- China

- /

- Metals and Mining

- /

- SZSE:002318

Here's Why We Think Zhejiang JIULI Hi-tech MetalsLtd (SZSE:002318) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Zhejiang JIULI Hi-tech MetalsLtd (SZSE:002318), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Zhejiang JIULI Hi-tech MetalsLtd

How Fast Is Zhejiang JIULI Hi-tech MetalsLtd Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Zhejiang JIULI Hi-tech MetalsLtd's EPS has grown 20% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Zhejiang JIULI Hi-tech MetalsLtd's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Zhejiang JIULI Hi-tech MetalsLtd shareholders can take confidence from the fact that EBIT margins are up from 12% to 14%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

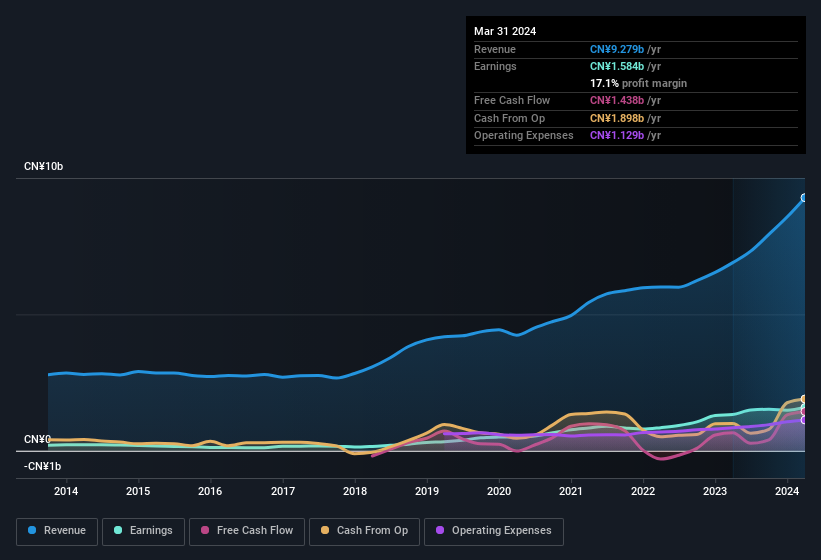

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Zhejiang JIULI Hi-tech MetalsLtd's future EPS 100% free.

Are Zhejiang JIULI Hi-tech MetalsLtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Zhejiang JIULI Hi-tech MetalsLtd followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. With a whopping CN¥584m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Is Zhejiang JIULI Hi-tech MetalsLtd Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Zhejiang JIULI Hi-tech MetalsLtd's strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. What about risks? Every company has them, and we've spotted 1 warning sign for Zhejiang JIULI Hi-tech MetalsLtd you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang JIULI Hi-tech Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002318

Zhejiang JIULI Hi-tech Metals

Researches and develops, manufactures, and sells industrial stainless steel and special alloy pipes, bars, wires, bimetal composite pipes, pipe fittings, and other pipeline products in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives