Further weakness as Zhejiang Yongtai TechnologyLtd (SZSE:002326) drops 6.5% this week, taking three-year losses to 46%

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, you risk returning less than the market. We regret to report that long term Zhejiang Yongtai Technology Co.,Ltd. (SZSE:002326) shareholders have had that experience, with the share price dropping 47% in three years, versus a market decline of about 22%. The more recent news is of little comfort, with the share price down 39% in a year. Unfortunately the share price momentum is still quite negative, with prices down 16% in thirty days.

With the stock having lost 6.5% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Zhejiang Yongtai TechnologyLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

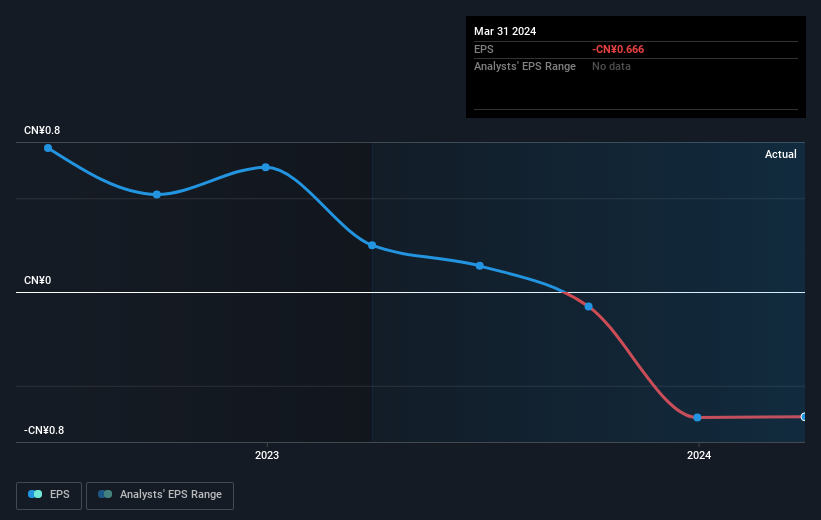

Over the three years that the share price declined, Zhejiang Yongtai TechnologyLtd's earnings per share (EPS) dropped significantly, falling to a loss. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Zhejiang Yongtai TechnologyLtd's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Zhejiang Yongtai TechnologyLtd shareholders are down 39% for the year. Unfortunately, that's worse than the broader market decline of 10%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Zhejiang Yongtai TechnologyLtd is showing 3 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Yongtai TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002326

Zhejiang Yongtai TechnologyLtd

Engages in the manufacture and sale of fluorinated pharmaceuticals, crop science, and new energy materials primarily in China.

Very low and overvalued.