Stock Analysis

Earnings are growing at Shenzhen Prince New MaterialsLtd (SZSE:002735) but shareholders still don't like its prospects

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Shenzhen Prince New Materials Co.,Ltd. (SZSE:002735) share price slid 30% over twelve months. That falls noticeably short of the market decline of around 16%. However, the longer term returns haven't been so bad, with the stock down 19% in the last three years. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

If the past week is anything to go by, investor sentiment for Shenzhen Prince New MaterialsLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Shenzhen Prince New MaterialsLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Shenzhen Prince New MaterialsLtd share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

Given the yield is quite low, at 0.5%, we doubt the dividend can shed much light on the share price. Revenue was pretty flat on last year, which isn't too bad. But the share price might be lower because the market expected a meaningful improvement, and got none.

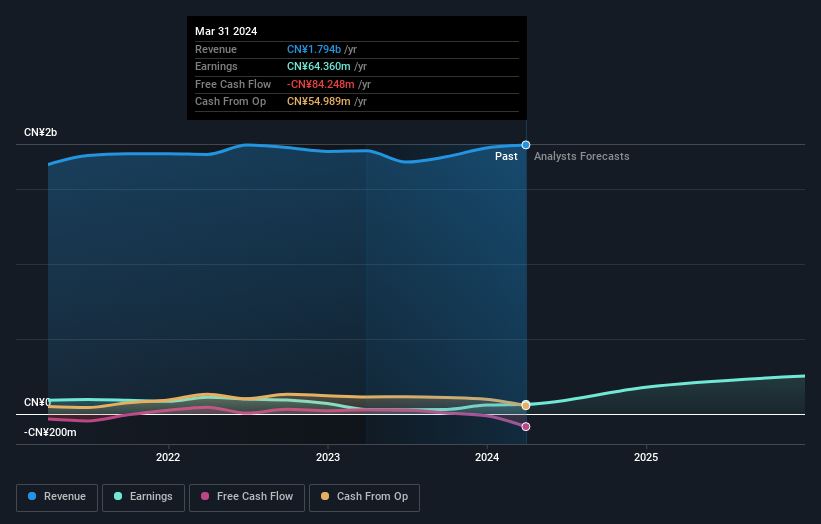

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Shenzhen Prince New MaterialsLtd has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market lost about 16% in the twelve months, Shenzhen Prince New MaterialsLtd shareholders did even worse, losing 30% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Shenzhen Prince New MaterialsLtd (1 is significant!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Shenzhen Prince New MaterialsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shenzhen Prince New MaterialsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002735

Shenzhen Prince New MaterialsLtd

Produces and sells packaging materials in China.

Flawless balance sheet with proven track record.