Further Upside For Hangzhou Oxygen Plant Group Co.,Ltd. (SZSE:002430) Shares Could Introduce Price Risks After 30% Bounce

Hangzhou Oxygen Plant Group Co.,Ltd. (SZSE:002430) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

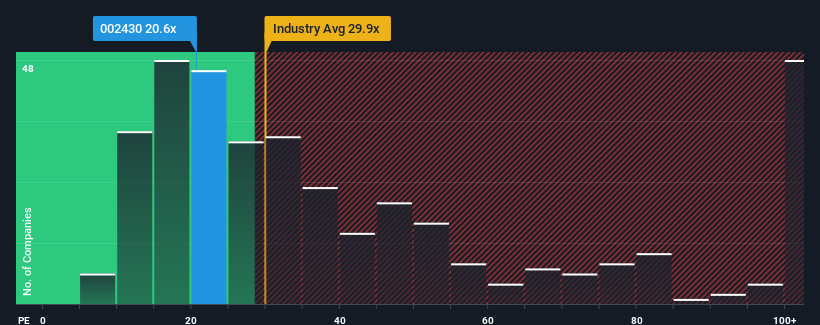

Even after such a large jump in price, Hangzhou Oxygen Plant GroupLtd's price-to-earnings (or "P/E") ratio of 20.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 58x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Hangzhou Oxygen Plant GroupLtd has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Hangzhou Oxygen Plant GroupLtd

How Is Hangzhou Oxygen Plant GroupLtd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hangzhou Oxygen Plant GroupLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 19% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% per annum, which is not materially different.

In light of this, it's peculiar that Hangzhou Oxygen Plant GroupLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Hangzhou Oxygen Plant GroupLtd's P/E?

Hangzhou Oxygen Plant GroupLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hangzhou Oxygen Plant GroupLtd currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Hangzhou Oxygen Plant GroupLtd that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Oxygen Plant GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002430

Hangzhou Oxygen Plant GroupLtd

Manufactures and sells air separation equipment and parts, cryogenic and petrochemical equipment, and other gas products in China and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives