- China

- /

- Metals and Mining

- /

- SZSE:002552

Further Upside For Baoding Technology Co., Ltd. (SZSE:002552) Shares Could Introduce Price Risks After 26% Bounce

Baoding Technology Co., Ltd. (SZSE:002552) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

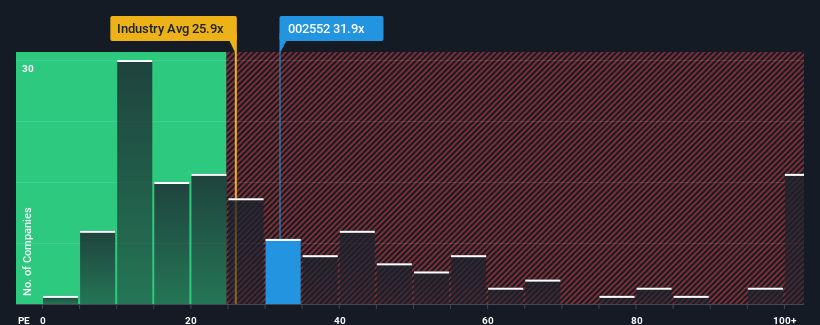

Although its price has surged higher, it's still not a stretch to say that Baoding Technology's price-to-earnings (or "P/E") ratio of 31.9x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 33x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Baoding Technology has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Baoding Technology

How Is Baoding Technology's Growth Trending?

In order to justify its P/E ratio, Baoding Technology would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. Pleasingly, EPS has also lifted 202% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Baoding Technology's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Its shares have lifted substantially and now Baoding Technology's P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Baoding Technology currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Baoding Technology that you should be aware of.

If you're unsure about the strength of Baoding Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Baoding Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002552

Baoding Technology

Engages in the non-ferrous metal mining and selection, and the research, development, production, and sales of electronic copper foil and copper clad laminate products in China.

Average dividend payer with low risk.

Market Insights

Community Narratives