- China

- /

- Semiconductors

- /

- SHSE:688599

Top Asian Growth Stocks With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As global markets respond to shifting monetary policies and geopolitical developments, Asia's stock markets have been navigating a complex landscape marked by trade negotiations and economic reforms. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities, as they often reflect strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19% | 84.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's dive into some prime choices out of the screener.

Trina Solar (SHSE:688599)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trina Solar Co., Ltd. is involved in the research, development, production, and sales of photovoltaic modules across various global markets including China, Europe, the Americas, and more; it has a market cap of CN¥44.01 billion.

Operations: Trina Solar generates revenue through its activities in the research, development, production, and sales of photovoltaic modules across diverse international markets such as China, Europe, the Americas, Japan, the Asia Pacific region, the Middle East, and Africa.

Insider Ownership: 33.3%

Trina Solar, despite recent financial setbacks with a net loss of CNY 4.20 billion for the nine months ending September 2025, remains a potential growth entity due to its forecasted annual profit growth surpassing market averages. The company is expected to achieve profitability within three years and anticipates revenue growth of 15.7% annually, outpacing the broader Chinese market's projected rate. Notably, Trina Solar has been active in share buybacks but lacks recent insider trading activity.

- Navigate through the intricacies of Trina Solar with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Trina Solar implies its share price may be lower than expected.

Yunnan Energy New Material (SZSE:002812)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yunnan Energy New Material Co., Ltd. and its subsidiaries offer film products both in China and internationally, with a market cap of CN¥46.69 billion.

Operations: Yunnan Energy New Material Co., Ltd. generates its revenue primarily through the provision of film products across domestic and international markets.

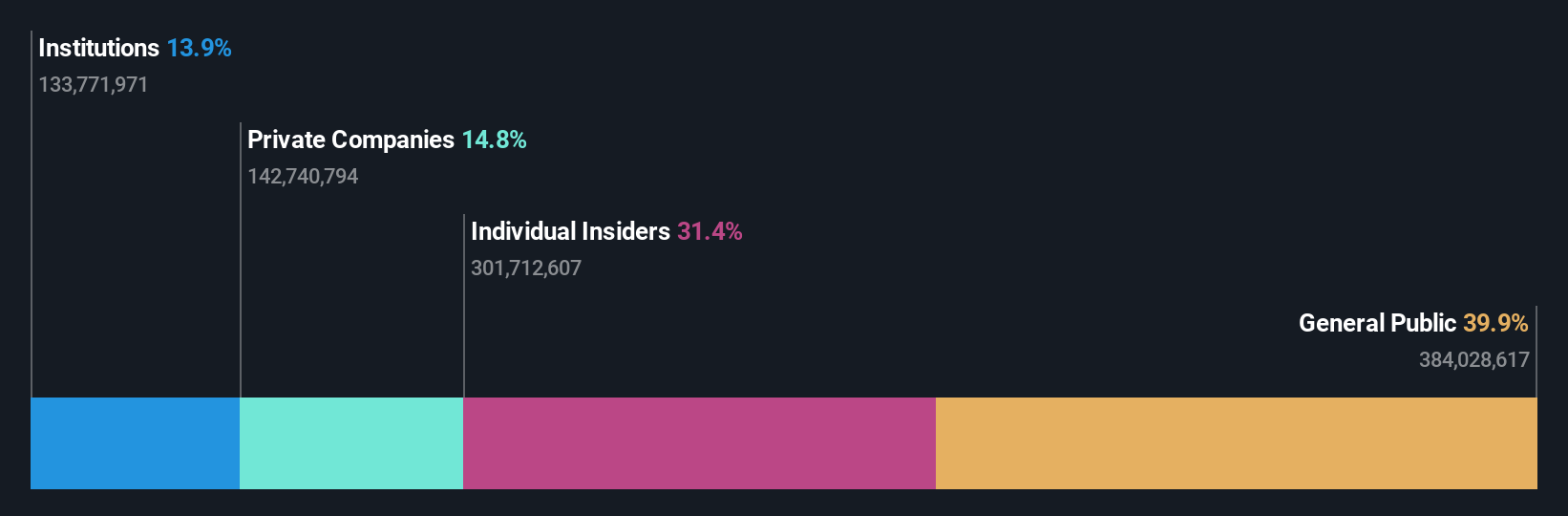

Insider Ownership: 31.4%

Yunnan Energy New Material faces challenges with a net loss of CNY 86.32 million for the nine months ending September 2025, despite increasing sales to CNY 9.54 billion from CNY 7.46 billion year-on-year. The company is forecasted to become profitable in three years, with earnings expected to grow significantly annually, surpassing market averages. However, its return on equity is projected to remain low at 4.6%, and revenue growth will be slower than desired but still above the Chinese market average.

- Get an in-depth perspective on Yunnan Energy New Material's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Yunnan Energy New Material's share price might be on the cheaper side.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★★

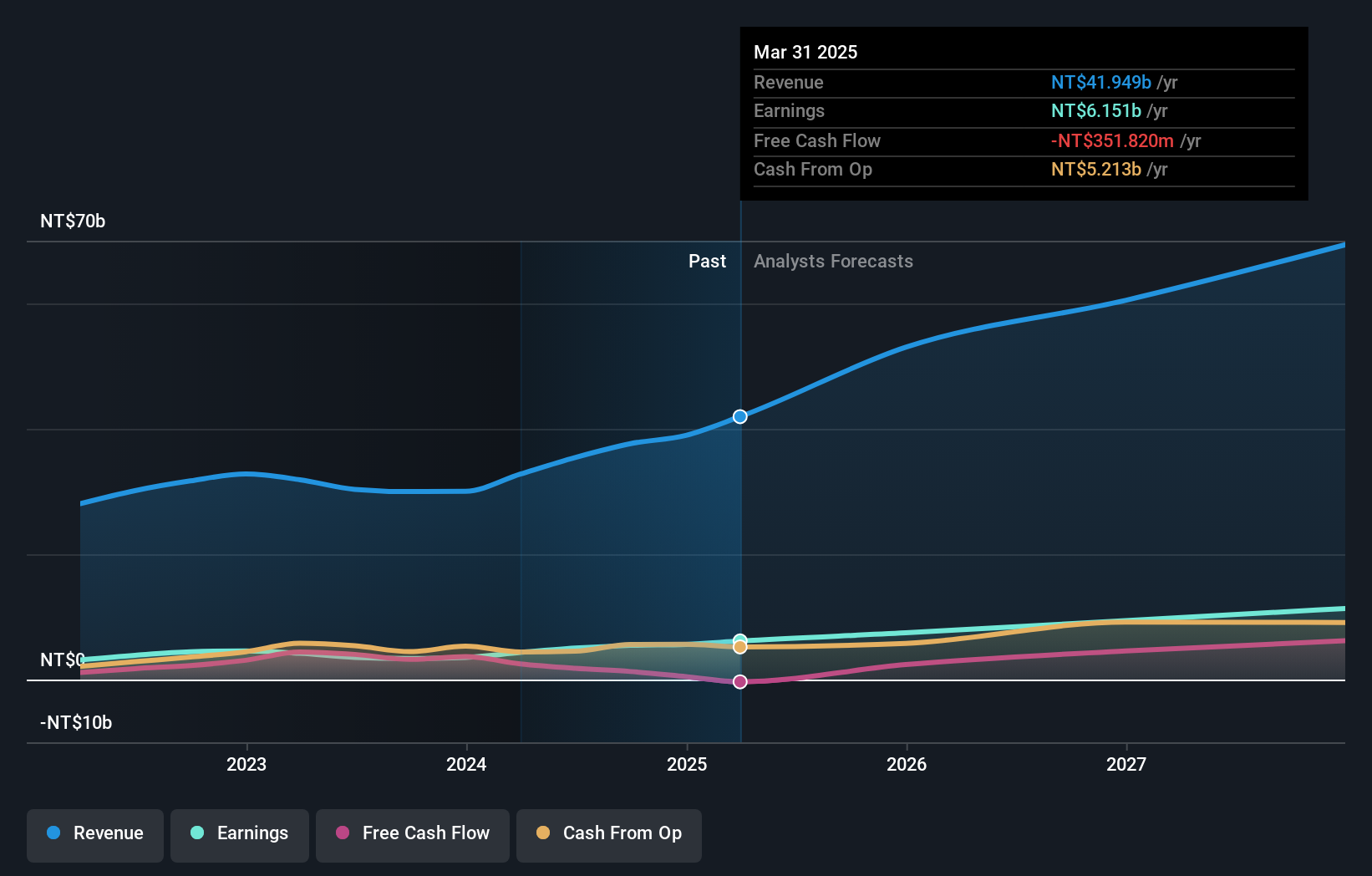

Overview: Gold Circuit Electronics Ltd. is a Taiwan-based company involved in the design, manufacturing, processing, and distribution of printed circuit boards, with a market cap of NT$226.55 billion.

Operations: The company's revenue primarily comes from the manufacturing and sales of printed circuit boards, totaling NT$46.23 billion.

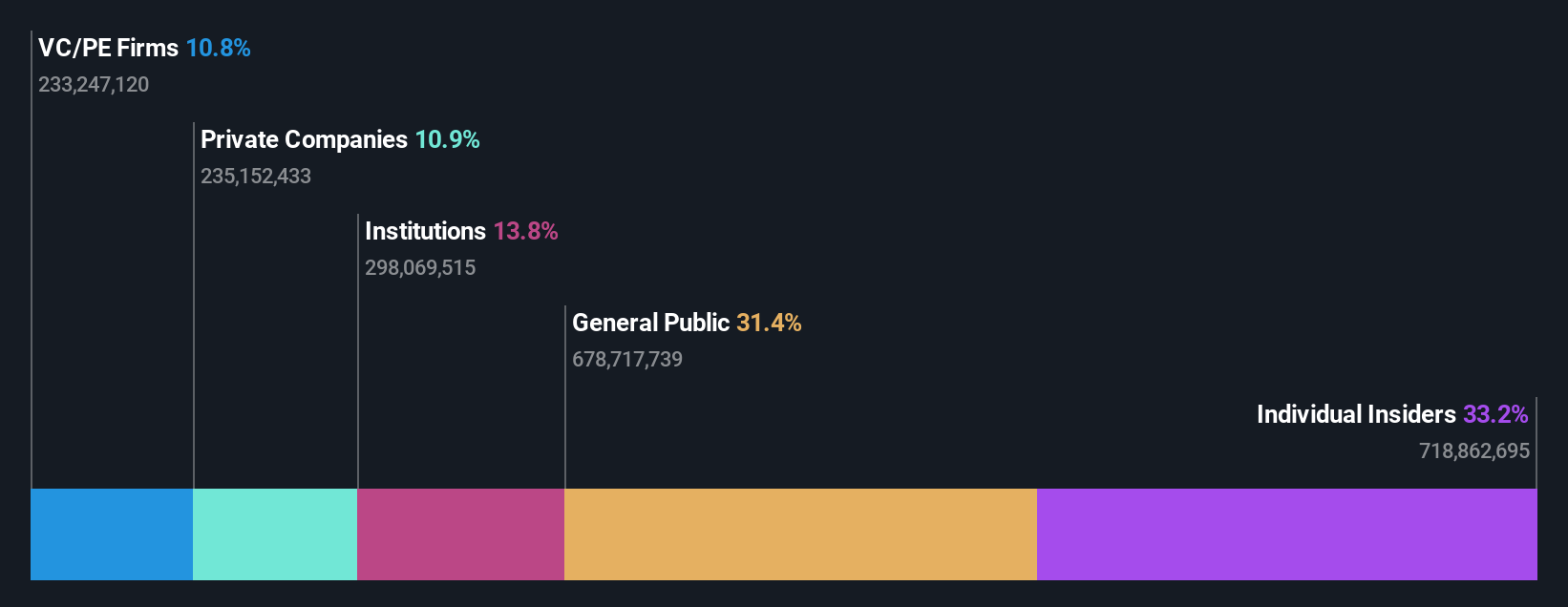

Insider Ownership: 31.4%

Gold Circuit Electronics has demonstrated strong financial performance, with recent earnings showing significant growth. For the second quarter of 2025, net income increased to TWD 1.69 billion from TWD 1.52 billion year-on-year, while revenue rose to TWD 13.85 billion from TWD 9.57 billion. The company was recently added to the FTSE All-World Index and is expected to achieve high annual profit and revenue growth rates exceeding market averages, driven by robust forecasts for earnings and return on equity improvements over three years.

- Click here to discover the nuances of Gold Circuit Electronics with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Gold Circuit Electronics is trading beyond its estimated value.

Turning Ideas Into Actions

- Gain an insight into the universe of 627 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Trina Solar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688599

Trina Solar

Engages in the research and development, production, and sales of photovoltaic (PV) modules in China, Europe, North and Latin America, the United States, Japan, the Asia Pacific, the Middle East, and Africa.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives