Spotlighting Three Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a turbulent landscape marked by AI competition concerns and fluctuating interest rates, investors are increasingly focused on corporate earnings and insider activities. In such an environment, companies with significant insider ownership often stand out as they may signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 20.5% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Jilin University Zhengyuan Information Technologies (SZSE:003029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin University Zhengyuan Information Technologies Co., Ltd. operates in the information technology sector with a market cap of CN¥3.95 billion.

Operations: The company generates revenue from its operations in the information technology sector.

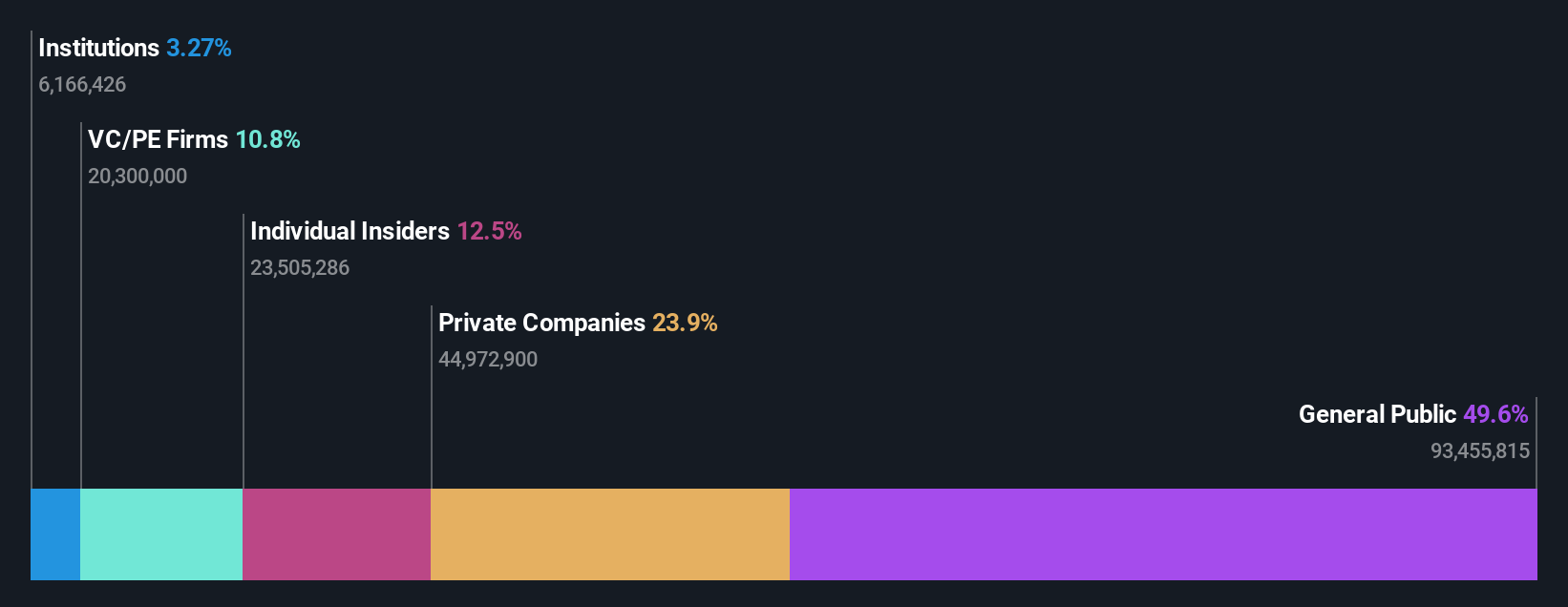

Insider Ownership: 12.5%

Jilin University Zhengyuan Information Technologies is poised for significant growth, with earnings projected to increase by 113.88% annually and revenue expected to grow by 72.9% per year, surpassing the Chinese market average. Despite its volatile share price, the company is on track to become profitable within three years. Recent activities include a completed share buyback of 5.22 million shares for ¥72.72 million and an upcoming shareholder meeting addressing fund allocation from its IPO proceeds.

- Delve into the full analysis future growth report here for a deeper understanding of Jilin University Zhengyuan Information Technologies.

- Our valuation report here indicates Jilin University Zhengyuan Information Technologies may be overvalued.

Chengdu Guibao Science & TechnologyLtd (SZSE:300019)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chengdu Guibao Science & Technology Co., Ltd. operates in the field of silicone sealants and adhesives, with a market cap of CN¥5.55 billion.

Operations: Chengdu Guibao Science & Technology Co., Ltd. generates its revenue primarily from the production and sale of silicone sealants and adhesives.

Insider Ownership: 35.3%

Chengdu Guibao Science & Technology Ltd. shows promising growth potential, with earnings projected to increase by 30.9% annually, outpacing the Chinese market average of 25%. Despite high share price volatility recently, its Price-To-Earnings ratio of 22.2x suggests it is undervalued compared to the broader CN market at 34.7x. However, its dividend yield of 2.13% is not well covered by free cash flows, and insider trading activity remains unclear over the past three months.

- Take a closer look at Chengdu Guibao Science & TechnologyLtd's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Chengdu Guibao Science & TechnologyLtd's current price could be quite moderate.

Hubei Huitian New Materials (SZSE:300041)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Huitian New Materials Co., Ltd. engages in the research, development, manufacture, and sale of adhesives and new materials both in China and internationally, with a market cap of CN¥4.63 billion.

Operations: The company's revenue segments include adhesives for CN¥5.20 billion and new materials for CN¥3.75 billion.

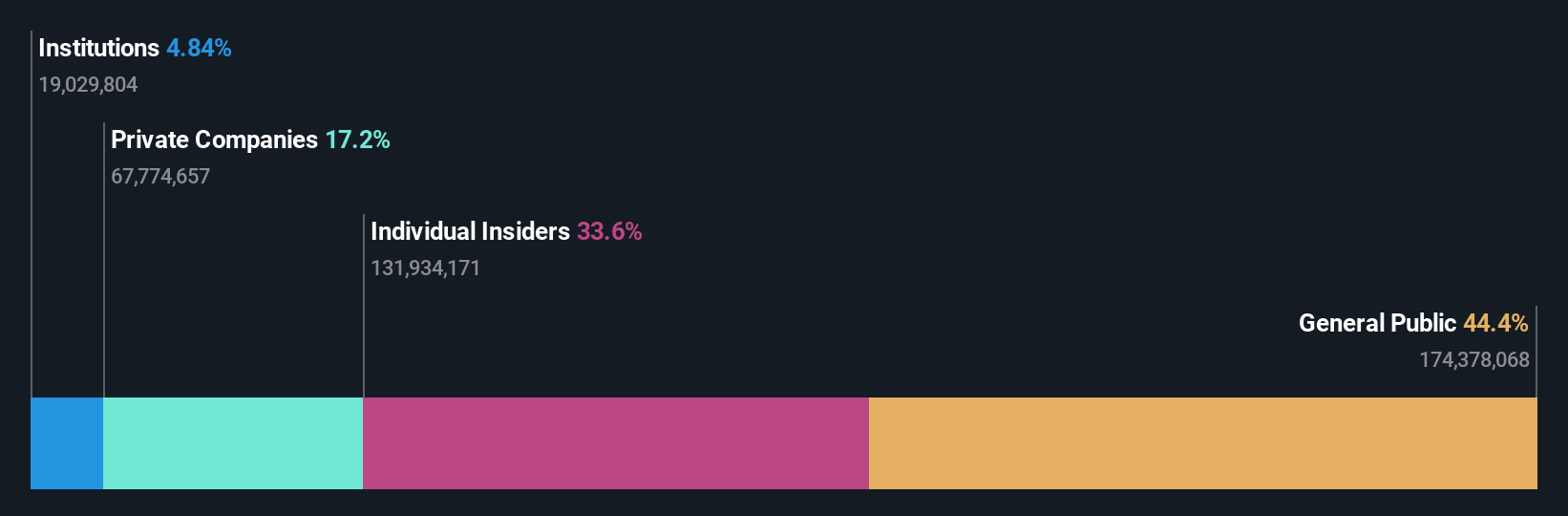

Insider Ownership: 21.1%

Hubei Huitian New Materials anticipates robust earnings growth of 29.8% annually, surpassing the Chinese market average of 25%. Despite trading at a significant discount to its estimated fair value, profit margins have decreased from 8.4% to 4.3%, impacted by large one-off items. Recent board changes include the election of non-employee supervisors through a cumulative voting system, reflecting active governance adjustments amidst its growth trajectory.

- Navigate through the intricacies of Hubei Huitian New Materials with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Hubei Huitian New Materials is trading behind its estimated value.

Make It Happen

- Delve into our full catalog of 1476 Fast Growing Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Huitian New Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300041

Hubei Huitian New Materials

Researches, develops, manufactures, and sells adhesives and new materials under the Weeton, Sappolo, and Huitian brands in China and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives