We Think That There Are Some Issues For Guangdong Delian Group (SZSE:002666) Beyond Its Promising Earnings

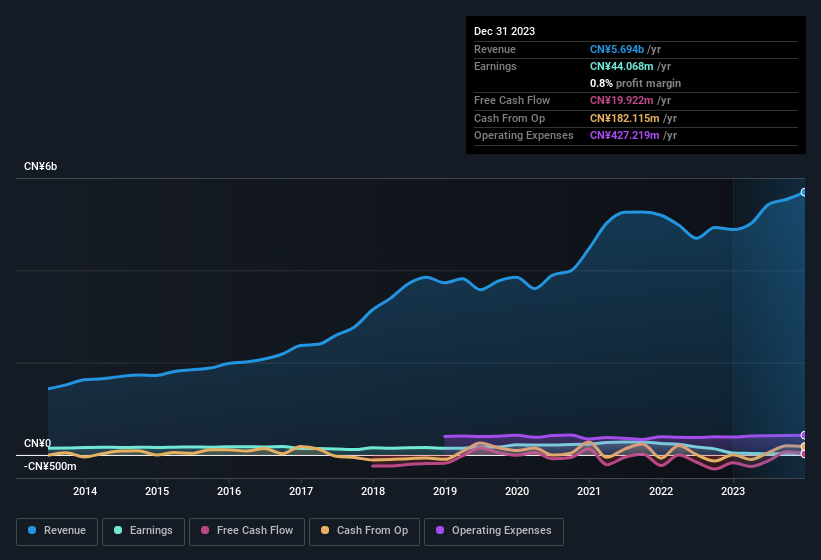

Guangdong Delian Group Co., Ltd.'s (SZSE:002666) healthy profit numbers didn't contain any surprises for investors. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

Check out our latest analysis for Guangdong Delian Group

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Guangdong Delian Group's profit received a boost of CN¥26m in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. We can see that Guangdong Delian Group's positive unusual items were quite significant relative to its profit in the year to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Guangdong Delian Group.

Our Take On Guangdong Delian Group's Profit Performance

As we discussed above, we think the significant positive unusual item makes Guangdong Delian Group's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Guangdong Delian Group's underlying earnings power is lower than its statutory profit. In further bad news, its earnings per share decreased in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So while earnings quality is important, it's equally important to consider the risks facing Guangdong Delian Group at this point in time. Case in point: We've spotted 3 warning signs for Guangdong Delian Group you should be mindful of and 2 of them don't sit too well with us.

This note has only looked at a single factor that sheds light on the nature of Guangdong Delian Group's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002666

Guangdong Delian Group

Engages in the automobile fine chemicals, automobile sales service, and automobile repair and maintenance businesses, and development of new application scenarios in China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026