- China

- /

- Metals and Mining

- /

- SZSE:002842

Further weakness as Guangdong Xianglu Tungsten (SZSE:002842) drops 19% this week, taking five-year losses to 67%

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example the Guangdong Xianglu Tungsten Co., Ltd. (SZSE:002842) share price dropped 68% over five years. We certainly feel for shareholders who bought near the top. And it's not just long term holders hurting, because the stock is down 33% in the last year. The last week also saw the share price slip down another 19%.

If the past week is anything to go by, investor sentiment for Guangdong Xianglu Tungsten isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Guangdong Xianglu Tungsten

Because Guangdong Xianglu Tungsten made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last half decade, Guangdong Xianglu Tungsten saw its revenue increase by 4.1% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 11% per year, in that time. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

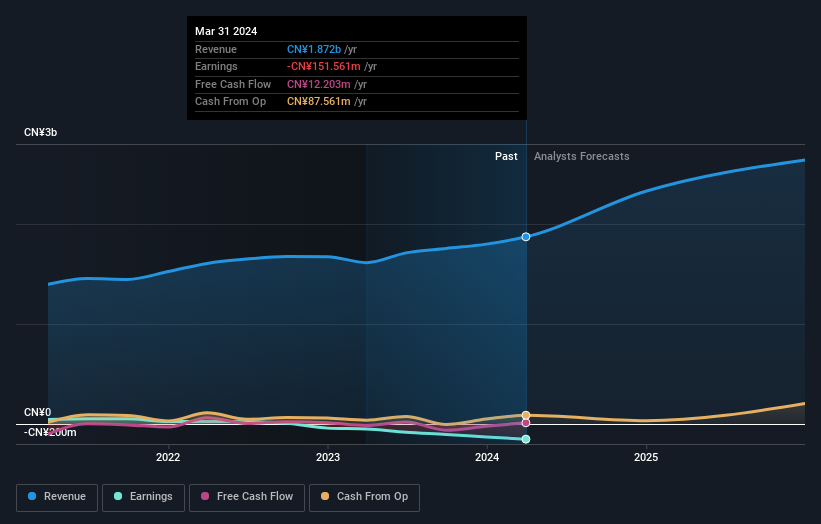

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Guangdong Xianglu Tungsten will earn in the future (free profit forecasts).

A Different Perspective

We regret to report that Guangdong Xianglu Tungsten shareholders are down 33% for the year. Unfortunately, that's worse than the broader market decline of 9.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Guangdong Xianglu Tungsten has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002842

Guangdong Xianglu Tungsten

Develops, produces, and sells tungsten products in China.

Low and slightly overvalued.