A Piece Of The Puzzle Missing From Shenzhen Noposion Crop Science Co., Ltd.'s (SZSE:002215) 26% Share Price Climb

Despite an already strong run, Shenzhen Noposion Crop Science Co., Ltd. (SZSE:002215) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 26%.

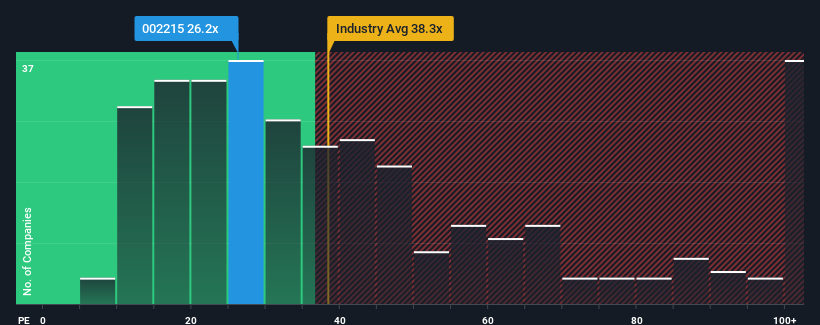

In spite of the firm bounce in price, Shenzhen Noposion Crop Science's price-to-earnings (or "P/E") ratio of 26.2x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 38x and even P/E's above 75x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Shenzhen Noposion Crop Science as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Shenzhen Noposion Crop Science

Is There Any Growth For Shenzhen Noposion Crop Science?

There's an inherent assumption that a company should underperform the market for P/E ratios like Shenzhen Noposion Crop Science's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 42% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 91% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 79% over the next year. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

With this information, we find it odd that Shenzhen Noposion Crop Science is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Shenzhen Noposion Crop Science's P/E

The latest share price surge wasn't enough to lift Shenzhen Noposion Crop Science's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Noposion Crop Science's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Shenzhen Noposion Crop Science that you should be aware of.

If these risks are making you reconsider your opinion on Shenzhen Noposion Crop Science, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002215

Shenzhen Noposion Crop Science

Researches and develops, manufactures, distributes, and provides technical services for pesticides and fertilizers in China and internationally.

Undervalued with high growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success