- China

- /

- Tech Hardware

- /

- SHSE:688036

Global Market's Trio Of Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating interest rates and mixed economic signals, investors are increasingly focused on identifying opportunities that may be undervalued in the current environment. In this context, a good stock is often characterized by strong fundamentals and potential for growth, even when broader market conditions appear uncertain.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.74 | SEK86.65 | 49.5% |

| Tofas Türk Otomobil Fabrikasi Anonim Sirketi (IBSE:TOASO) | TRY222.70 | TRY442.33 | 49.7% |

| Takara Bio (TSE:4974) | ¥922.00 | ¥1829.46 | 49.6% |

| Norconsult (OB:NORCO) | NOK46.10 | NOK92.05 | 49.9% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.24 | CN¥28.36 | 49.8% |

| MilDef Group (OM:MILDEF) | SEK165.40 | SEK329.01 | 49.7% |

| Kuraray (TSE:3405) | ¥1802.50 | ¥3550.47 | 49.2% |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$530.47 | MX$1056.54 | 49.8% |

| AprilBioLtd (KOSDAQ:A397030) | ₩25200.00 | ₩49763.01 | 49.4% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥48.96 | CN¥97.19 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

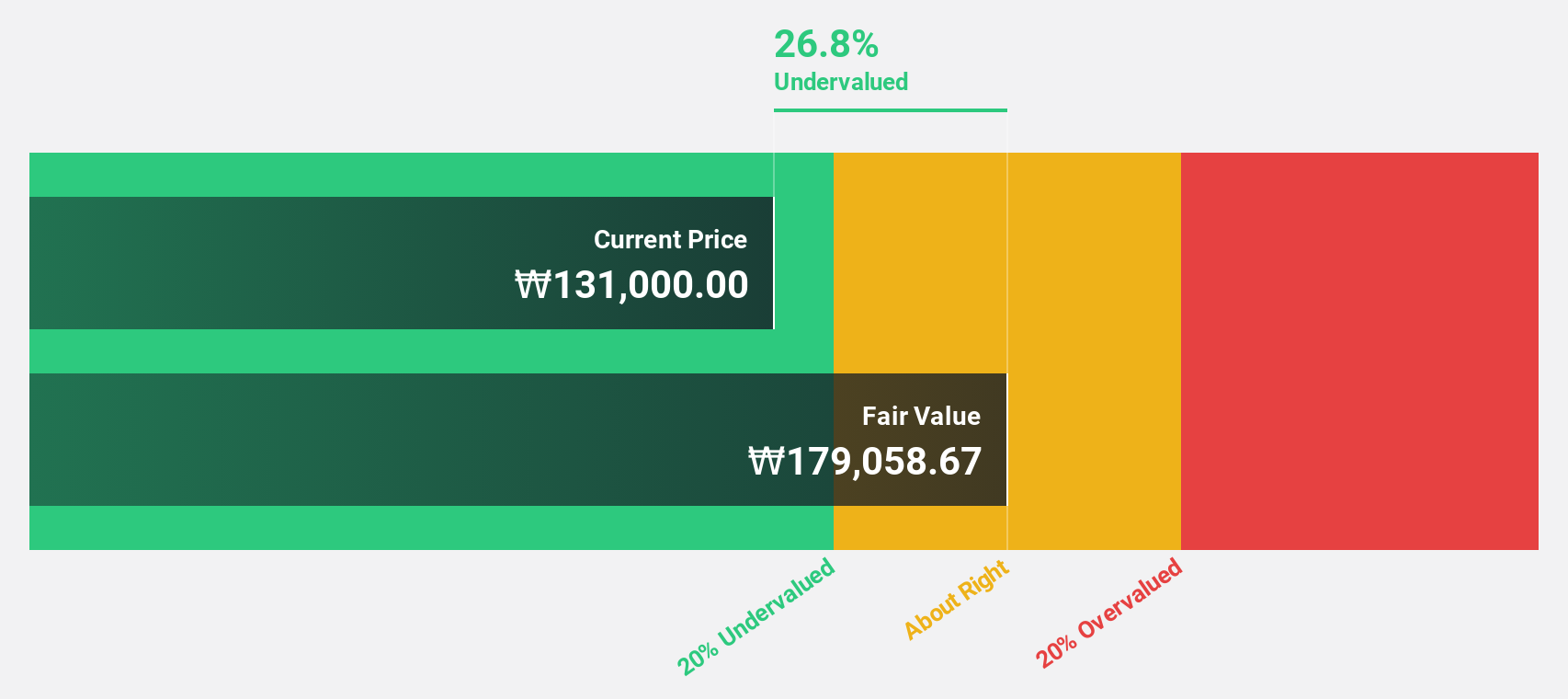

APR (KOSE:A278470)

Overview: APR Co., Ltd. is a company that manufactures and sells cosmetic products for both men and women, with a market capitalization of ₩8.35 billion.

Operations: The company's revenue segments include Cosmetics generating ₩1.25 billion, Coordination at -₩285.69 million, and Apparel Fashion contributing ₩43.61 million.

Estimated Discount To Fair Value: 25.5%

APR Co., Ltd. is currently trading at ₩230,500, significantly below its estimated fair value of ₩309,314.13. Despite recent share price volatility, the company shows strong cash flow potential with earnings growth of 93.7% over the past year and an expected annual profit growth rate of 33.7%, outpacing the Korean market average. However, its dividend yield of 3.12% isn't well covered by free cash flows, which may concern some investors seeking income stability.

- Upon reviewing our latest growth report, APR's projected financial performance appears quite optimistic.

- Get an in-depth perspective on APR's balance sheet by reading our health report here.

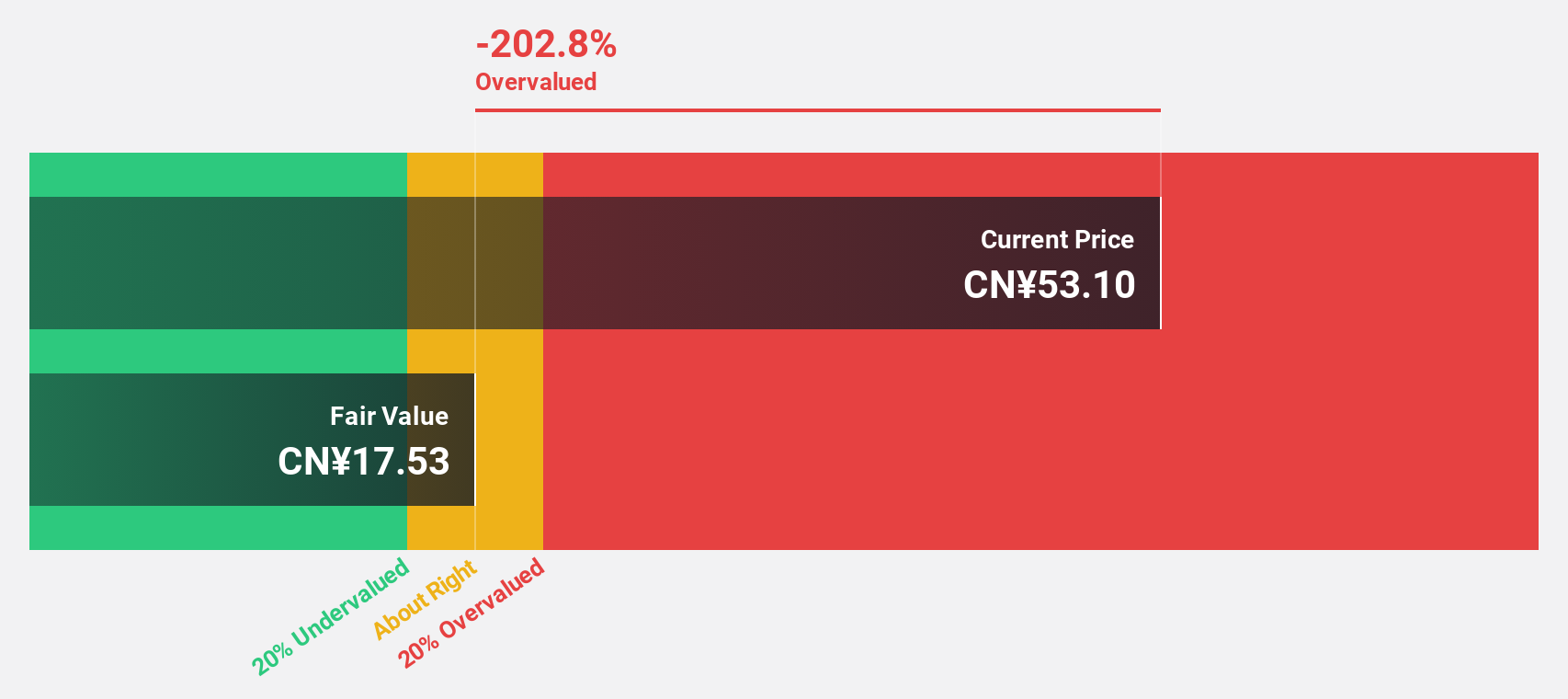

Shenzhen Transsion Holdings (SHSE:688036)

Overview: Shenzhen Transsion Holdings Co., Ltd. and its subsidiaries offer smart devices and mobile services across Africa, South and Southeast Asia, the Middle East, Latin America, and other international markets with a market cap of CN¥100.77 billion.

Operations: Shenzhen Transsion Holdings generates revenue through its provision of smart devices and mobile services across various regions including Africa, South and Southeast Asia, the Middle East, Latin America, and other international markets.

Estimated Discount To Fair Value: 14.7%

Shenzhen Transsion Holdings is trading at CN¥95, below its estimated fair value of CN¥111.35, suggesting it may be undervalued based on cash flows. The company reported a decline in net income to CNY 1.21 billion for H1 2025 from CNY 2.85 billion the previous year but forecasts show earnings growth of 28.8% annually, surpassing the Chinese market average of 26.2%. However, its dividend track record remains unstable and recent share price declines reflect market challenges.

- Our comprehensive growth report raises the possibility that Shenzhen Transsion Holdings is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Shenzhen Transsion Holdings' balance sheet health report.

Shenzhen Capchem Technology (SZSE:300037)

Overview: Shenzhen Capchem Technology Co., Ltd. engages in the research, development, production, sale, and servicing of electronic chemicals and functional materials globally with a market cap of CN¥37.27 billion.

Operations: The company's revenue segments include electronic chemicals and functional materials, which are developed, produced, sold, and serviced both domestically and internationally.

Estimated Discount To Fair Value: 26.9%

Shenzhen Capchem Technology is trading at CN¥48.63, below its fair value estimate of CN¥66.56, reflecting potential undervaluation based on cash flows. Recent earnings showed a rise in net income to CNY 483.84 million for H1 2025 from CNY 415.8 million the previous year, with revenue growing faster than the market average at 19.6% annually. However, its return on equity remains low and dividend stability is uncertain despite significant projected earnings growth of over 20% annually.

- According our earnings growth report, there's an indication that Shenzhen Capchem Technology might be ready to expand.

- Take a closer look at Shenzhen Capchem Technology's balance sheet health here in our report.

Seize The Opportunity

- Access the full spectrum of 525 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688036

Shenzhen Transsion Holdings

Provides smart devices and mobile services in Africa, South and Southeast Asia, the Middle East, Latin America, and internationally.

Very undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives