Subdued Growth No Barrier To Sichuan Development Lomon Co., Ltd. (SZSE:002312) With Shares Advancing 29%

Sichuan Development Lomon Co., Ltd. (SZSE:002312) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

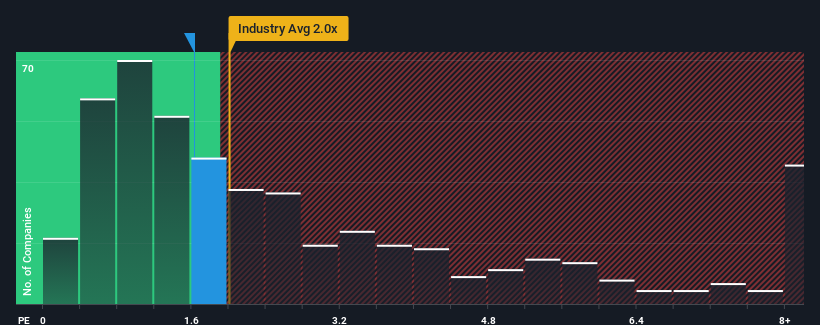

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sichuan Development Lomon's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in China is also close to 2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Sichuan Development Lomon

How Sichuan Development Lomon Has Been Performing

Sichuan Development Lomon could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Sichuan Development Lomon's future stacks up against the industry? In that case, our free report is a great place to start.How Is Sichuan Development Lomon's Revenue Growth Trending?

In order to justify its P/S ratio, Sichuan Development Lomon would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Even so, admirably revenue has lifted 55% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 18% during the coming year according to the sole analyst following the company. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

In light of this, it's curious that Sichuan Development Lomon's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Sichuan Development Lomon's P/S?

Sichuan Development Lomon's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Sichuan Development Lomon's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 3 warning signs for Sichuan Development Lomon you should be aware of, and 1 of them is a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002312

Sichuan Development LomonLtd

Engages in the research and development, production, and sale of phosphorus chemical products in China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026