Puyang Refractories Group Co., Ltd. (SZSE:002225) Held Back By Insufficient Growth Even After Shares Climb 28%

Puyang Refractories Group Co., Ltd. (SZSE:002225) shares have continued their recent momentum with a 28% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

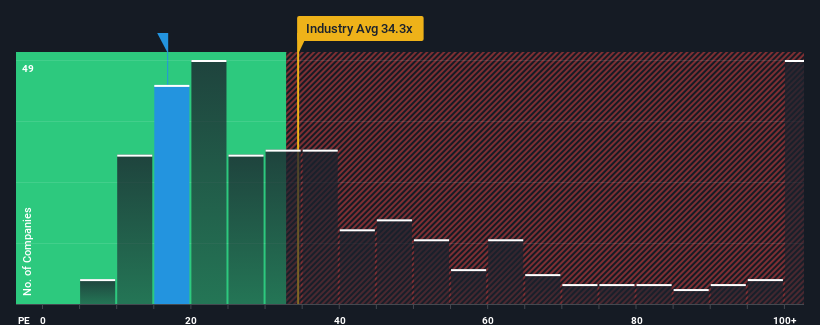

Although its price has surged higher, Puyang Refractories Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.7x, since almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 61x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Puyang Refractories Group has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Puyang Refractories Group

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Puyang Refractories Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 38%. However, this wasn't enough as the latest three year period has seen a very unpleasant 9.8% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 12% per annum during the coming three years according to the one analyst following the company. Meanwhile, the rest of the market is forecast to expand by 25% each year, which is noticeably more attractive.

In light of this, it's understandable that Puyang Refractories Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Puyang Refractories Group's P/E?

The latest share price surge wasn't enough to lift Puyang Refractories Group's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Puyang Refractories Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Puyang Refractories Group (1 is concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Puyang Refractories Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002225

Puyang Refractories Group

Engages in the research, development, production, and sales of shaped, unshaped, and functional refractory products in China and internationally.

Slight risk with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success