The three-year shareholder returns and company earnings persist lower as Chengxin Lithium Group (SZSE:002240) stock falls a further 4.5% in past week

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So spare a thought for the long term shareholders of Chengxin Lithium Group Co., Ltd. (SZSE:002240); the share price is down a whopping 79% in the last three years. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 51%, so we doubt many shareholders are delighted. Furthermore, it's down 31% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 13% in the same timeframe.

Since Chengxin Lithium Group has shed CN¥483m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Chengxin Lithium Group

We don't think that Chengxin Lithium Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years, Chengxin Lithium Group saw its revenue grow by 42% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 21% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

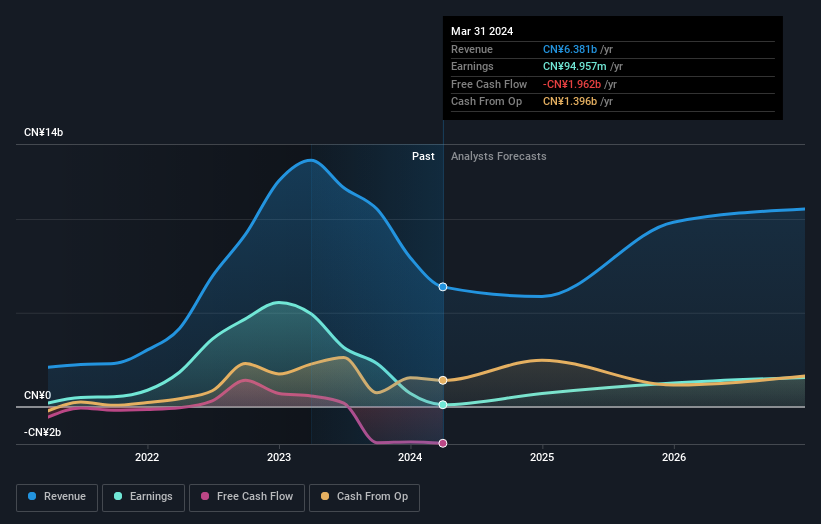

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Chengxin Lithium Group shareholders are down 50% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Chengxin Lithium Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Chengxin Lithium Group (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

We will like Chengxin Lithium Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002240

Chengxin Lithium Group

Engages in the mining, production, and sale of lithium salt and metal, and timber products in China.

High growth potential with adequate balance sheet.