Zhejiang Zhongxin Fluoride Materials Co.,Ltd's (SZSE:002915) 26% Jump Shows Its Popularity With Investors

Zhejiang Zhongxin Fluoride Materials Co.,Ltd (SZSE:002915) shares have continued their recent momentum with a 26% gain in the last month alone. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

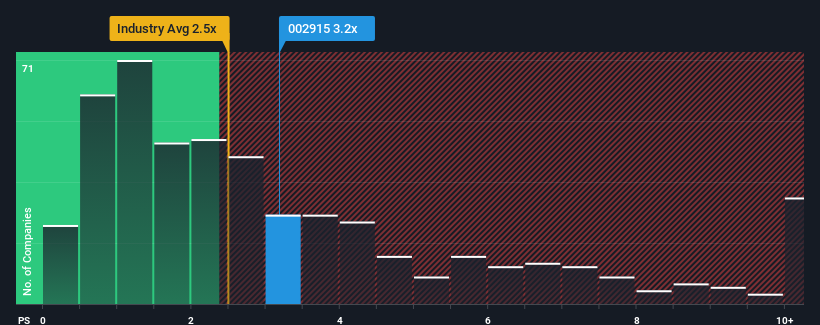

After such a large jump in price, you could be forgiven for thinking Zhejiang Zhongxin Fluoride MaterialsLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Zhejiang Zhongxin Fluoride MaterialsLtd

How Zhejiang Zhongxin Fluoride MaterialsLtd Has Been Performing

Zhejiang Zhongxin Fluoride MaterialsLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Zhongxin Fluoride MaterialsLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Zhejiang Zhongxin Fluoride MaterialsLtd would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.2% last year. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 63% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Zhejiang Zhongxin Fluoride MaterialsLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Zhejiang Zhongxin Fluoride MaterialsLtd's P/S Mean For Investors?

Zhejiang Zhongxin Fluoride MaterialsLtd's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Zhejiang Zhongxin Fluoride MaterialsLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Zhejiang Zhongxin Fluoride MaterialsLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhongxin Fluoride MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002915

Zhejiang Zhongxin Fluoride MaterialsLtd

Engages in the research and development, production, and sale of fluorine-based fine chemicals in China.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives