- China

- /

- Metals and Mining

- /

- SZSE:300328

Dongguan Eontec Co., Ltd. (SZSE:300328) Looks Just Right With A 33% Price Jump

Dongguan Eontec Co., Ltd. (SZSE:300328) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

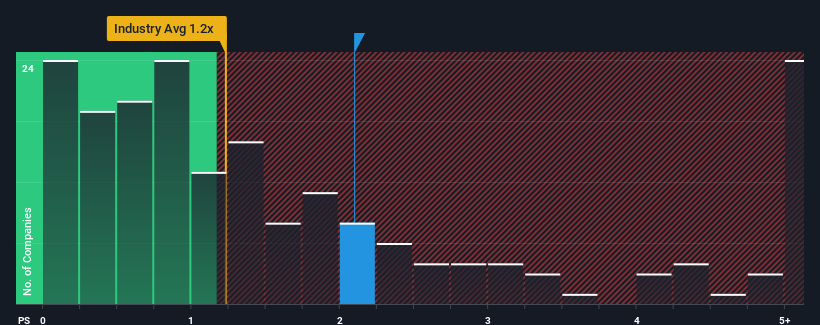

Following the firm bounce in price, you could be forgiven for thinking Dongguan Eontec is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.1x, considering almost half the companies in China's Metals and Mining industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Dongguan Eontec

How Dongguan Eontec Has Been Performing

Dongguan Eontec has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dongguan Eontec will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Dongguan Eontec would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The latest three year period has also seen an excellent 86% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 15% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Dongguan Eontec's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Dongguan Eontec's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Dongguan Eontec can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Plus, you should also learn about these 3 warning signs we've spotted with Dongguan Eontec (including 2 which are concerning).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300328

Dongguan Eontec

Engages in the research and development, production, and sale of light alloy materials in China and internationally.

Very low risk with worrying balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026