Guangdong Sunwill Precising Plastic Co.,Ltd (SZSE:002676) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Guangdong Sunwill Precising Plastic Co.,Ltd (SZSE:002676) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

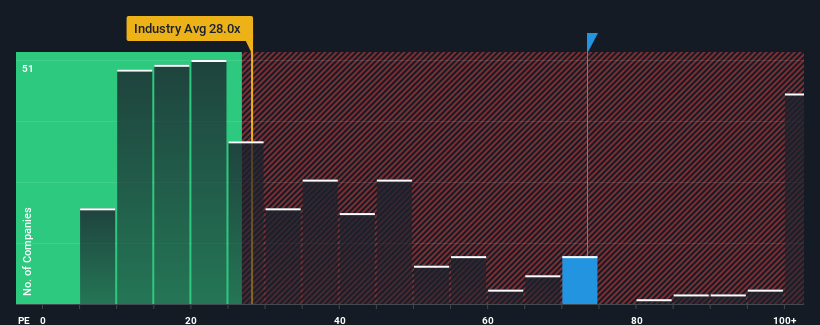

Since its price has surged higher, Guangdong Sunwill Precising PlasticLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 73.3x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Guangdong Sunwill Precising PlasticLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Guangdong Sunwill Precising PlasticLtd

Is There Enough Growth For Guangdong Sunwill Precising PlasticLtd?

The only time you'd be truly comfortable seeing a P/E as steep as Guangdong Sunwill Precising PlasticLtd's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 64% gain to the company's bottom line. The latest three year period has also seen an excellent 43% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's alarming that Guangdong Sunwill Precising PlasticLtd's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Guangdong Sunwill Precising PlasticLtd's P/E

The strong share price surge has got Guangdong Sunwill Precising PlasticLtd's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Guangdong Sunwill Precising PlasticLtd currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 1 warning sign for Guangdong Sunwill Precising PlasticLtd that we have uncovered.

If you're unsure about the strength of Guangdong Sunwill Precising PlasticLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002676

Guangdong Sunwill Precising PlasticLtd

Researches and develops air conditioner blades and molding compound integrated solutions in China.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives