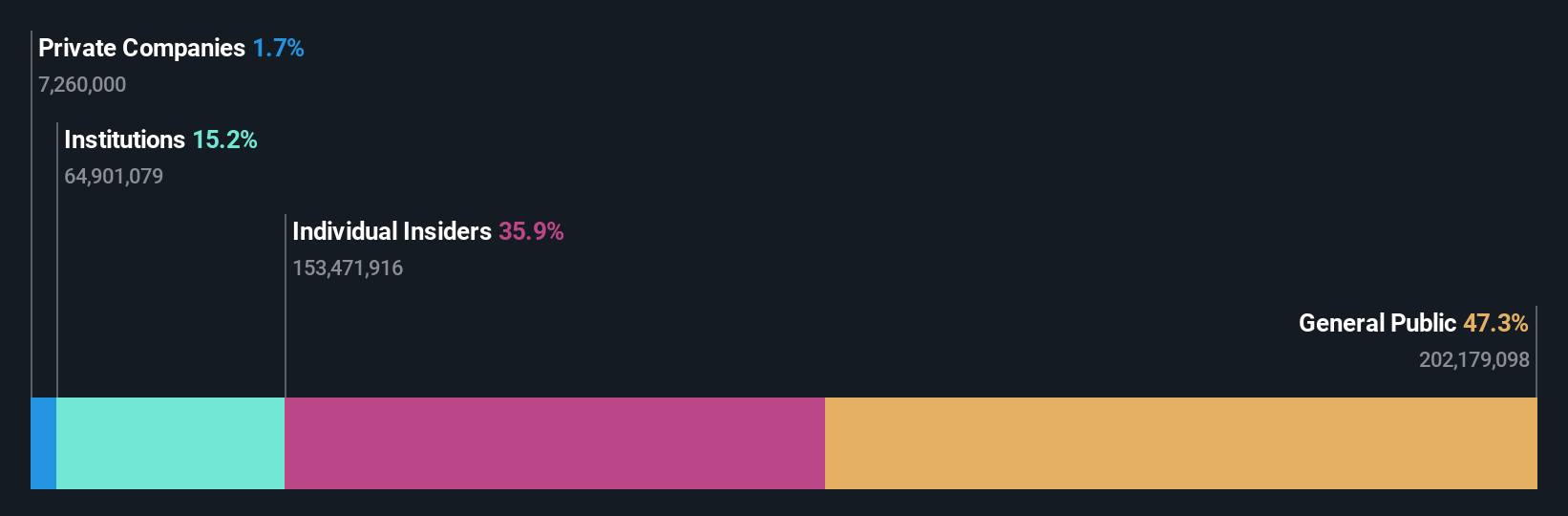

Insider Ownership: 36.5%

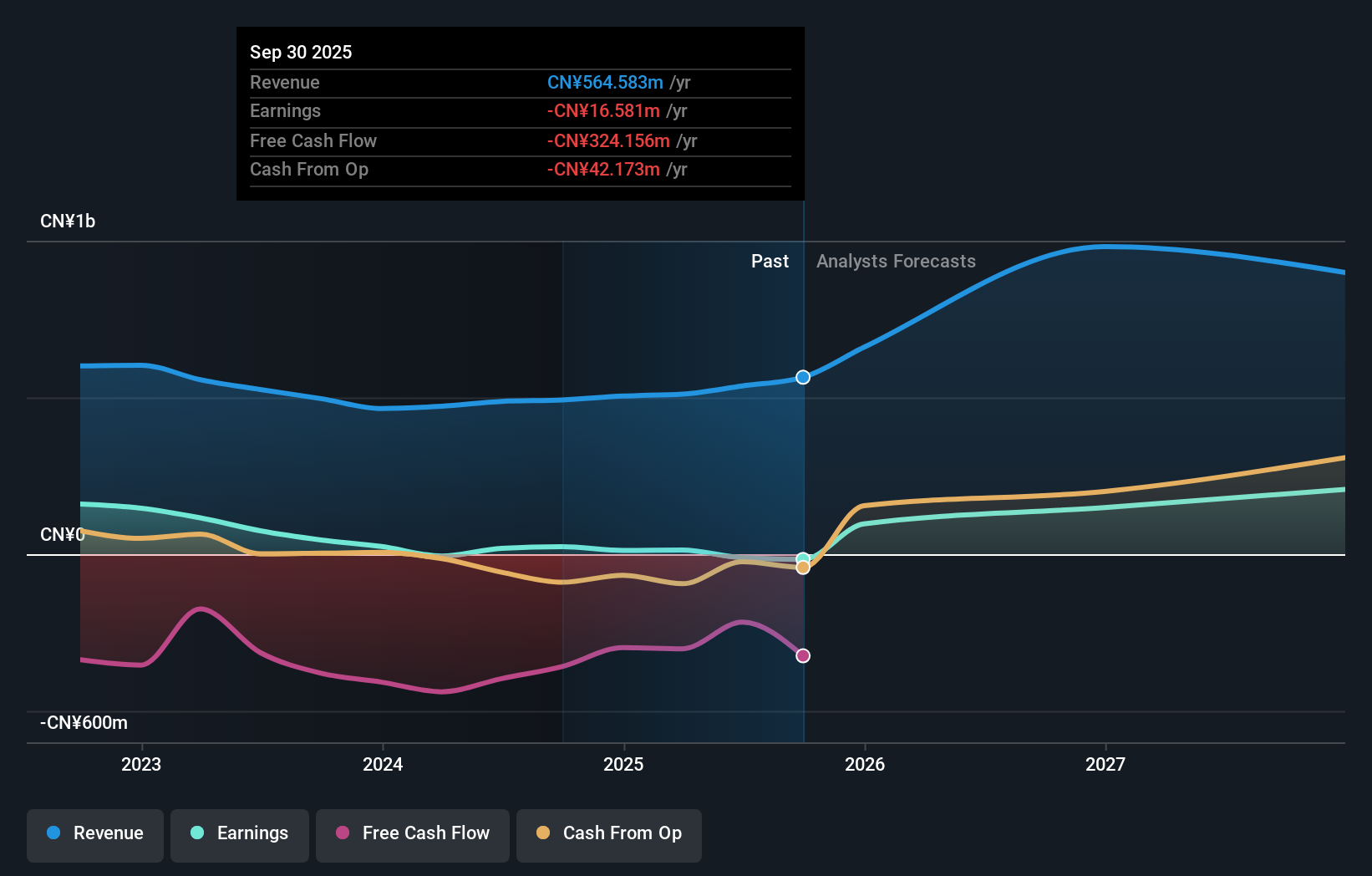

Tianyang New Materials (Shanghai) Technology is forecast to experience significant growth, with expected revenue increases of 27.4% annually, outpacing the broader Chinese market. Despite recent net losses and declining earnings per share, the company is anticipated to achieve profitability within three years. However, its current dividend yield of 1.11% lacks coverage from earnings or free cash flow, which could be a concern for income-focused investors.

- Click here and access our complete growth analysis report to understand the dynamics of Tianyang New Materials (Shanghai) Technology.

- Insights from our recent valuation report point to the potential overvaluation of Tianyang New Materials (Shanghai) Technology shares in the market.

Anhui Estone Materials TechnologyLtd (SHSE:688733)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Estone Materials Technology Co., Ltd operates in China, offering lithium battery coatings, electronic communication functional fillings, and low-smoke halogen-free flame-retardant materials, with a market cap of CN¥3.90 billion.

Operations: The company's revenue from specialty chemicals is CN¥491.84 million.

Insider Ownership: 33.4%

Anhui Estone Materials Technology is expected to see significant earnings growth of 59.1% annually, surpassing the Chinese market average. Despite this, recent financials show net income decreased slightly to CNY 14.76 million for the first nine months of 2024 compared to last year. Revenue rose from CNY 347.42 million to CNY 374.71 million, indicating strong sales performance despite lower profit margins and a volatile share price over the past three months.

- Take a closer look at Anhui Estone Materials TechnologyLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Anhui Estone Materials TechnologyLtd's shares may be trading at a premium.

Hubei Feilihua Quartz Glass (SZSE:300395)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hubei Feilihua Quartz Glass Co., Ltd. is a global manufacturer and seller of quartz material and quartz fiber products, with a market cap of CN¥20.42 billion.

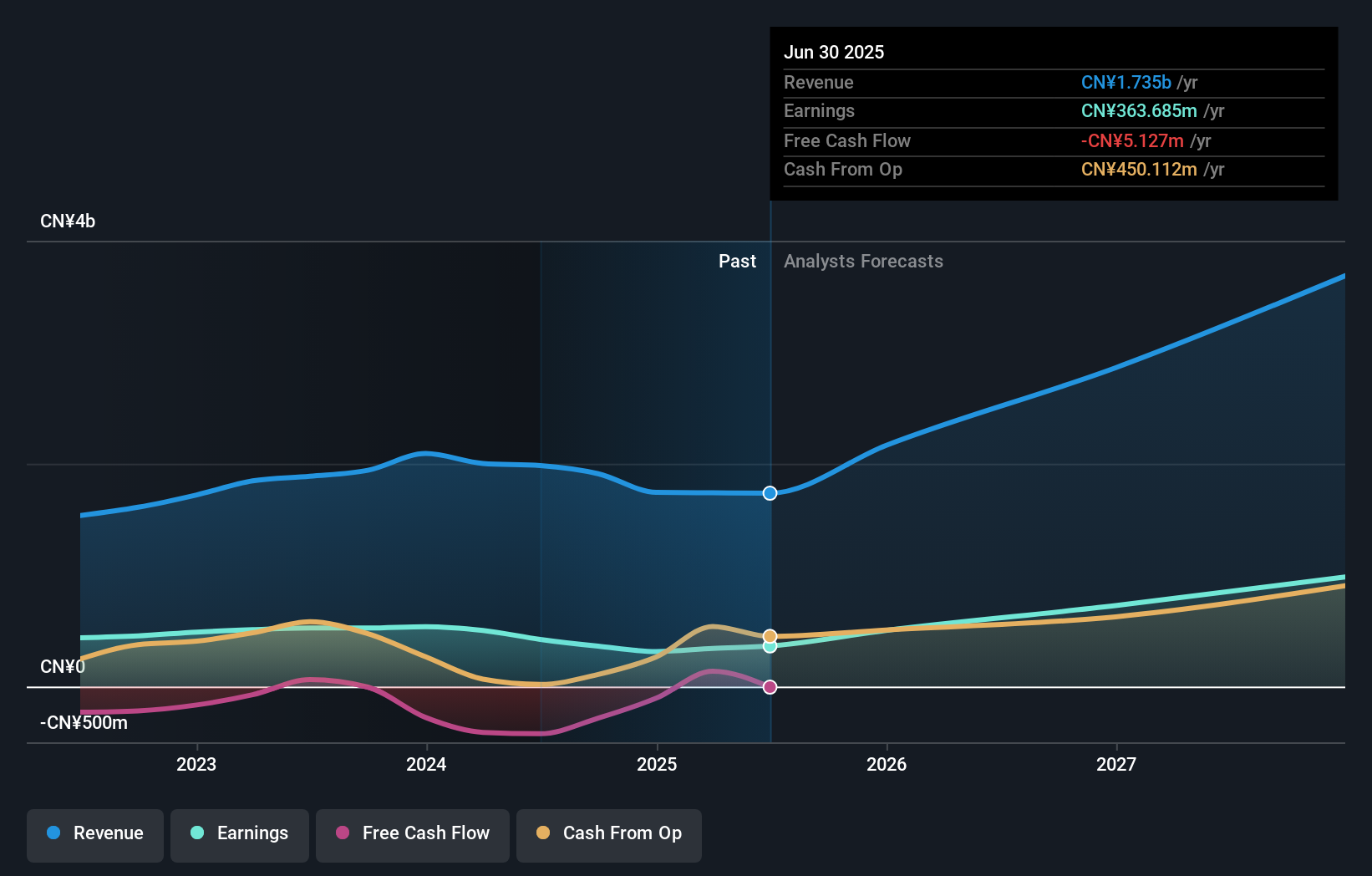

Operations: The company generates revenue primarily from the Non-Metallic Mineral Products Industry, amounting to CN¥1.84 billion.

Insider Ownership: 18%

Hubei Feilihua Quartz Glass is poised for robust growth, with earnings forecasted to increase significantly at 44.6% annually, outpacing China's market average. Revenue is also expected to grow at a strong rate of 28.5% per year. Despite recent financials showing a decline in net income to CNY 234.65 million and sales dropping to CNY 1.31 billion for the first nine months of 2024, insider ownership remains stable with no substantial trading activity reported recently.

- Get an in-depth perspective on Hubei Feilihua Quartz Glass' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Hubei Feilihua Quartz Glass' current price could be inflated.

Summing It All Up

- Explore the 1524 names from our Fast Growing Companies With High Insider Ownership screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688733

Anhui Estone Materials TechnologyLtd

Provides lithium battery coating, electronic communication functional filling, and low-smoke halogen-free flame-retardant materials in China.

High growth potential with mediocre balance sheet.