- China

- /

- Metals and Mining

- /

- SZSE:002547

What Suzhou Chunxing Precision Mechanical Co., Ltd.'s (SZSE:002547) 35% Share Price Gain Is Not Telling You

Those holding Suzhou Chunxing Precision Mechanical Co., Ltd. (SZSE:002547) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

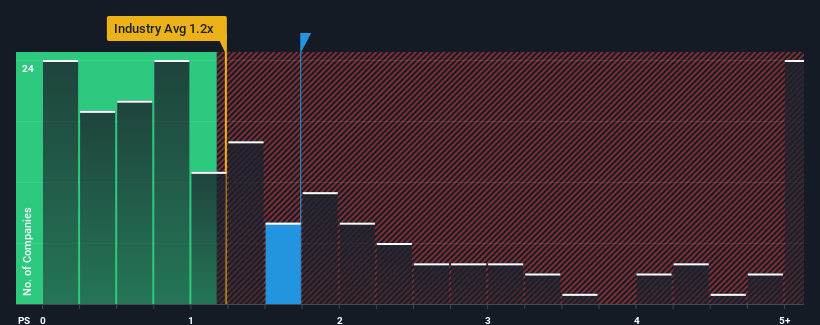

After such a large jump in price, given close to half the companies operating in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Suzhou Chunxing Precision Mechanical as a stock to potentially avoid with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Suzhou Chunxing Precision Mechanical

How Suzhou Chunxing Precision Mechanical Has Been Performing

The recent revenue growth at Suzhou Chunxing Precision Mechanical would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Suzhou Chunxing Precision Mechanical's earnings, revenue and cash flow.How Is Suzhou Chunxing Precision Mechanical's Revenue Growth Trending?

Suzhou Chunxing Precision Mechanical's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.8% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 59% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 15% shows it's an unpleasant look.

With this in mind, we find it worrying that Suzhou Chunxing Precision Mechanical's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in Suzhou Chunxing Precision Mechanical's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Suzhou Chunxing Precision Mechanical currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Suzhou Chunxing Precision Mechanical that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002547

Suzhou Chunxing Precision Mechanical

Suzhou Chunxing Precision Mechanical Co., Ltd.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth