Stock Analysis

Qingdao Gaoce Technology And 2 More Dividend Stocks On Chinese Exchanges

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets and heightened trade tensions, Chinese equities have shown resilience, with sectors like technology experiencing notable volatility. In this environment, dividend stocks such as Qingdao Gaoce Technology can offer investors potential stability and yield opportunities.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.72% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 4.14% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.55% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.93% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.98% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.80% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.60% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.77% | ★★★★★★ |

Click here to see the full list of 255 stocks from our Top Chinese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

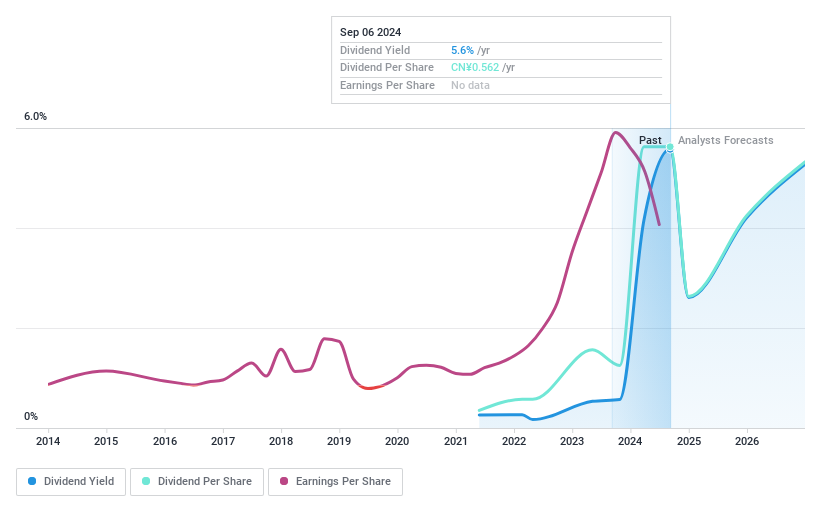

Qingdao Gaoce Technology (SHSE:688556)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Gaoce Technology Co., Ltd. specializes in researching, developing, manufacturing, and selling cutting equipment and tools for hard and brittle materials in China, with a market capitalization of approximately CN¥6.54 billion.

Operations: Qingdao Gaoce Technology Co., Ltd. generates its revenue primarily from the sale of cutting equipment and tools designed for processing hard and brittle materials within China.

Dividend Yield: 4.7%

Qingdao Gaoce Technology reported a Q1 revenue of CNY 1.42 billion, up from CNY 1.26 billion year-over-year, though net income fell to CNY 211.65 million from CNY 334.44 million. Despite a short dividend history and volatility in payments, the company's dividend yield stands at a competitive 4.7%. Dividends appear sustainable with a payout ratio of 36.4% and are well-covered by earnings and cash flows (cash payout ratio: 43.8%). However, recent shareholder dilution raises concerns about future payouts.

- Take a closer look at Qingdao Gaoce Technology's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Qingdao Gaoce Technology is trading behind its estimated value.

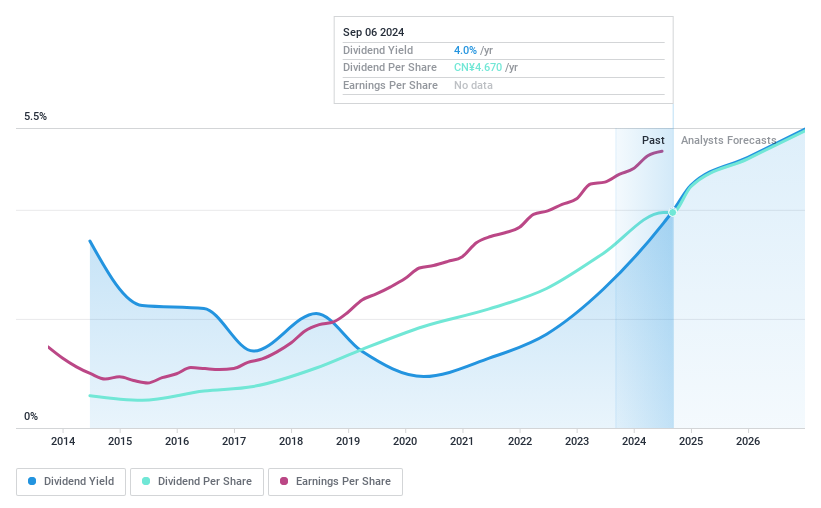

Wuliangye YibinLtd (SZSE:000858)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Wuliangye Yibin Co., Ltd. is a Chinese company that manufactures and sells liquor and wine products under the Wuliangye brand, with a market capitalization of approximately CN¥517.88 billion.

Operations: Wuliangye Yibin Co., Ltd. generates its revenue primarily from the production and sale of liquor and wine products.

Dividend Yield: 3.5%

Wuliangye Yibin Co., Ltd. recently confirmed a cash dividend of CNY 46.70 per 10 shares for 2023, reflecting its commitment to shareholder returns, supported by a stable payout ratio of 57.2% and cash payout ratio of 59.8%. With earnings growing at an annual rate of 14.3% over the past five years and expected to rise by 10.72% annually, the company's dividend yield is attractive at 3.5%, ranking in the top quartile within China's market average of 2.6%. However, trading at a significant discount to estimated fair value suggests potential undervaluation relative to industry peers.

- Get an in-depth perspective on Wuliangye YibinLtd's performance by reading our dividend report here.

- Our valuation report here indicates Wuliangye YibinLtd may be undervalued.

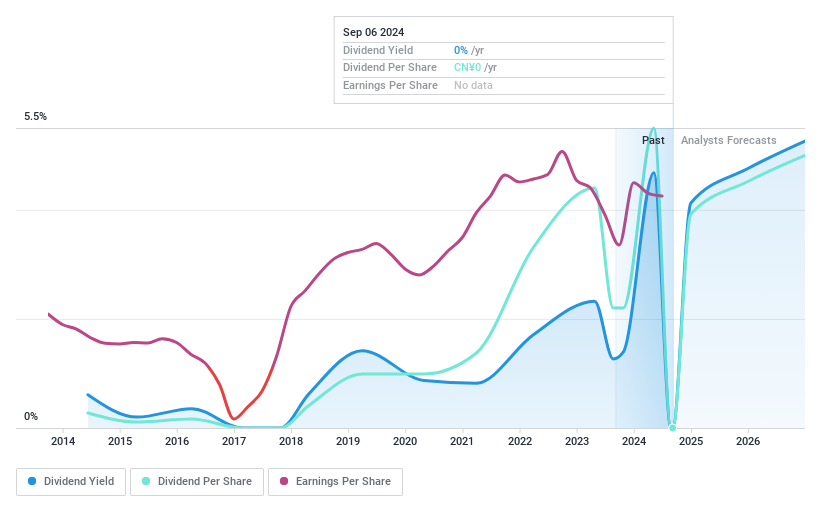

Hangzhou Oxygen Plant GroupLtd (SZSE:002430)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hangzhou Oxygen Plant Group Co., Ltd. operates globally, specializing in the design, production, and sale of air separation equipment, petrochemical equipment, and various gas products with a market capitalization of CN¥19.48 billion.

Operations: Hangzhou Oxygen Plant Group Co., Ltd. generates revenue primarily from the sale of air separation and petrochemical equipment, along with various gas products.

Dividend Yield: 5.1%

Hangzhou Oxygen Plant Group Co., Ltd. offers a dividend yield of 5.05%, placing it in the top 25% of dividend payers in the Chinese market. However, its dividends have shown volatility and are not well-supported by earnings or free cash flows, with a payout ratio at 85.7%. Recent corporate actions include amendments to its articles of association and significant operational changes approved on July 17, 2024. Despite challenges, analysts predict substantial stock price growth and note it trades below fair value estimates.

- Delve into the full analysis dividend report here for a deeper understanding of Hangzhou Oxygen Plant GroupLtd.

- Our comprehensive valuation report raises the possibility that Hangzhou Oxygen Plant GroupLtd is priced lower than what may be justified by its financials.

Taking Advantage

- Dive into all 255 of the Top Chinese Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Wuliangye YibinLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000858

Wuliangye YibinLtd

Manufactures and sells liquor and wine products under the Wuliangye brand in China.

Very undervalued with flawless balance sheet and pays a dividend.