As global markets navigate the uncertainties surrounding the Trump 2.0 administration and fluctuating economic indicators, small-cap stocks have experienced a mixed performance, with indices like the Russell 2000 reflecting this volatility. Amidst these broader market dynamics, identifying promising opportunities in lesser-known stocks can be a strategic move for investors seeking potential growth in an evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Marie Brizard Wine & Spirits (ENXTPA:MBWS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marie Brizard Wine & Spirits SA is involved in the production, marketing, and sale of wines and spirits across various regions including France, Europe, Africa, the Americas, and the Asia Pacific with a market capitalization of €437.47 million.

Operations: MBWS generates revenue primarily from France (€83.80 million) and international markets (€106.60 million).

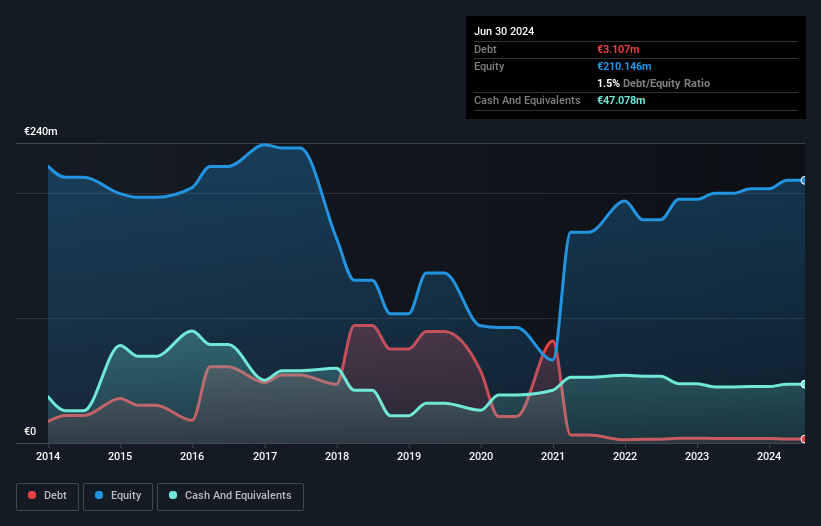

Marie Brizard Wine & Spirits has shown a remarkable earnings growth of 517% in the past year, significantly outpacing the beverage industry's -31.5%. This performance is partly attributed to a substantial one-off gain of €3 million, which influenced its financial results up to June 2024. Over five years, the company's debt-to-equity ratio impressively dropped from 66% to just 1.5%, indicating strong financial management. Despite sales dipping slightly from €116.96 million to €115.18 million for the half-year ending June 2024, net income rose from €5.1 million to €6.52 million, reflecting improved profitability amidst industry challenges.

Elite Color Environmental Resources Science & Technology (SZSE:002998)

Simply Wall St Value Rating: ★★★★★☆

Overview: Elite Color Environmental Resources Science & Technology Co., Ltd. operates in the environmental resources industry with a market capitalization of CN¥2.19 billion.

Operations: Financial data for Elite Color Environmental Resources Science & Technology is not available in the provided text, so a detailed summary of revenue streams and cost breakdowns cannot be provided.

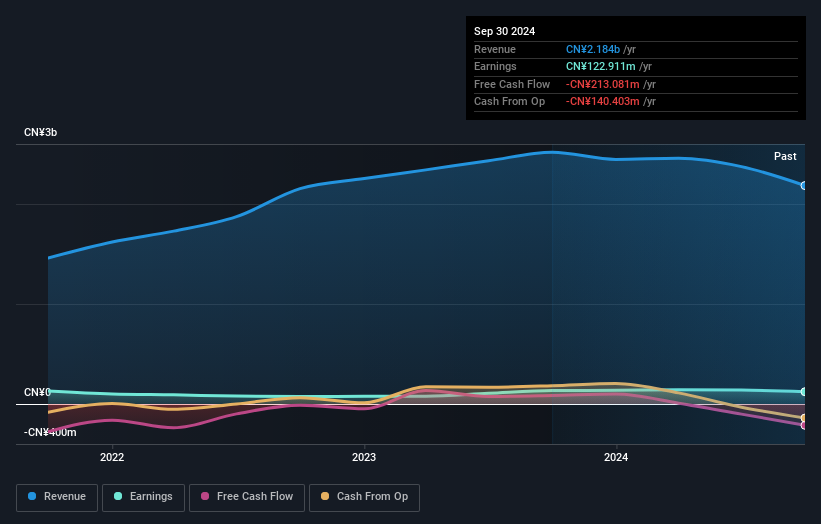

Elite Color Environmental Resources Science & Technology, a smaller player in the industry, has shown some resilience amid challenges. Over the past five years, its debt to equity ratio improved from 38% to 31%, indicating better financial management. Despite negative earnings growth of -8.8% against an industry average of -5.3%, its price-to-earnings ratio stands attractively at 17.8x compared to the broader CN market's 35.3x, suggesting potential undervaluation. Recent sales figures for nine months ended September show CNY 1,614 million with net income at CNY 97 million, down from last year's CNY 111 million, reflecting ongoing market pressures yet steady operations overall.

- Take a closer look at Elite Color Environmental Resources Science & Technology's potential here in our health report.

Learn about Elite Color Environmental Resources Science & Technology's historical performance.

TSI HoldingsLtd (TSE:3608)

Simply Wall St Value Rating: ★★★★★★

Overview: TSI Holdings Co., Ltd. is involved in the planning, manufacture, and sale of clothing both in Japan and internationally, with a market cap of ¥62.57 billion.

Operations: TSI Holdings generates revenue through the planning, manufacture, and sale of clothing in Japan and internationally. The company's market cap is ¥62.57 billion.

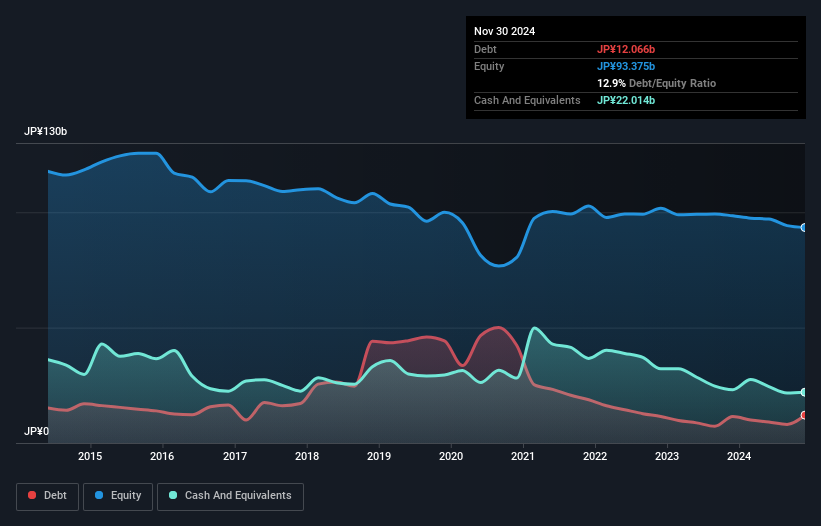

TSI Holdings, a promising player in the luxury sector, has demonstrated a notable reduction in its debt-to-equity ratio from 47.8% to 8.6% over five years, indicating improved financial health. The company is trading at approximately 39.3% below its estimated fair value, presenting potential investment appeal. Despite recent volatility in share price and earnings growth of 13.1%, which trails the industry average of 16.7%, TSI's strategic buyback program aims to repurchase up to ¥3 billion worth of shares by March 2025, reflecting confidence in future prospects and commitment to shareholder returns amidst ongoing structural reforms and cost control efforts.

- Click to explore a detailed breakdown of our findings in TSI HoldingsLtd's health report.

Review our historical performance report to gain insights into TSI HoldingsLtd's's past performance.

Seize The Opportunity

- Discover the full array of 4639 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSI HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3608

TSI HoldingsLtd

Engages in the planning, manufacture, and sale of clothing in Japan and internationally.

Flawless balance sheet with moderate growth potential.