Kingenta Ecological Engineering Group (SZSE:002470) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Kingenta Ecological Engineering Group Co., Ltd. (SZSE:002470) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Kingenta Ecological Engineering Group

How Much Debt Does Kingenta Ecological Engineering Group Carry?

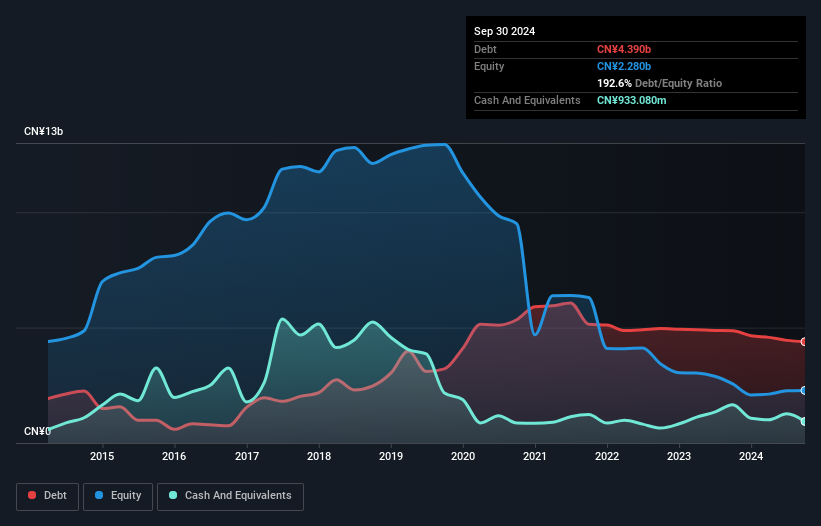

As you can see below, Kingenta Ecological Engineering Group had CN¥4.39b of debt at September 2024, down from CN¥4.87b a year prior. However, it also had CN¥933.1m in cash, and so its net debt is CN¥3.46b.

How Healthy Is Kingenta Ecological Engineering Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kingenta Ecological Engineering Group had liabilities of CN¥6.69b due within 12 months and liabilities of CN¥2.13b due beyond that. On the other hand, it had cash of CN¥933.1m and CN¥607.2m worth of receivables due within a year. So it has liabilities totalling CN¥7.29b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of CN¥6.34b, we think shareholders really should watch Kingenta Ecological Engineering Group's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

As it happens Kingenta Ecological Engineering Group has a fairly concerning net debt to EBITDA ratio of 5.2 but very strong interest coverage of 1k. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. We also note that Kingenta Ecological Engineering Group improved its EBIT from a last year's loss to a positive CN¥142m. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kingenta Ecological Engineering Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Kingenta Ecological Engineering Group burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Kingenta Ecological Engineering Group's net debt to EBITDA left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider Kingenta Ecological Engineering Group to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. While Kingenta Ecological Engineering Group didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Kingenta Ecological Engineering Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002470

Kingenta Ecological Engineering Group

Research, develops, produces, and sells agricultural fertilizers and raw materials in China.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives