Jiangsu Huachang Chemical's (SZSE:002274) earnings have declined over three years, contributing to shareholders 30% loss

While it may not be enough for some shareholders, we think it is good to see the Jiangsu Huachang Chemical Co., Ltd (SZSE:002274) share price up 15% in a single quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 37% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

While the stock has risen 5.3% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Jiangsu Huachang Chemical

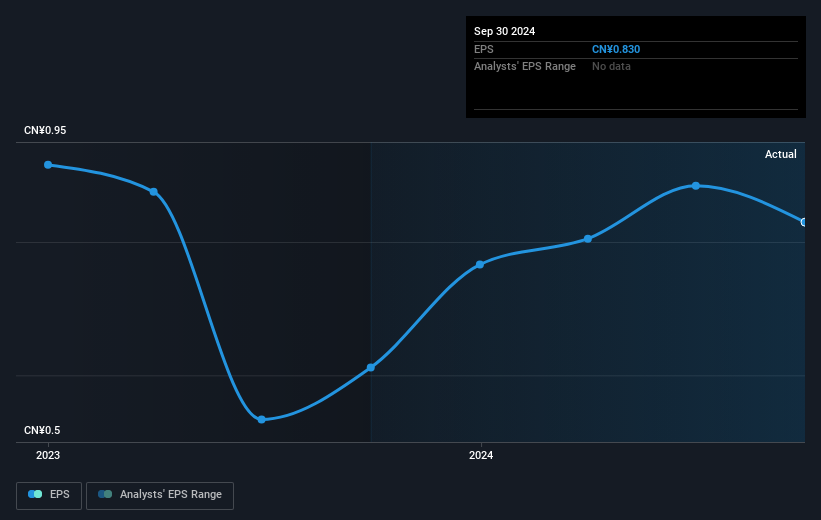

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, Jiangsu Huachang Chemical's earnings per share (EPS) dropped by 21% each year. This fall in the EPS is worse than the 14% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Jiangsu Huachang Chemical's key metrics by checking this interactive graph of Jiangsu Huachang Chemical's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Jiangsu Huachang Chemical the TSR over the last 3 years was -30%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Jiangsu Huachang Chemical shareholders have received a total shareholder return of 16% over one year. Of course, that includes the dividend. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Keeping this in mind, a solid next step might be to take a look at Jiangsu Huachang Chemical's dividend track record. This free interactive graph is a great place to start.

We will like Jiangsu Huachang Chemical better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002274

Jiangsu Huachang Chemical

Manufactures and sells agrochemicals, basic chemicals, fine chemicals, and biochemical products in China.

Flawless balance sheet with solid track record and pays a dividend.