As global markets navigate a challenging landscape marked by concerns over AI valuations and economic uncertainties, Asian markets have shown resilience, with China's indices experiencing gains amid easing trade tensions. In this context, growth companies with high insider ownership can offer unique insights into potential opportunities, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

We'll examine a selection from our screener results.

China XLX Fertiliser (SEHK:1866)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China XLX Fertiliser Ltd. is an investment holding company focused on the development, manufacture, and sale of urea in Mainland China and internationally, with a market cap of HK$11.37 billion.

Operations: The company's revenue is derived from several segments, including CN¥8.45 billion from urea, CN¥7.02 billion from compound fertiliser, CN¥5.98 billion from methanol, CN¥1.19 billion from DMF, and CN¥928.22 million from melamine sales.

Insider Ownership: 17.6%

China XLX Fertiliser exhibits strong insider ownership, with recent buyback transactions potentially enhancing earnings per share. The company trades at a favorable price-to-earnings ratio of 7.6x compared to the Hong Kong market average of 12.6x, despite a slower revenue growth forecast of 14.6% annually. Earnings are expected to grow significantly at 27.1% per year, outpacing the market's growth rate, although debt coverage by operating cash flow remains a concern.

- Navigate through the intricacies of China XLX Fertiliser with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that China XLX Fertiliser's current price could be quite moderate.

Zhejiang Zhongxin Fluoride MaterialsLtd (SZSE:002915)

Simply Wall St Growth Rating: ★★★★☆☆

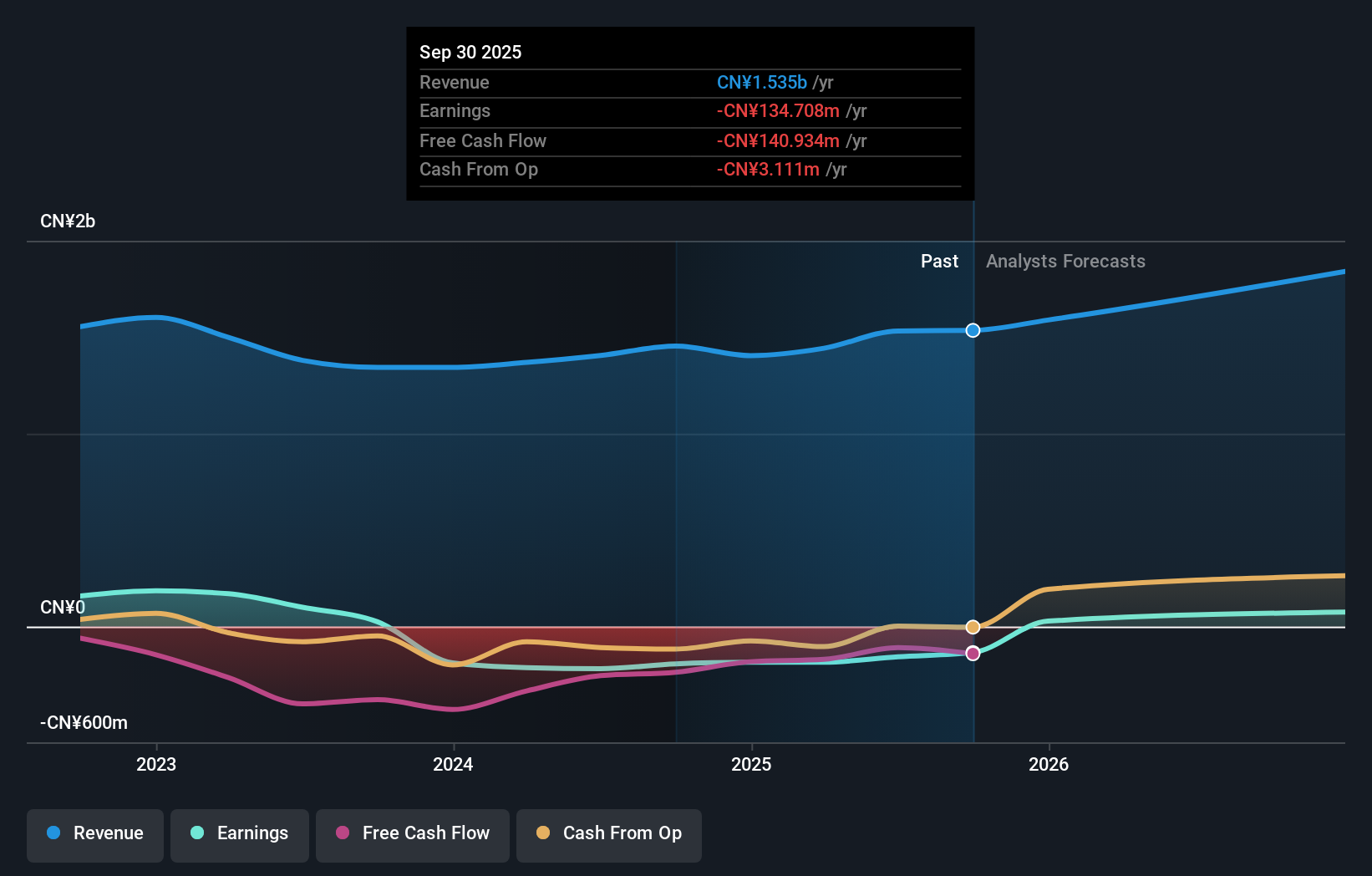

Overview: Zhejiang Zhongxin Fluoride Materials Co., Ltd specializes in the R&D, production, and sale of fluorine-based fine chemicals in China with a market cap of CN¥8.83 billion.

Operations: The company generates revenue from the research, development, production, and sale of fluorine-based fine chemicals in China.

Insider Ownership: 19.2%

Zhejiang Zhongxin Fluoride Materials shows significant insider ownership, aligning with its anticipated profitability within three years. Despite a volatile share price and revenue growth forecasted at 14.9% annually—slightly surpassing the Chinese market—the company reported improved financials, transitioning from a net loss to CNY 7.82 million in net income for the first nine months of 2025. However, debt coverage by operating cash flow remains insufficient, necessitating cautious financial management going forward.

- Take a closer look at Zhejiang Zhongxin Fluoride MaterialsLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Zhejiang Zhongxin Fluoride MaterialsLtd's shares may be trading at a premium.

Wens Foodstuff Group (SZSE:300498)

Simply Wall St Growth Rating: ★★★★☆☆

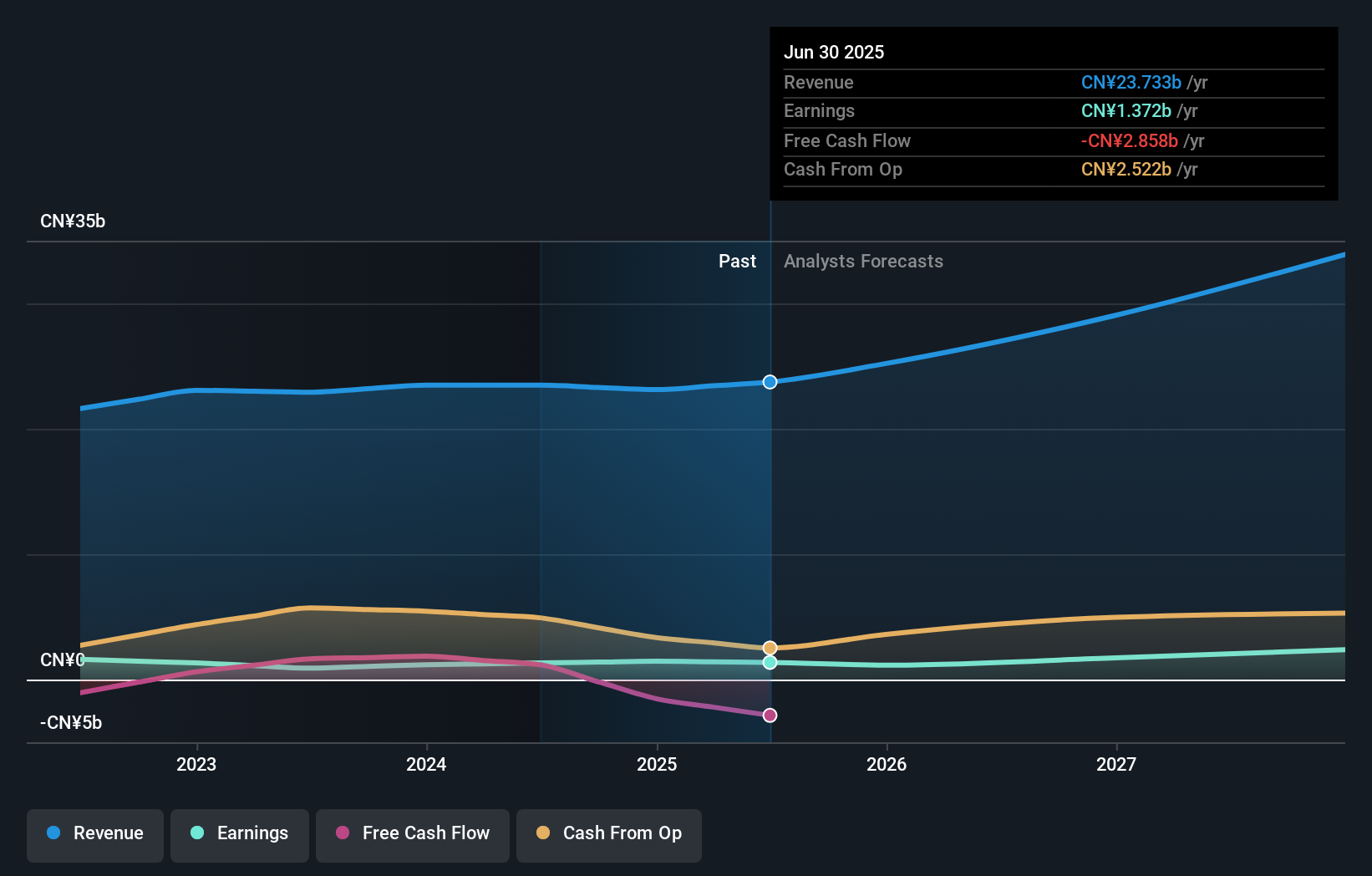

Overview: Wens Foodstuff Group Co., Ltd. is an agricultural and animal husbandry company in China with a market cap of CN¥121.77 billion.

Operations: Wens Foodstuff Group Co., Ltd. generates its revenue from agricultural and animal husbandry operations in China.

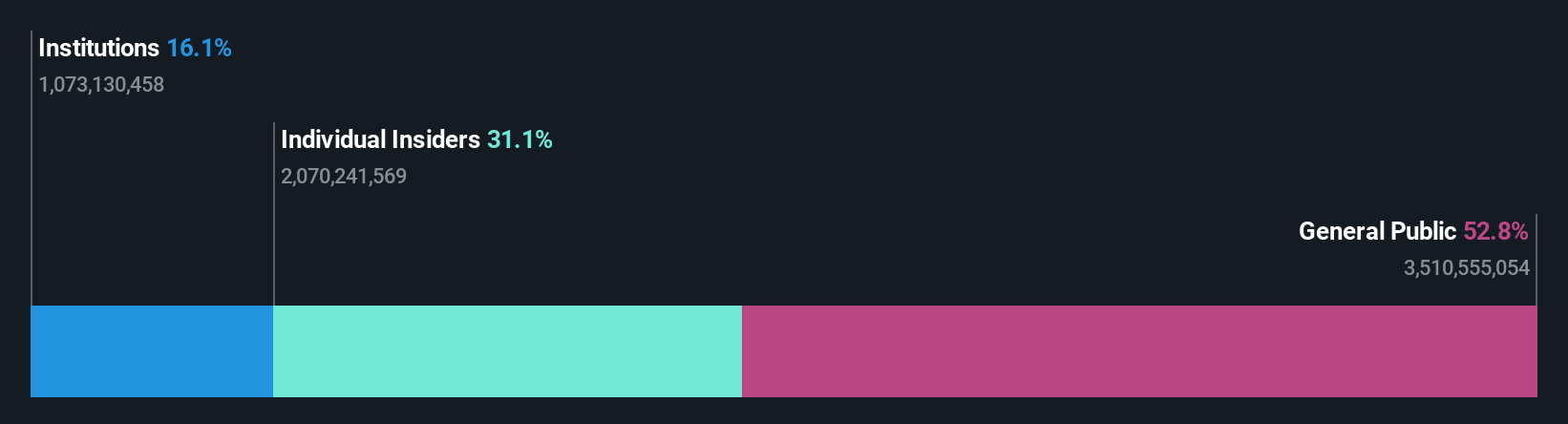

Insider Ownership: 31.1%

Wens Foodstuff Group's substantial insider ownership aligns with its robust earnings growth forecast of 31.73% annually over the next three years, surpassing the Chinese market average. The company trades at a favorable P/E ratio of 15.1x compared to the market's 45x, indicating good relative value. Despite an unstable dividend track record, recent earnings show a decline in net income to CNY 5.26 billion for nine months ending September 2025, suggesting potential challenges amidst growth prospects.

- Click to explore a detailed breakdown of our findings in Wens Foodstuff Group's earnings growth report.

- Our valuation report unveils the possibility Wens Foodstuff Group's shares may be trading at a discount.

Where To Now?

- Reveal the 625 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhongxin Fluoride MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002915

Zhejiang Zhongxin Fluoride MaterialsLtd

Engages in the research and development, production, and sale of fluorine-based fine chemicals in China.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives