Investors Still Aren't Entirely Convinced By Shenzhen Noposion Crop Science Co., Ltd.'s (SZSE:002215) Earnings Despite 26% Price Jump

Shenzhen Noposion Crop Science Co., Ltd. (SZSE:002215) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

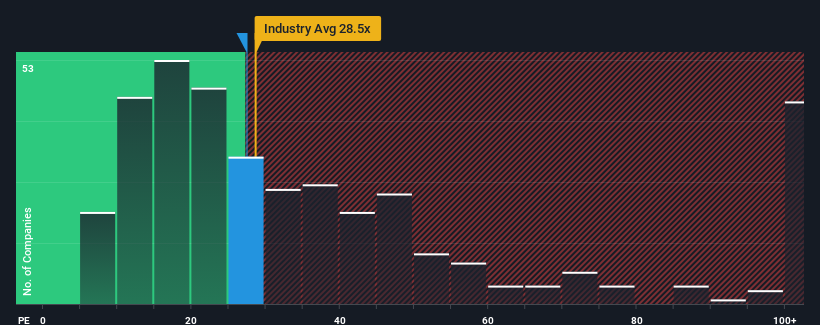

In spite of the firm bounce in price, there still wouldn't be many who think Shenzhen Noposion Crop Science's price-to-earnings (or "P/E") ratio of 27.4x is worth a mention when the median P/E in China is similar at about 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for Shenzhen Noposion Crop Science as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Shenzhen Noposion Crop Science

How Is Shenzhen Noposion Crop Science's Growth Trending?

The only time you'd be comfortable seeing a P/E like Shenzhen Noposion Crop Science's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a decent 9.1% gain to the company's bottom line. EPS has also lifted 6.2% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 92% as estimated by the four analysts watching the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Shenzhen Noposion Crop Science is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Shenzhen Noposion Crop Science's P/E?

Shenzhen Noposion Crop Science appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Shenzhen Noposion Crop Science's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Shenzhen Noposion Crop Science has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002215

Shenzhen Noposion Crop Science

Researches and develops, manufactures, distributes, and provides technical services for pesticides and fertilizers in China and internationally.

High growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives